- Chip stocks hit by selloff after ASML cuts 2025 guidance

- Dollar stretches gains as pound and kiwi fall on lower inflation

- Oil steadier amid ongoing ME drama, gold heads towards fresh record

Chip and AI Stocks Take a Dive

Equity markets suffered a setback on Tuesday after Dutch semiconductor giant, ASML (NASDAQ:ASML), sparked panic about the demand outlook for chips when it accidentally published its earnings report a day early. ASML missed estimates for third-quarter earnings per share but what shocked markets was its updated sales guidance for 2025, which was far below its previous forecast.

Although the company said that this weakness excludes the AI segment, other chip makers such as Intel (NASDAQ:INTC), AMD (NASDAQ:AMD) and Taiwan Semiconductor Manufacturing (NYSE:TSM) also took a big hit. Even Nvidia (NASDAQ:NVDA) shares tumbled, finishing the session 4.5% lower, while ASML plunged by 15.6%. The broader tech sector came under pressure too, with the Nasdaq 100 shedding 1.4% on Tuesday.

But European stocks and US futures are steadier today, suggesting that an overdue correction following the recent strong gains likely exacerbated yesterday’s selloff.

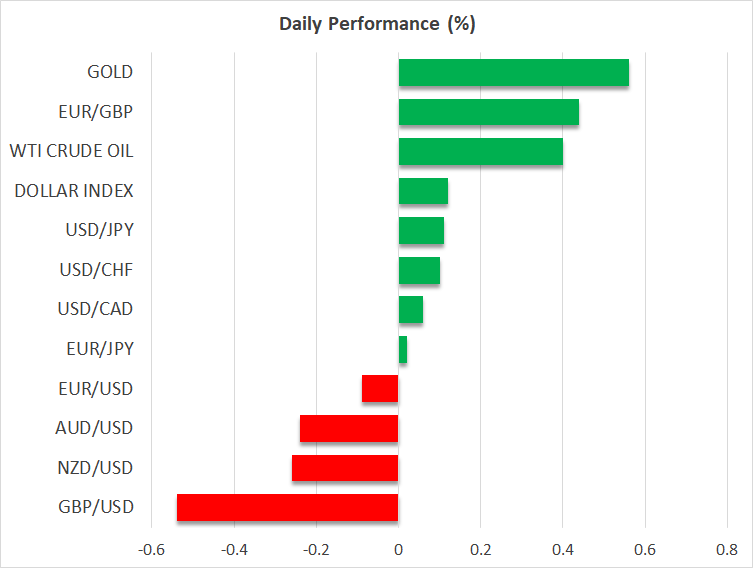

Pound Skids as UK CPI Drops Below 2%

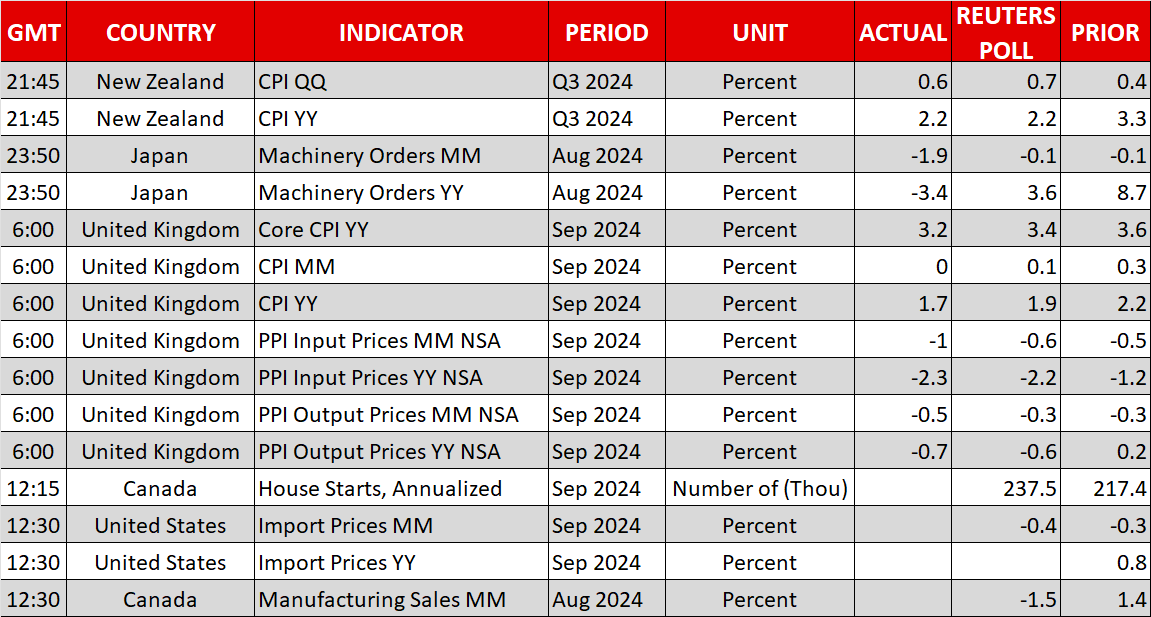

London’s FTSE 100 is leading the rebound in equity markets, buoyed by a bigger-than-expected drop in UK inflation. The annual rate of CPI fell from 2.2% to 1.7% in September versus forecasts of 1.9%. Core CPI declined from 3.6% to 3.2%, while services CPI eased sharply from 5.6% to 4.9%, boosting the odds of a rate cut by the Bank of England at its November meeting.

Prior to today’s inflation figures, there were some doubts as to whether the BoE will cut rates in three weeks’ time amid some mixed messages from policymakers. But whilst the CPI data makes a November cut a done deal, there is still some uncertainty about the rate path beyond the next meeting, as UK inflation is set to accelerate towards the end of the year due to the expected rise in energy bills.

Nevertheless, the pound slid to two-month lows below $1.3000, as investors upped their bets for a 25-bps reduction in November, which is now close to being fully priced in.

Kiwi and Loonie in the Spotlight Too

The New Zealand dollar also underperformed, as the country’s inflation rate fell within the Reserve Bank of New Zealand’s 1-3% target band in the third quarter in data released earlier today. The reading of 2.2% was in line with projections but it has reinforced expectations that the RBNZ will slash rates by another 50 basis points at its November gathering.

The Canadian dollar, however, was somewhat steadier after pulling back from 10-week lows against the greenback yesterday. Canadian CPI numbers for September were also on the soft side, strengthening expectations of a 50-bps cut by the Bank of Canada next week. But having already rallied by around 2% this month, it seems that profit-taking set in for the dollar/loonie after the knee-jerk surge on the back of the data.

More broadly, the US dollar is resuming its climb today, reaching two-month highs against a basket of currencies, while the euro remains on the backfoot ahead of tomorrow’s ECB decision and US retail sales report.

Gold Eyes New Record, Oil Struggles

In commodities, gold advanced for a second day, approaching its September all-time high of $2,685.42/oz. The mild retreat in US Treasury yields is likely behind the gains in the precious metal as the dollar’s strength this week is mainly being driven by weakness in other currencies rather than anything new on the Fed front.

But heightened geopolitical risks are contributing too, with oil futures attempting to halt their decline today after Israel signaled that a strike on Iranian oil facilities hasn’t been completely ruled out.