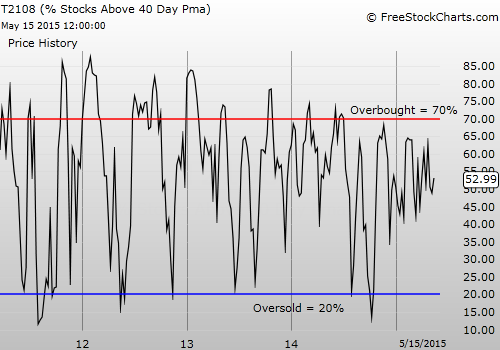

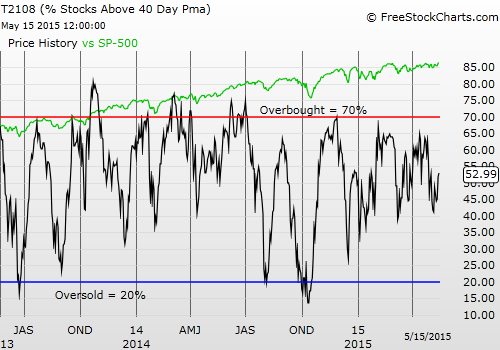

T2108 Status: 53.0%

T2107 Status: 54.1%

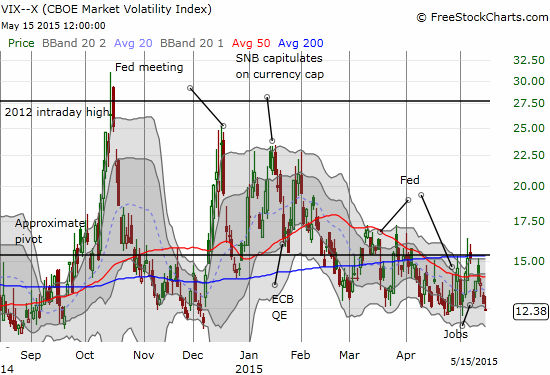

VIX Status: 12.4

General (Short-term) Trading Call: Neutral.

Active T2108 periods: Day #144 over 20%, Day #103 above 30%, Day #47 above 40%, Day #2 over 50% (overperiod), Day #13 under 60%, Day #213 under 70%

Commentary

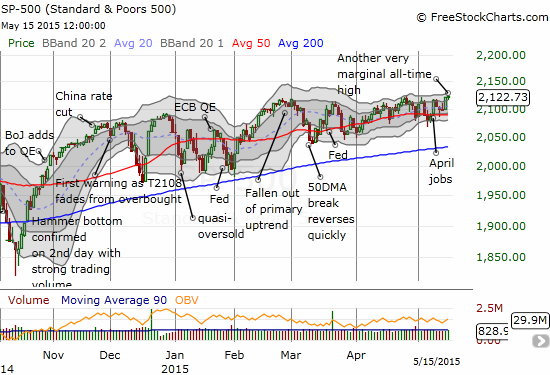

The S&P 500 (via the SPDR S&P 500 ETF (ARCA:SPY)) printed another all-time high on Friday, May 15th. The index is up 0.3% from a week ago when I wrote the last T2108 Update noting how those Friday gains represented half of 2015’s entire year-to-date gain. Such is the nature of the chop of the market that goes nowhere yet manages the smallest slivers of miniscule progress.

The S&P 500 just keeps chopping along into one marginal all-time after another

The S&P 500 is making so such slow progress upward along its 50-day moving average (DMA) that I describe this as a chopping range. The move is not technically a trading range since new highs are being made along the way. All the chop makes it feel like nothing is really happening. The index is also looking like a coiled spring given it is spending a lot more time above its 50DMA than below.

T2108 is chopping even more than the S&P 500. It closed at 53.0% – smack in the middle of a very firm range for 2015. This lag means, technically, the S&P 500 has a lot more upside potential before a notable pullback. My trading call stays in neutral though. Instead of betting on market direction, I am betting on an increase in volatility.

Volatility has held onto its lows despite this chopping range. The VIX is now back to levels that have preceded brief pops higher.

Volatility is falling asleep again

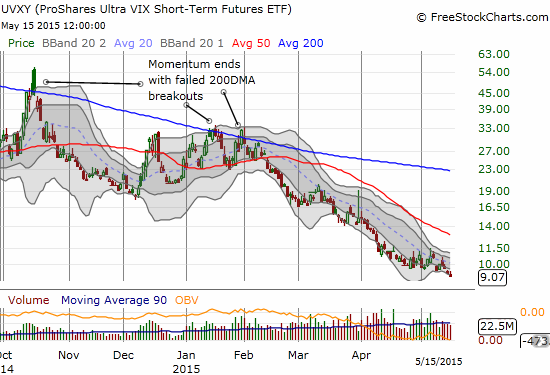

In the last T2108 Update, I noted I would bet on volatility once the S&P 500 made a new marginal high. The market’s chopping behavior did not disappoint. So, on Friday I loaded up on ProShares Ultra VIX Short-Term Futures (ARCA:UVXY) call options. I only purchased half the position I wanted as I was looking for rock-bottom prices. Why be so cheap? Well, a bet on UVXY is a bet against a very strong trend…

ProShares Ultra VIX Short-Term Futures (UVXY) is in familiar territory – spiraling downward

…so betting on UVXY is a particularly tricky form of market-timing. In my favor is UVXY’s tendency to end a decline with a tap on its lower-Bollinger® Band (BB).

