Citigroup Inc. (NYSE:C) recently announced 100% redemption of its outstanding 4.650% Fixed Rate/Floating Rate Subordinated Notes due October 2022. The principal amount of the notes was C$481.5 million.

The notes are redeemable on Oct 11, 2017. Citigroup stated that the total amount to be paid on redemption includes the entire principal amount of the notes, plus accrued and unpaid interest thereof (amounting to approximately C$11 million). Citibank, N.A. is the paying agent for the subordinated notes.

Citigroup stated that this redemption is in accordance with its liability management strategy. Also, it is in line with the company’s efforts to boost efficiency of funds and capital structure. Further, its Basel III Tier 2 Capital is expected to remain unaffected by the redemption.

As of Jun 30, 2017, Citigroup’s cash along with due from banks balance totaled $20.69 million, reflecting its strong liquidity position and ability to pay off debts.

In order to reduce funding costs, Citigroup has successfully redeemed or retired about $25.6 billion worth securities since 2015. Also, it remains on track to continue looking for similar opportunities on the basis of factors like the economic value of securities and impact of regulatory changes. Citigroup also takes into consideration the effect on its net interest margin and borrowing costs. Lastly, it takes into account the remaining tenure of the company’s debt portfolio.

The latest debt redemption would further reduce Citigroup’s interest expenses.

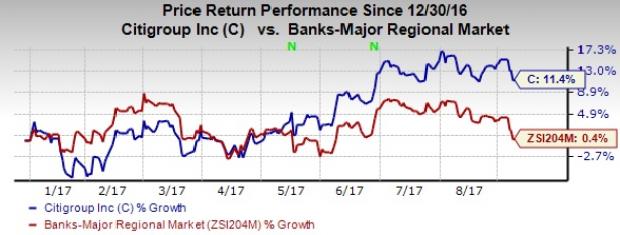

Shares of Citigroup have rallied 11.4% year to date, outperforming the industry’s marginal gain.

Currently, the stock carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are The PNC Financial Services Group (NYSE:PNC) , State Street Corporation (NYSE:STT) and FB Financial Corporation (NYSE:FBK) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PNC Financial’s Zacks Consensus Estimate for current-year earnings was revised 1.8% upward for 2017, in the past 60 days. Also, its share price has increased more than 30% in the past 12 months.

State Street’s current-year earnings estimates were revised 3.6% upward, over the past 60 days. Further, the company’s shares have gained above 30% in a year.

FB Financial’s Zacks Consensus Estimate for current-year earnings was revised 2.7% upward, over the last 60 days. Moreover, in the past year, its shares have gained above 60%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

PNC Financial Services Group, Inc. (The) (PNC): Free Stock Analysis Report

State Street Corporation (STT): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

FB Financial Corporation (FBK): Free Stock Analysis Report

Original post

Zacks Investment Research