Networking equipment giant Cisco Systems (NASDAQ:CSCO) will deliver its fiscal Q1-earnings results after the closing bell today. Here’s a preview of what investors can expect.

Cisco will unveil its results via press release shortly after the market closes at 4:00 pm Eastern, with a 4:30 pm conference call to follow. Typically, the company provides guidance within the press release itself, so the conference call tends to be a non-event.

Analysts are expecting Q1 EPS of $0.59, which would be flat from last year, on revenue of $12.33 billion, which would be a 2.7% decrease. Cisco should provide guidance for Q2 as well, and Wall Street is expecting a forecast of $0.59 per share and $12.15 billion for the current period.

Another important metric to key on will be CSCO’s gross margins. Last quarter, the company posted non-GAAP gross margins of 64.6%, up 0.7 percentage points, and product gross margins of 62.9%, also up 0.7 points. Meanwhile, service gross margins were 67.0%, up 1.1 points.

You wouldn’t know it from its share price performance this year, but Cisco has repeatedly said the current operating environment is very challenging. The company sees significant volatility continuing in its geographic markets, which was evident by the fact that in fiscal Q4, revenue in its Service Provider and Emerging Markets segments turned negative, down 5% and 6%, respectively. Outside of those two units, however, the remainder of Cisco’s businesses saw 5% growth in orders.

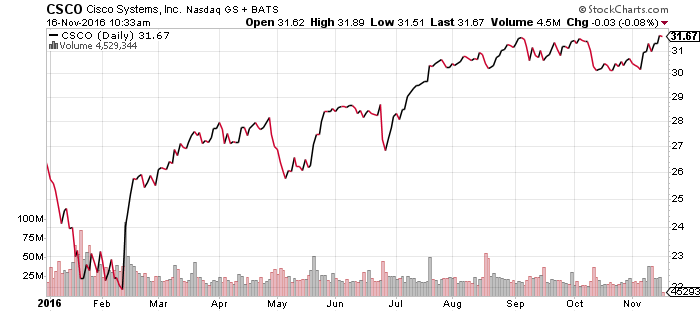

Cisco shares fell $0.03 (-0.08%) to $31.67 in Wednesday morning trading. Year-to-date, CSCO has gained 16.52%, more than doubling the return of the benchmark S&P 500 index during the same period.