Asian markets turned to decline, failing to develop growth against the background of weakening US stock markets. China’s A50 blue-chip index loses 2% on Thursday, developing a retreat from its highs in almost a year. Futures on the S&P 500 fell to 3-week lows amid alarming US data. The deficit of the foreign trade balance increased to record for the past 10 years due to the frontloading ahead of the tariffs increase.

In this scenario, we see how much the expectations of financial markets and companies differ. While the financial markets tuned on the negotiations progress, the business tunes to a completely different scenario.

It is possible that the fears of business extend not only to orders of goods. Published February ADP statistics showed an employment increase by 183K, which is significantly lower than 300K and 249K of new jobs in the previous two months. Such data intensify the market’s fears but hardly can cause a serious sell-off. Attention is now focused on the ECB comments later in the afternoon and tomorrow’s official US employment data.

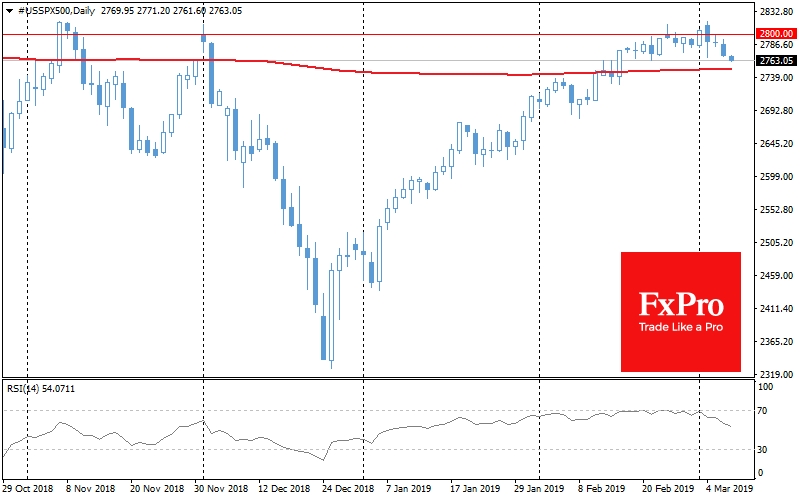

Technical analysis still indicates the need to be wary of looking at the market’s growth prospects in the coming days. The RSI index is declining, indicating a weakening of the growth momentum for both China A50 and S&P 500. And this is a signal of a possible further increase of pressure on stock indices.

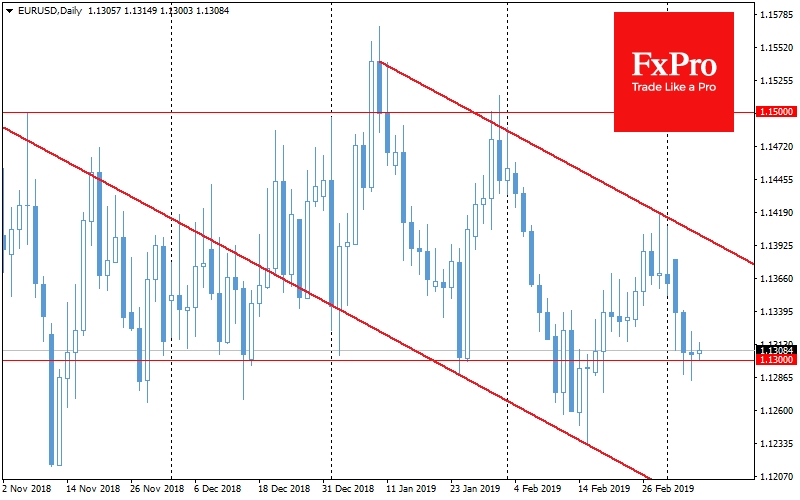

The US dollar, in turn, got close to the upper end of the USDX index trading range. EUR/USD is testing 1.13 again, turning to decline at the end of February. And this is an alarming sign for the pair, which since the beginning of the year has been demonstrating a series of declining local highs and lows.

Over the next few days, there will be enough reasons for the development and reversal of newly formed trends, so you should carefully follow the news, as there may well be sudden flashes of volatility.