The US has its FANG (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), Alphabet (NASDAQ:GOOGL) – read Google) that is often the focus of the stock market. In China there is the BAT (Baidu Inc (NASDAQ:BIDU), Alibaba (NYSE:BABA) and Tencent Holdings Ltd ADR (OTC:TCEHY)) that dominates the market. Lately Jack Ma, the CEO of Alibaba, and his crew have been unable to right the Chinese market though and it has plunged nearly 10% since the end of January. Can this BAT turn the market around?

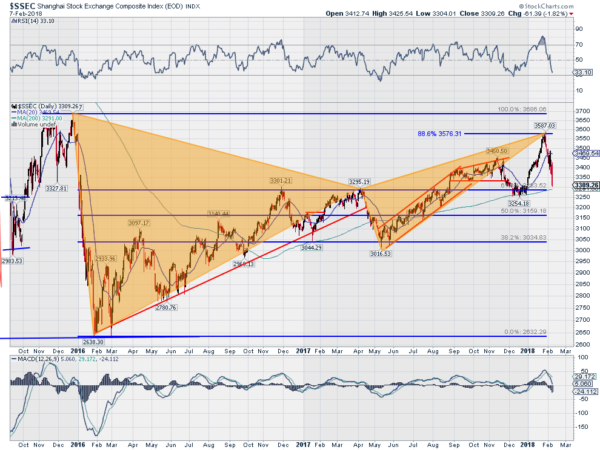

Actually there is another Bat in play in the Chinese market. A harmonic Bat. The chart below shows the price action of the Shanghai Composite over the last 2 and a half years. It starts with the steep fall to start 2016 followed by a long push higher to a short term double top in March last year. Then another pullback to a higher low before the move up to the January high.

That January high pushed through the Potential Reversal Zone (PRZ) of a bearish Bat harmonic and printed a Terminal Price Bar to trigger the reversal. The pattern looks for a retracement of 38.2% of the broad pattern as a first target. This is about where the Composite sits now. And with the 200 day SMA in proximity this is a doubly important price level. The 200 day SMA has been key to the long term trend in the Composite.

Failure to hold here near term would look for a 61.8% retracement of the pattern, so back to about 3000 in the Shanghai Composite. With momentum building to the downside the prospects of a stall here are fading. The RSI however is now close to being in oversold territory, a glimmer of hope. Perhaps Jack Ma can send out the BAT signal to turn this market around.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.