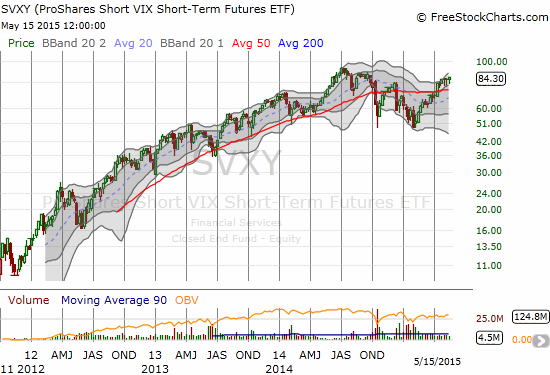

Speaking of volatility bets, the REAL bet on volatility has been to bet against it. ProShares Short VIX Short-Term Futures (ARCA:SVXY) has been an amazingly winning bet which has far surpassed market returns even with the stumbling since late last year.

Betting against volatility has been a tremendous long-term play with returns far surpassing the market

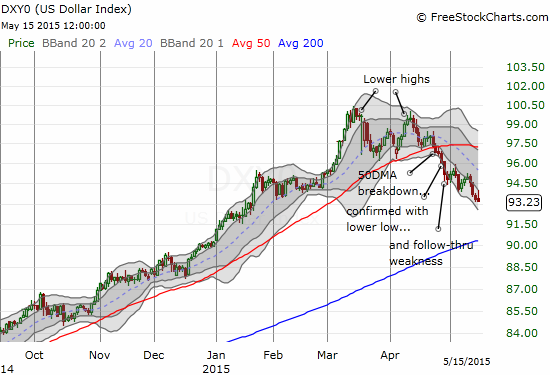

Some market observers have expressed concern that a strengthening U.S. dollar (via PowerShares DB US Dollar Bullish (NYSE:UUP)) would kill corporate profits and the stock market. Now they can worry that the dollar’s decline signals a lowering confidence in the U.S. economy. I pointed out the dollar’s “trend troubles” in late April. The dollar’s primary uptrend is now officially over and an outright DOWNtrend from the recent highs is fully underway.

The U.S. dollar index is experiencing a very orderly breakdown that has confirmed an end to the primary uptrend

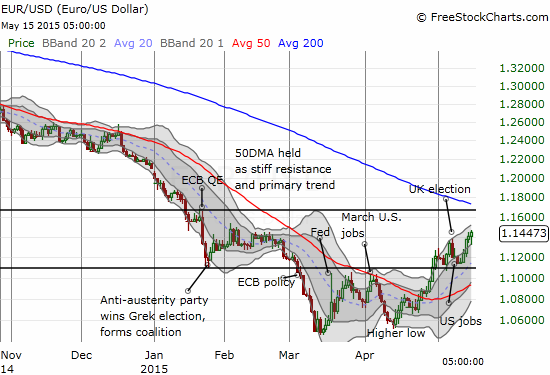

Market observers should duly note that the S&P 500 has not skyrocketed higher upon the dollar’s weakness. Perhaps it is because much of the dollar’s decline has come from a shift in sentiment toward the euro (via Guggenheim CurrencyShares Euro ETF (NYSE:FXE)). EUR/USD has returned to the QE/Greek election trading band and is trading in-line with the post-election high. I am currently betting on at least a return to the bottom of this band. I am also expecting the top of the band to hold as resistance.

The euro is slowly but surely bottoming as the 50DMA turns upward

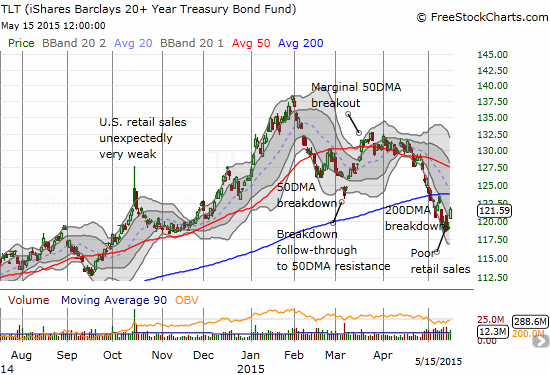

The U. S. dollar is not benefiting from a rise in rates. Surprisingly, the stock market seems not to care about these developments either. The sell-off in bonds is causing a lot of hand-wringing in fixed income circles, but not in equity circles. The 200DMA breakdown for the iShares 20+ Year Treasury Bond (ARCA:TLT) continues, but TLT is not giving up easily. I am still expecting a rebound to at least the 50DMA – I guess I have just been burned too many times thinking that the rally in bonds has finally ended.

