“CNY CPI y/y (1.3% v 1.5% expected and 1.6% previously)”

With inflation being a major indicator of demand and activity in an economy, yesterday’s miss out of China will only exaggerate the perception that the world’s largest emerging economy is experiencing a major slowdown.

Chinese inflation rose just 1.3%, missing expectations of a 1.5% increase and also slowed from the September reading of 1.6%. With the Chinese economy already struggling to reach almost crazy growth targets of 7%, this release almost certainly keeps continued stimulus at the forefront of trader’s minds.

Most Chinese related stories in financial media today seem to be focused around the effect that this has had on the commodities markets and the pain that could be experienced by export economies such as Australia if the PBOC doesn’t continue to act.

Despite six interest rate cuts in 12 months, spending hasn’t followed and more fiscal measures are on the cards.

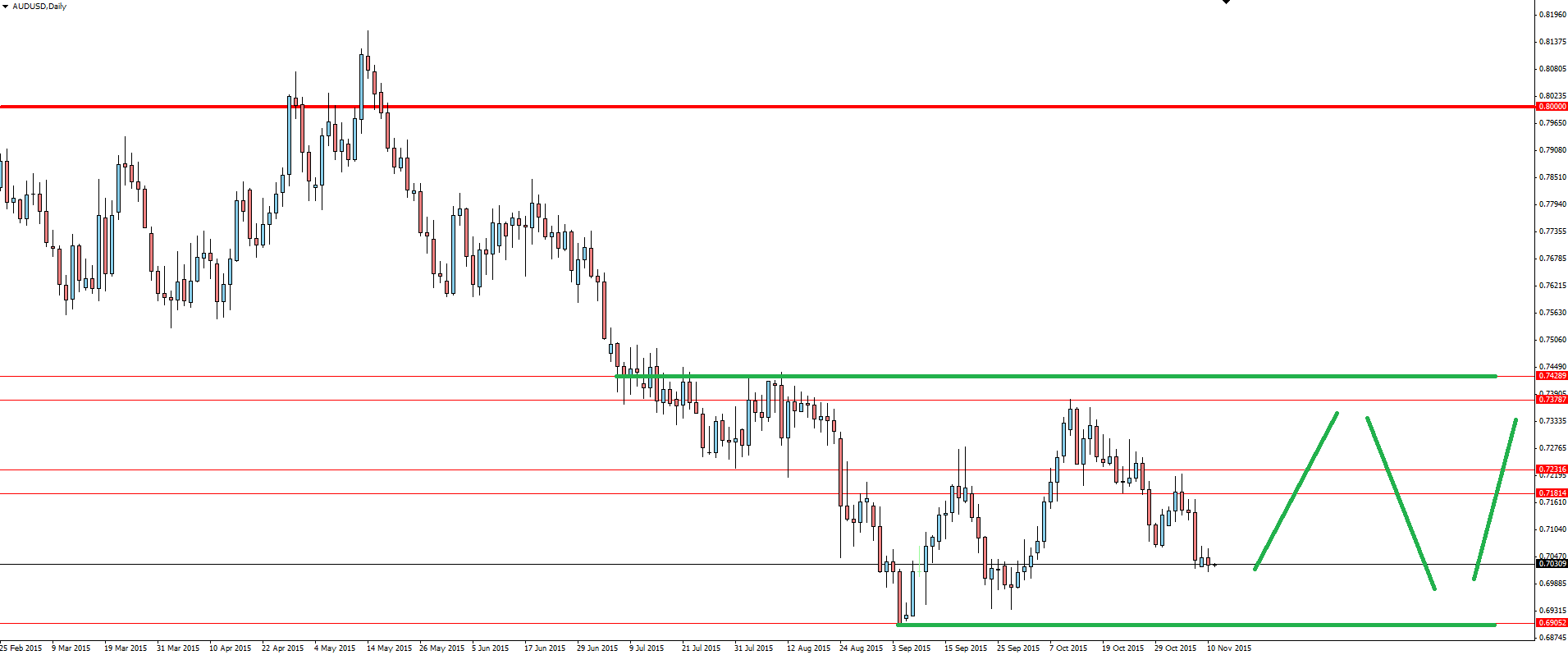

Click on chart to see a larger view.

AUD/USD sold off all of yesteday, pushing the pair to fresh lows for the month. Price has, however, been happy to sit between the 0.74 and 0.69 levels in the nice clear range marked here, with a few key levels between which price has moved quite technically between.

