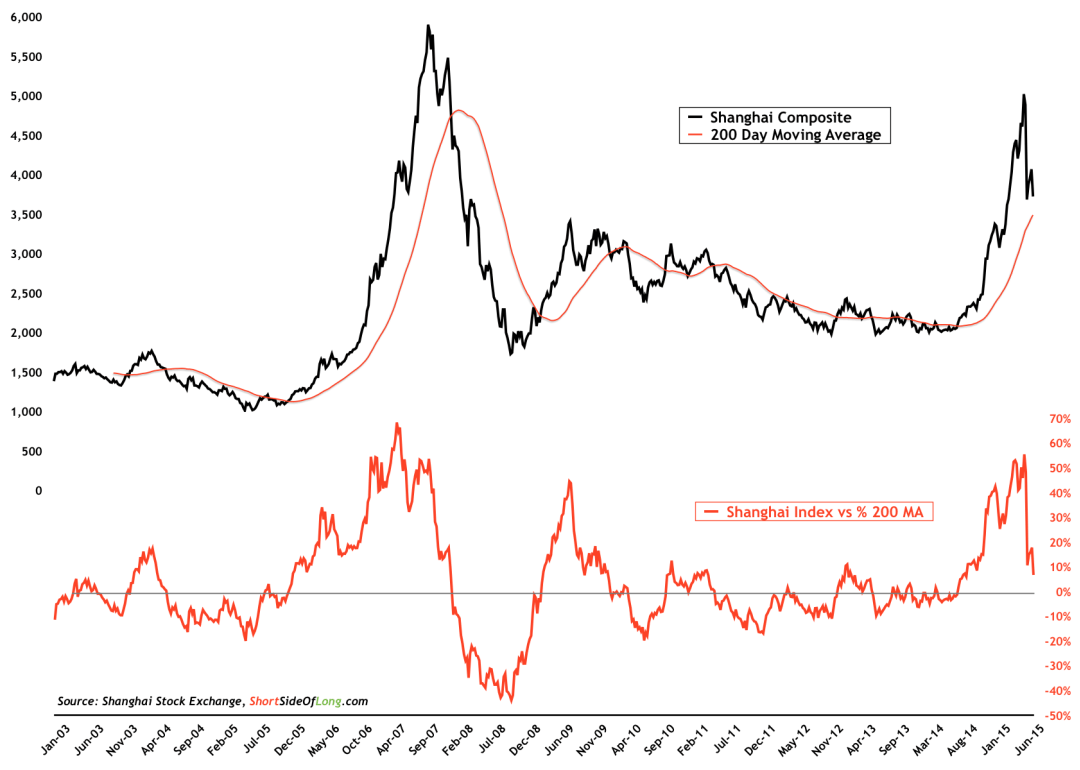

Chart Of The Day: Shanghai Composite hasn’t finished its downtrend just yet…

Chinese equities fell a whopping 8.5% in today's session, as the index unravelled after lunch in Shanghai. Unprecedented government intervention was bound to fail, as the index was actually working off its extreme oversold conditions with a multi-week bounce. In Hong Kong, the China Enterprises Index sold off by almost 4.5%, while Hong Kong’s Hang Seng Index lost 3.2%.

As the chart above clearly shows, Chinese mainland shares are in the process of mean reversion towards their 200 day moving average. First, let us remember that the Shanghai Composite went as far as 55% above its 200 MA into June of this year. That was an extremely overbought condition, similar to the peak in 2007.

My view is that, whenever an asset trades above the mean for an extended period, it tends to spend a considerable amount of time below that mean too.