Mounting concerns over the U.S. retreat from global business has shaken banks in the U.S. The Wall Street biggie – Citigroup Inc. (NYSE:C) – is expediting plans of expanding its corporate banking across the Asia-Pacific region. The plan also comes up on the increasing fame of China in relation to global trade. Notably, other U.S. banks, including Morgan Stanley (NYSE:MS) and The Goldman Sachs Group, Inc. (NYSE:GS) , are expanding operations in this region with new recruits.

According to sources, new recruits will be employed for APAC operations in order to boost lending volume. Gerald Keefe, Citigroup’s head of corporate banking, in the Asia-Pacific region, commented that cross-border trade in the APAC region resulted from the U.S. retreat from the Trans-Pacific Partnership.

“APAC markets are all increasingly interlinked with one another,” he told the publication. “That just winds up creating a very different picture in the next 10 to 20 years,” a picture, he added, that is “much more geared around China than one that has historically been geared around the U.S.”

Citigroup’s focused areas for growth include Korea, India, Vietnam, China, Japan, Hong Kong, Southeast Asia and Taiwan. Additionally, boosting growth in such local cities will help Citigroup in providing corporate solutions, including treasury, trade finance, cash management, business loans and other enterprise-focused services.

Citigroup also targets double growth in these areas, with increasing loans up to $2 billion in new corporate loans. Notably, on increasing trading activities in APAC region, Citigroup plans to hire 25 people in the above mentioned regions, including 10 new employees and 15 redeploying from other parts of Citigroup’s APAC bank.

Notably, the APAC region records a quarter of Citigroup’s earnings depicting largest market outside North America for the bank. In first-quarter 2017, the bank’s APAC loan portfolio was increased to $60 billion from $57 billion.

Conclusion

For Citigroup, this is expected to be a step in the right direction for enhancing profitability. The company has restructured many of its global operations.

Amid the troubled financial currents, Citigroup is likely to gain some financial flexibility from such moves. We believe that the company is well poised to address its internal inefficiencies and setbacks. Further, we believe that the company’s streamlining initiatives will boost its capital position, reduce expenses and drive operational efficiency.

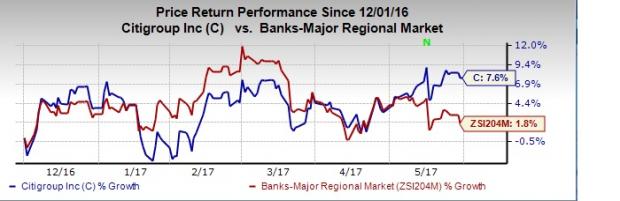

Citigroup currently carries a Zacks Rank #3 (Hold). The bank has recorded growth of 7.6% compared with 1.8% growth recorded by the Zacks categorized Regional Banks-Major industry, over the past six months.

Stocks to Consider

M&T Bank Corporation (NYSE:MTB) has been witnessing upward estimate revisions for the last 60 days. Over the last six months, the company’s share price has been up more than 7.4%. It carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

M&T Bank Corporation (MTB): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

Goldman Sachs Group, Inc. (The) (GS): Free Stock Analysis Report

Original post