- The opening of Chinese markets to foreign investors will likely result in larger capital inflows

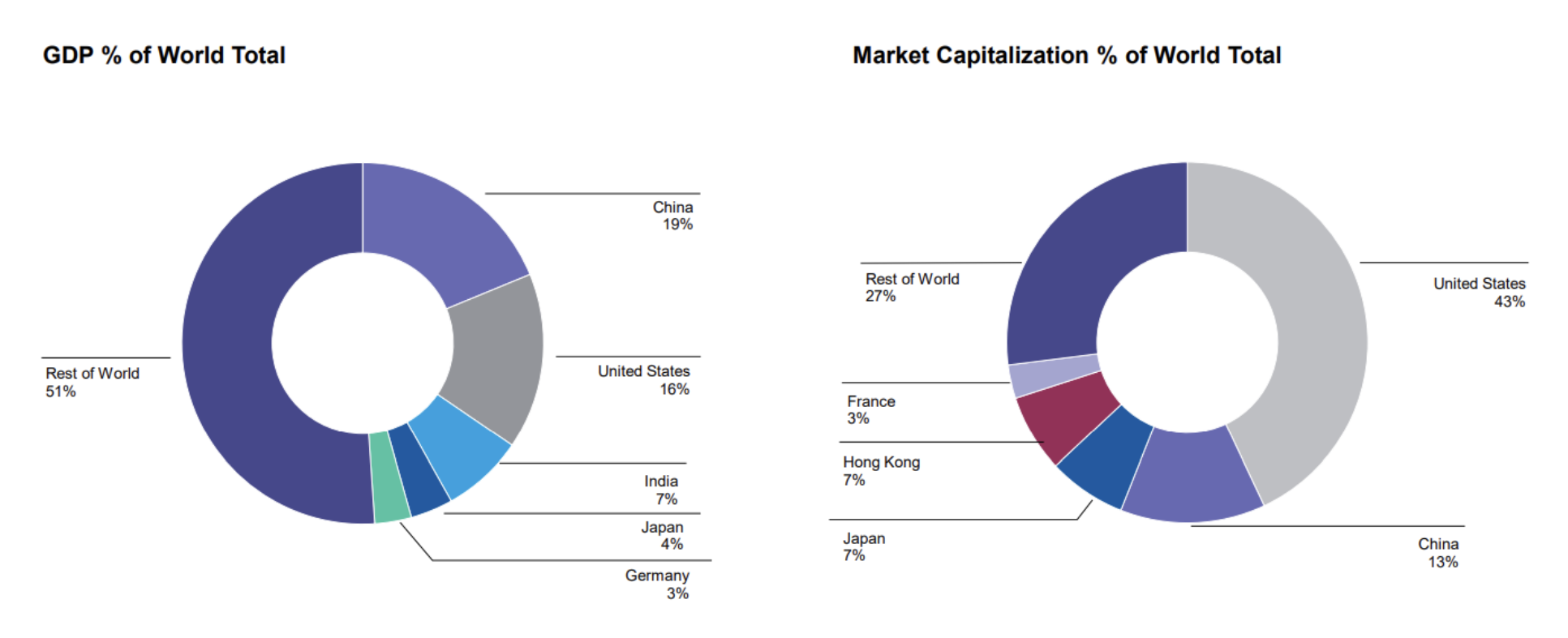

- China currently accounts for 19% of the global GDP, but only 13% of equity capitalization

- From a strictly economic standpoint, adding Chinese stocks to your portfolio is an important part of a long-term diversification strategy

There are several reasons why you should consider adding Chinese equities to your long-term portfolio. Of course—and let's make that clear right away—with the appropriate weight. Global and U.S. equities should still account for the most significant allocations.

After hitting all-time highs in 2015 at almost 5500 points, the Shanghai Composite Index has been moving sideways within a channel, ranging from 2670 to 3660 (see image below).

This long "indecision" is bound to break out to the upside for several reasons. First and foremost, with the opening of Chinese markets to foreign investors, new flows are expected between now and the next few years.

Second, it is very likely that China will overtake the United States as the world's largest GDP in the coming years, and we must take that into account. Comparing GDP and market capitalization, we note that China weighs in at 19% of the world's GDP but only 13% of equity capitalization. So adjusting the two values (more likely to align capitalization upward) would lead to a 50% growth in Chinese equity values.