iShares 20+ Year Treasury Bond (TLT) is not giving up without a fight

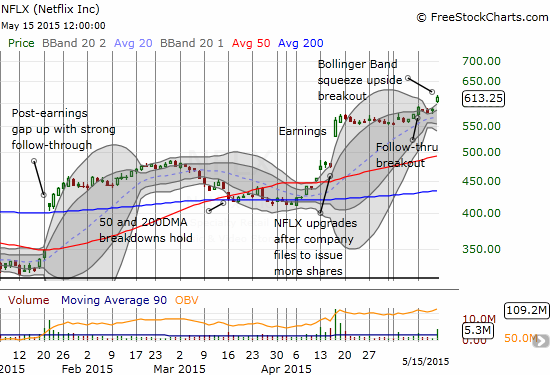

The big trade of the week goes to Netflix (NASDAQ:NFLX). As regular readers know, I have been following NFLX closely from a technical standpoint. On Friday, the stock made a major breakout that resolved a Bollinger Band (BB) squeeze to the upside. I only caught this trade by following the stock closely. I sold my call options right at the open. The stock quickly retreated to $600 from there but rewarded new entrants handsomely with a run-up to as high as $615 before the close. NFLX is now up an incredible 80% year-to-date.

Netflix (NFLX) is in “full bull” mode as a Bollinger Band squeeze is resolved to the upside

Best Buy (NYSE:BBY) is moving opposite NFLX. This week, BBY broke down below its 200DMA for the second time in three weeks. This seems to confirm the head and shoulders top shown in the chart below. Earnings are coming up this week. Will they serve as the nail in the coffin? Prospects certainly seem poor with U.S. retail sales disappointing yet again.

Best Buy (BBY) is breaking down ahead of earnings

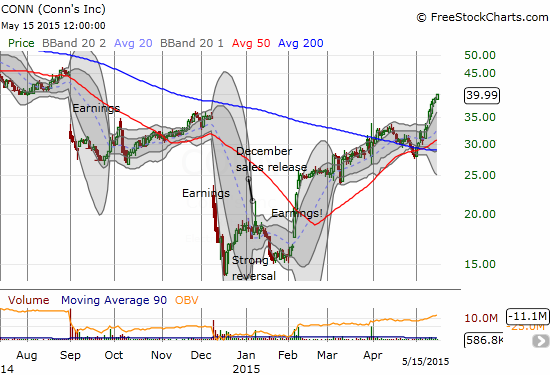

Or maybe money is leaving Best Buy and going to Conns Inc. (NASDAQ:CONN)!?!

Conns Inc. (CONN) continues an incredibly strong recovery with a fresh bounce off 50/200DMA support

Whole Foods Market (NASDAQ:WFM) is also breaking down. November’s 200DMA breakout is essentially over with WFM’s 200DMA breakdown last week. WFM is now a stock to fade on rallies although astute bears could easily have shorted WFM after it broke down below its 50DMA support in March. Note the orderly decline since then.

Will the real Whole Foods Market (WFM) please stand up?!?

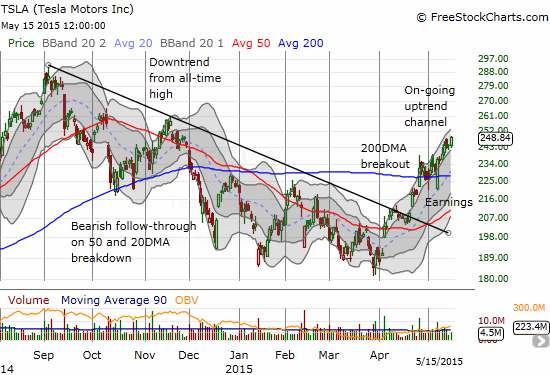

Tesla Motors (NASDAQ:TSLA) is throwing bears for a loop all over again.

TSLA dropped in response to earnings but has not looked back since. TSLA is now up 37% since the late March low. The current uptrend looks strong enough to take the stock back to all-time highs. I do not think I am brave enough to place such a bet though.

Tesla Motors (TSLA) has regained its mojo and is throwing bears for another loop

Crocs (CROX) is making a great follow-through to a bullish post-earnings setup as I pointed out last week. Unlike NFLX, I was not following closely enough to take the entry when CROX notched a new high on this run-up. In fact, with hindsight, I am seeing I should have bought a half position at THAT time and looked for the entry to complete the tranche. Another lesson learned.

Impressive follow-through for Crocs (CROX) as market sentiment has definitely become more bullish on the company

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Disclosure: long UVXY call options, short EUR/USD, long TLT call spread