Asian markets are broadly positive despite a major renewed selloff in commodities overnight following a strong European session and a fairly flat US session. The buying in gold and oil driven by market uncertainty in the wake of the Paris attacks unwound dramatically overnight. This went hand-in-hand with major falls in iron ore and copper. This was also partly driven by a strong performance in the US dollar overnight as US CPI came in slightly stronger-than-expected at 0.2% year-on-year against expectations for 0.1%. This helped drive the WIRP bond market implied probability of a December Fed rate hike back up to 68% from 66%.

This has seen the vast majority of Asian currencies weaken against the USD during the session with the Korean won and Thai baht seeing the worst of the selling. The Kiwi dollar didn’t fall as dramatically as expected despite the Global Dairy Trade auction seeing dairy prices fall again, although this had largely been priced into the dairy futures. The huge Chinese demand for infant formula does not seem to have been spilling over into wholesale dairy prices just yet despite the major Aussie supermarket chains of Coles and Woolworths Ltd (AX:WOW) following Hong Kong’s lead and putting restrictions on the purchase of infant formula. The ASX-listed infant formula producers Bellamys Australia Ltd (AX:BAL) and A2 Milk Company Ltd (AX:A2M) continue to see strong buying on the back of the record demand.

China

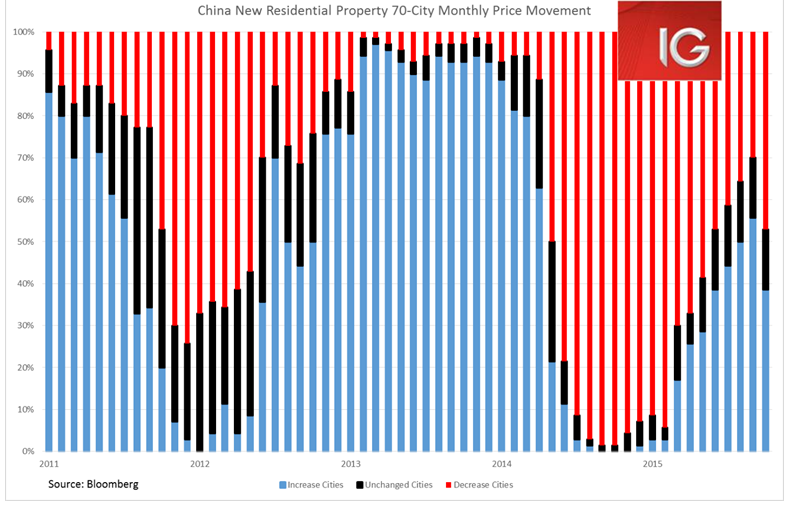

Despite a relatively weak performance in Chinese Mainland and Hong Kong bourses, the mixed Chinese property data did boost a number of property-related stocks. The real estate sector on the Shanghai Composite was up 0.9% in early trade, with top performances seen by Jiangxi Zhongjiang Real Estate, POLY Real Estate and Greenland (HK:0337). The real estate sector on the Hang Seng Index was relatively flat, but there were noticeable gains by COLI and China Resources Land Ltd (HK:1109). The continued rise in Tier 1 and Tier 2 cities seemed to be the driver by the selective outperformance of certain Chinese real estate stocks.

Of most concern in the Chinese data was the decline in the number of cities that saw increasing month-on-month prices to 27 from 39 the previous month. Nonetheless, in year-on-year terms, the number of cities with increasing prices moved up to 16 from 12 the previous month. Even though Chinese property prices have been steadily increasing in recent months, this has failed to follow through with a noticeable uptick in newly started property construction. The data likely added further downward pressure to materials sectors alongside the renewed selloff in commodities.

ASX

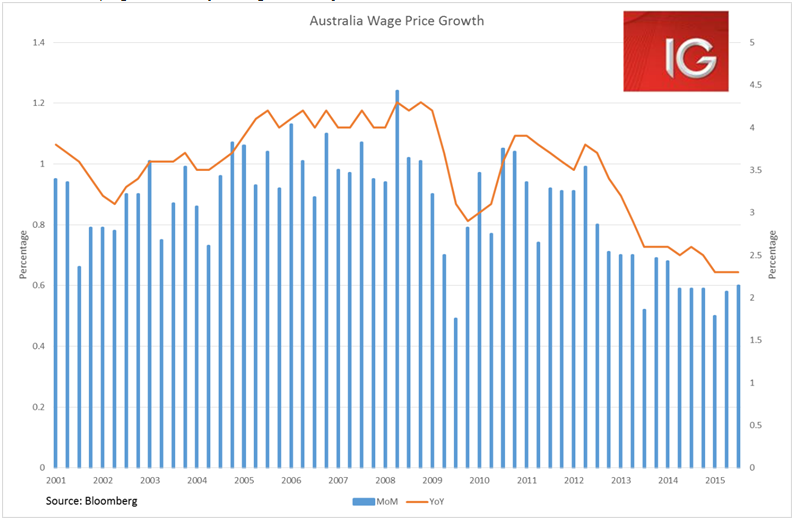

The Australian wage price index was largely unchanged in Q3 from Q2. Wage growth has clearly slowed in 2014 and 2015, but the RBA will be hoping that the very weak growth in Q1 was the bottom.

The ASX got off to a rocky start following on from a weak US session and a renewed selloff in commodities. But by mid-session, the index was pulling back into positive territory.

The index was greatly helped by a strong performance by the Aussie banks after suffering from a difficult couple of weeks. CBA’s Annual General Meeting yesterday seems to have quelled some investor concerns about the stock as it saw the best performance in the sector. But also the big selling of the banks in the past couple of weeks have brought them down to more compelling valuations. So long as investors believe the banks will be able to keep their high dividend policies up they are likely to still find buyers.

A-REITS and Utilities also saw solid buying with Dexus Property Group (AX:DXS) and AGL Energy Ltd (AX:AGL) both seeing decent days.

The materials sector was the worst performer by a long shot with gold miners in particular seeing heavy selling in the wake of the strong moves in the December Fed rate hike probability. BHP Billiton Ltd (AX:BHP) and Rio Tinto PLC (N:RIO) both had pretty terrible days as copper and iron swooned overnight – both stocks lost over 2%.

A close above 5100 is definitely going to be a positive for the ASX going forward and we could see the market continue on a steady upward trajectory from here.