Citigroup (NYSE:C) is bouncing back, and analysts are optimistic for the stock as it heads into its third quarter earnings report and kicks off the financial services sector's Q3 numbers parade. Analysts tracked by Zacks Investment Research are looking for EPS $1.97 when the bank announces earnings October 11. And RBC Capital Markets analysts are bullish in particular, with an 'Outperform' rating and a $76 target on Citi stock.

So far this year, Citi stock is up more than 26%.

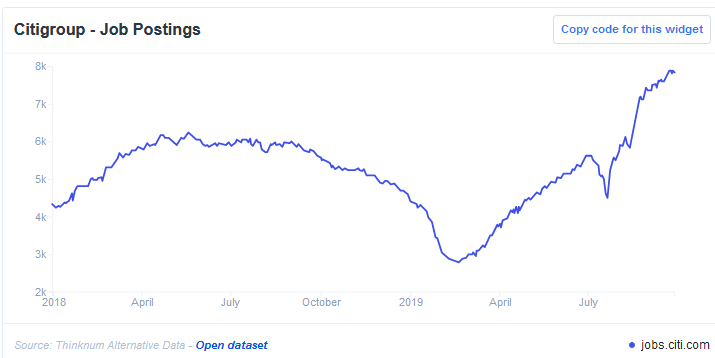

Job postings are a solid indicator of where a bank is targeting growth - and for an international firm like Citi, it has designs on expanding operations in the US and abroad, according to data. Job postings are cyclical, but up, even beyond the same pace of a year prior, and increased more than 180% from their February low.

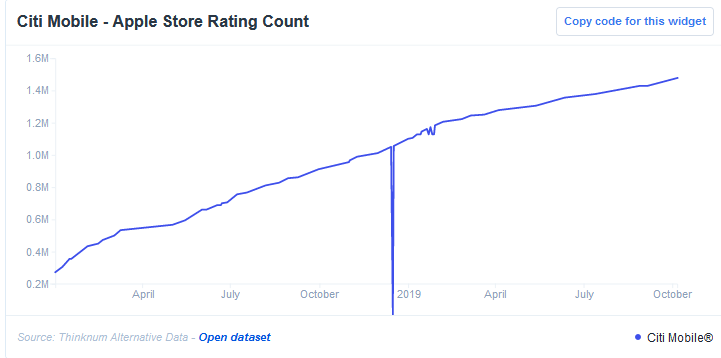

Part of what RBC analysts optimistic is Citi's digital business. In fact, they wrote in a report dated September 30, "investment banking revenues would likely be down year over year."

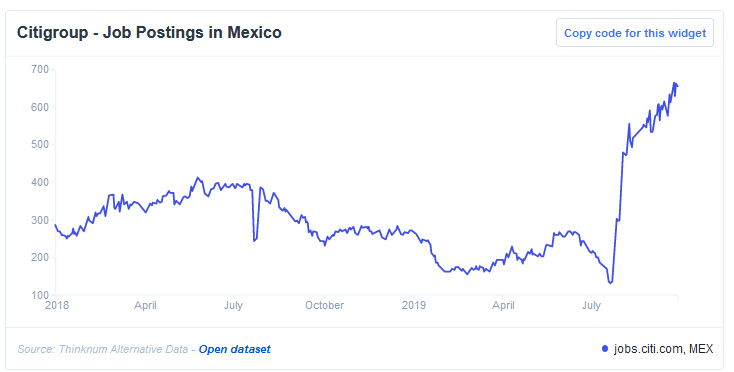

Citi is poised for emerging markets growth, and analysts are big on the bank.

"With more than 50% of its revenues coming from outside North America," the RBC analysts wrote, " Citigroup (NYSE:C) is the best-positioned bank for emerging markets growth."

Recent activity in Mexico reflects this - Citigroup (NYSE:C) grew job postings in Mexico by about 385% since mid-July.

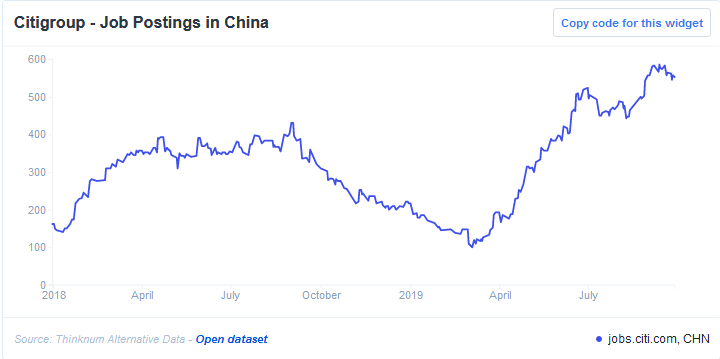

Citi is joining a growing group of US firms bucking President Donald J. Trump's anti-China edict, and growing job postings there after a temporary decline. Proportionally, China job postings are soaring for Citi; it has grown postings there more than 450% from their March 2019 lows.

Finally, the RBC analysts note, the bank is "heavily investing in its digital/mobile platform," generating a $2 billion growth in deposits in the first half of 2019. "Banks with favorable technology offerings will experience better customer engagement and can maintain and grow relationships," they concluded. Our chart tracks total Apple (NASDAQ:AAPL) ratings submitted for the Citi Mobile app, which continue to drive up over time - reflecting growth in engagement.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.