Source: Eaton Vance

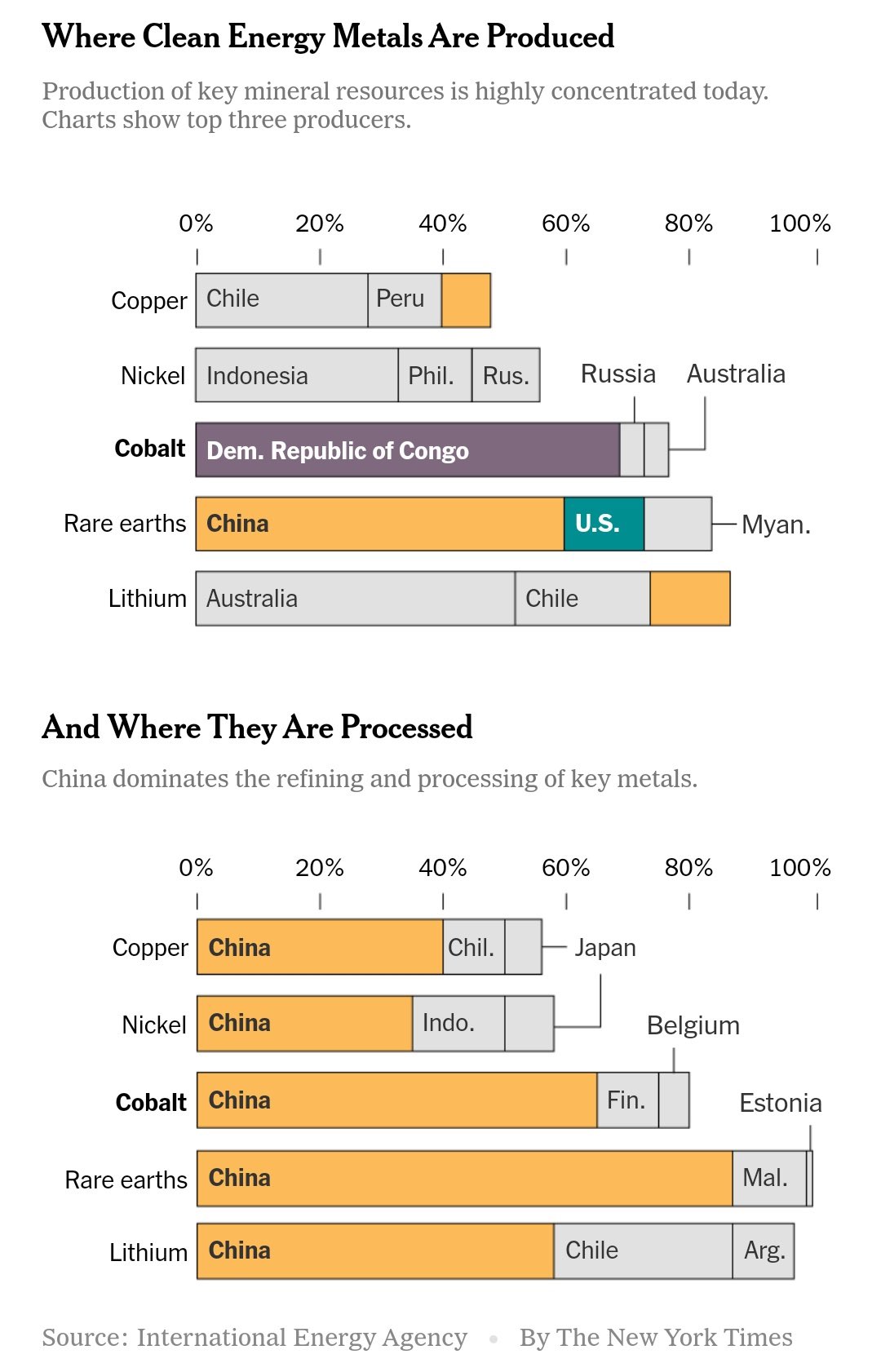

But let's also talk about energy transition and raw materials. Guess who has (almost) absolute dominance on rare-earth elements, which are an essential part of many high-tech devices and other industrial applications? China with 60% (see below).

Source: Financial Times

And it doesn't end there; for the other metals, which are fundamental in various industries, China handles the final processing stages for almost all of them. In short, since there is so much talk today about the energy problem, we need to understand who is in the dominant position on the issue.

