Over the past few weeks the market has shown some rotation out of big cap stocks and into mega cap stocks. When this occurs it generally causes choppy sideways consolidation, at the least, or a short term top with a modest consolidation (5% to 15%).

I like to use a dip below the 20-week moving average in the ratio between the S&P 500 Equal Weight Index (SPXEW1) and the S&P 500 index (SPX) as a warning sign. This week, we’ve got that warning, so we should expect a choppy market ahead. Only time will tell if this is normal rotation or a flight to safety, so keep an eye on this indicator over the next few weeks.

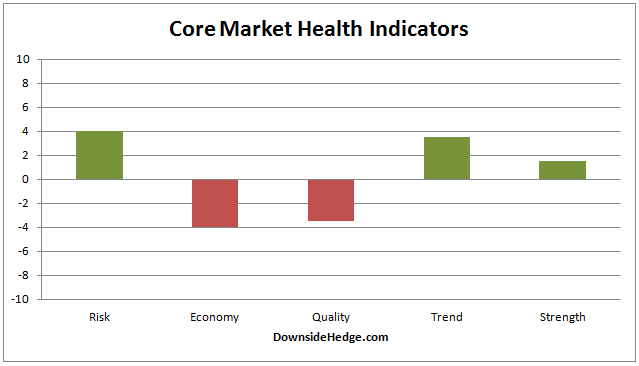

My core market health indicators showed weakness this week too, with the exception of market quality. It managed to improve, which is a minor hint that the rotation we’re seeing is more likely profit taking and re-positioning rather than a flight to quality/safety.

Conclusion

It looks like we should expect some choppy market action over the week or two (at the least). If the ratio between SPXEW and SPX continues to drop then I’ll get concerned that we’re seeing a flight to safety.