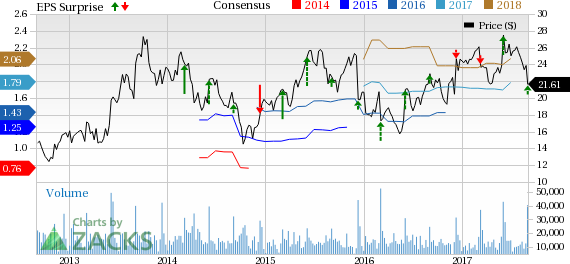

Ciena Corp. (NYSE:CIEN) reported fiscal third-quarter 2017 non-GAAP earnings of 51 cents, which increased 21.4% on a year-over-year basis and beat the Zacks Consensus Estimate of 49 cents.

Revenues of $728.7 million increased 8.7% year over year and beat the consensus mark of $726.9 million.

Although shares of Ciena have lost 11.5% of its value year to date, it fared better than the industry to which it belongs that declined 13.8%.

Segmental Details

Product revenues (83.8% of revenues) were up 10.3% year over year to $610.7 million. Services revenues (16.2% of revenues) increased 0.8% year over year to $118 million.

Segment-wise, networking platforms (81.3% of total revenue) grew 9.5% year over year to $592.3 million, benefiting from the addition of 14 new customers to its WaveServer platform.

Revenues from Software and software-related services (5.8% of total revenue) soared 33.9% year over year to $42.3 million, mainly driven by accelerated software deployments.

Global services revenues (12.9% of total revenue) declined 4.1% from the year-ago quarter to $94.1 million.

Region-wise, Ciena’s revenues grew 6.2% in North America, 10.9% in Caribbean and Latin America (CALA) and 41.6% in Asia Pacific (APAC) but fell 7.9% in Europe, Middle East and Africa (EMEA).

U.S. customers accounted for 60.1% of its revenues, of which 28% was contributed by two major customers namely AT&T (NYSE:T) and Verizon (NYSE:VZ) .

Margins

The company’s non-GAAP gross margin contracted 130 basis points (bps) year over year to 45.5%.

Ciena incurred non-GAAP operating expenses of $229.3 million, up 2.6% from the year-ago quarter. However, as a percentage of revenues, it decreased 180 bps from the year-ago quarter to 31.5%.

As a result, non-GAAP operating margin expanded 60 bps to 14.1%.

Balance Sheet

The company ended the quarter with cash and investments of $854.2 million.

Ciena generated operating cash flow of $50.6 million in the quarter compared with approximately $70 million in the year-ago quarter.

Guidance

Ciena also provided guidance for fourth-quarter fiscal 2017. Revenues for the current quarter are forecast in the range of $720–$750 million. Non-GAAP gross margin is anticipated to be approximately in the mid-40% range. Non-GAAP operating expenses are projected to be around $240 million.

Our Take

Ciena enjoys a competitive edge, given its diversifying product portfolio, which is helping it to expand its customer base. The company has been successful in selling its new products to existing customers and signing up new customers as well. This indicates high demand for its products.

The company’s stackable data center interconnect platform, WaveServer is trending well. The company received two major orders in the third quarter, one each in North America and CALA. Given the good adoption rate of WaveServer, the company maintains its expectation of $100 million revenues from the platform in the current fiscal.

Ciena is gaining traction in the optical data center interconnect (DCI) market. This is further backed by the analyst firm Delll’Oro Group’s recent report in which it positioned the company as one of the dominant players, along with Cisco (NASDAQ:CSCO) and Infinera.

Moreover, Ciena is also doing well in the international market. Going ahead, the company believes that its newly launched 400 gig per wavelength chip, Wavelogic AI, will have a significant impact on its global sales. During the third quarter conference call, Ciena revealed that Wavelogic AI will provide “significant opportunity to capture additional share globally as it comes to market in its various forms over the next few months.”

Besides developing 5G technologies for service providers and Fiber Deep cable MSO customers, it will also have a positive role to play in further fiber densification of the network.

Ciena is also anticipating high growth in the APAC zone, especially in India. The company also expects stabilized growth in EMEA and CALA zones.

The company’s revenues are expected to benefit from its flourishing software segment. It maintains its leading position in the submarine cable upgrade market. All these bode well for the near term.

However, competition, uncertainty related to government business and macroeconomic volatility remain headwinds.

Zacks Rank and Stocks to Consider

Ciena carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Ciena Corporation (CIEN): Free Stock Analysis Report

Original post