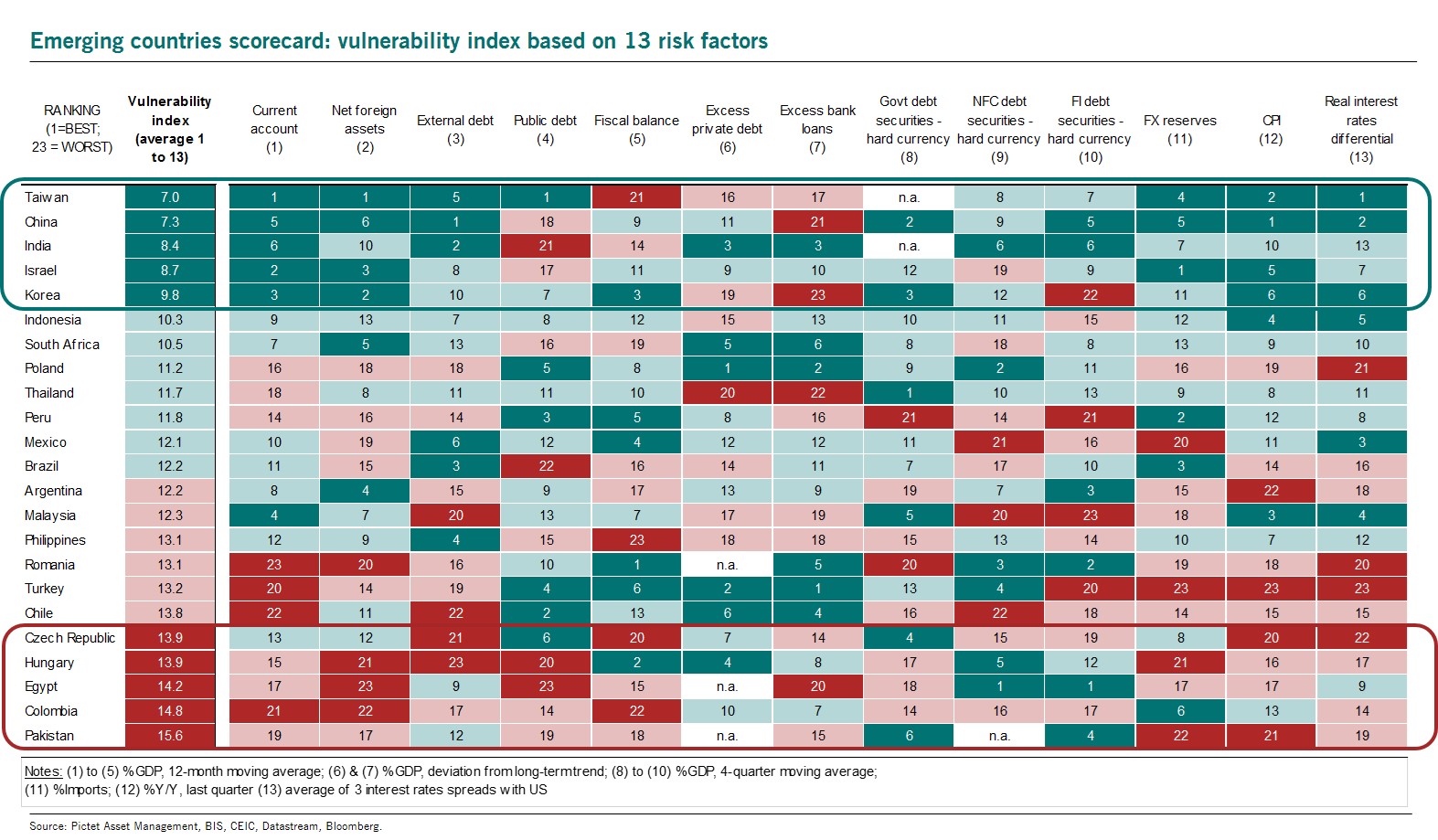

And lastly, U.S. dependence. Not only has China been unloading U.S. debt recently, as a new economic and political bloc with Russia and India is now evident, but if we look at the list of countries least sensitive to U.S. rate hikes, here we find China among those best-placed.

Source: Pictet Asset Management

So political discussions apart, from a strictly economic standpoint, I believe that China should weigh anywhere between 5 and 15 percent in an investor's long-term portfolio, depending on your personal preference—preferably at an open exchange rate for currency diversification.

Here are three of my favorite ETFs for betting on the Chinese market.

- iShares MSCI China ETF (NASDAQ:MCHI), which provides exposure to the locally listed portion of the Chinese stock market in the local currency.

- iShares China Large-Cap ETF (NYSE:FXI), which tracks the performance of the 50 largest Chinese stocks that trade on the Hong Kong Stock Exchange.

- Xtrackers MSCI China UCITS ETF (LON:XCX6), which tracks large and mid-cap Chinese companies across various types of listings.

Disclosure: Francesco Casarella is long on the Xtrackers MSCI China UCITS ETF.