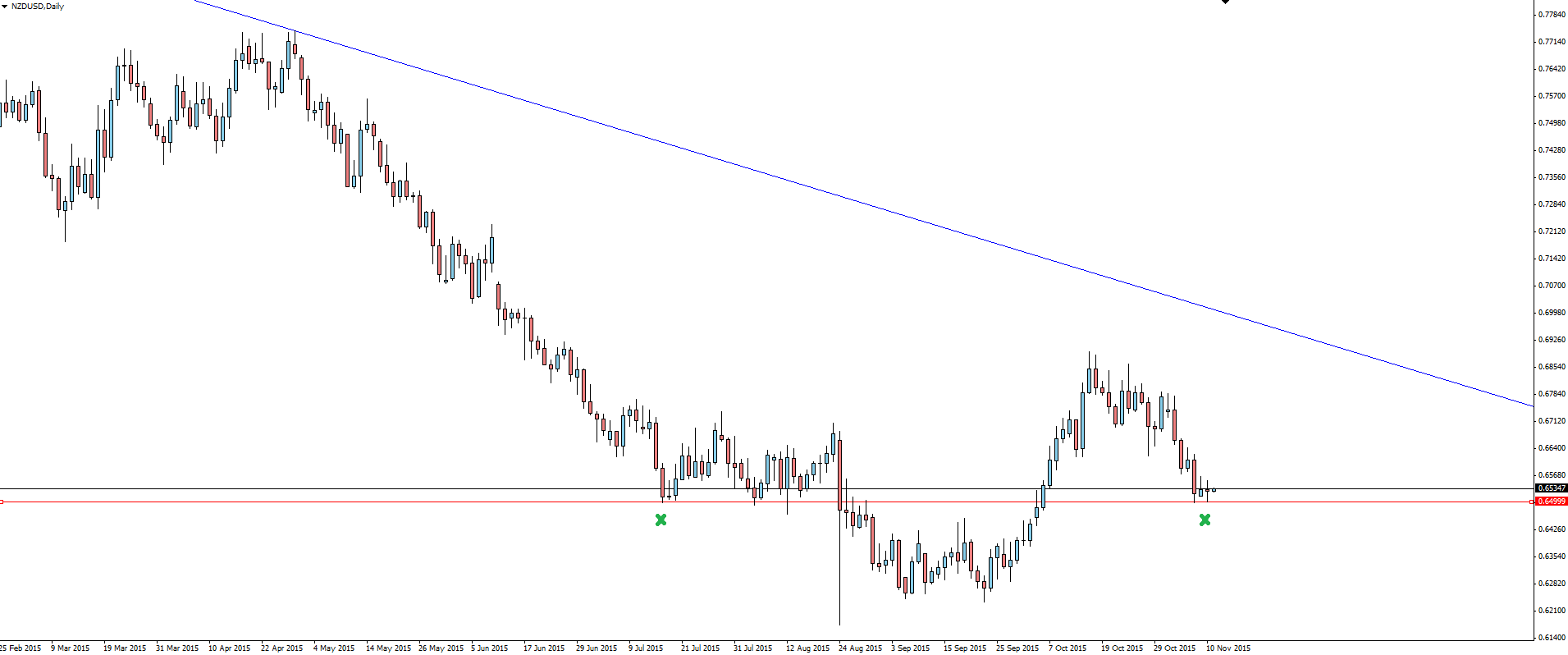

Judging by some of the less than hawkish statements in this morning’s RBNZ Financial Stability Report, kiwi support also looks happy to hold.

“The exchange rate has been moving higher since September, which could, if sustained, dampen tradables sector activity and medium-term inflation. This would require a lower interest rate path than would otherwise be the case.”

NZD/USD Daily:

Click on chart to see a larger view.

Not enough from Wheeler to push the kiwi through support in early Asia and is definitely a nice level to manage risk around heading into the back end of the week.

———

On the Calendar Wednesday:

CNY Industrial Production y/y

CNY Fixed Asset Investment ytd/y

EUR French Bank Holiday

GBP Average Earnings Index 3m/y

GBP Claimant Count Change

CAD Bank Holiday

USD Bank Holiday

EUR ECB President Draghi Speaks

Plenty of holidays throughout the world’s major economies today. Be aware of decreased liquidity and possibly erratic market conditions.

“Remembrance Day (sometimes known as Poppy Day) is a memorial day observed in Commonwealth of Nations member states since the end of the First World War to remember the members of their armed forces who have died in the line of duty.”

———-

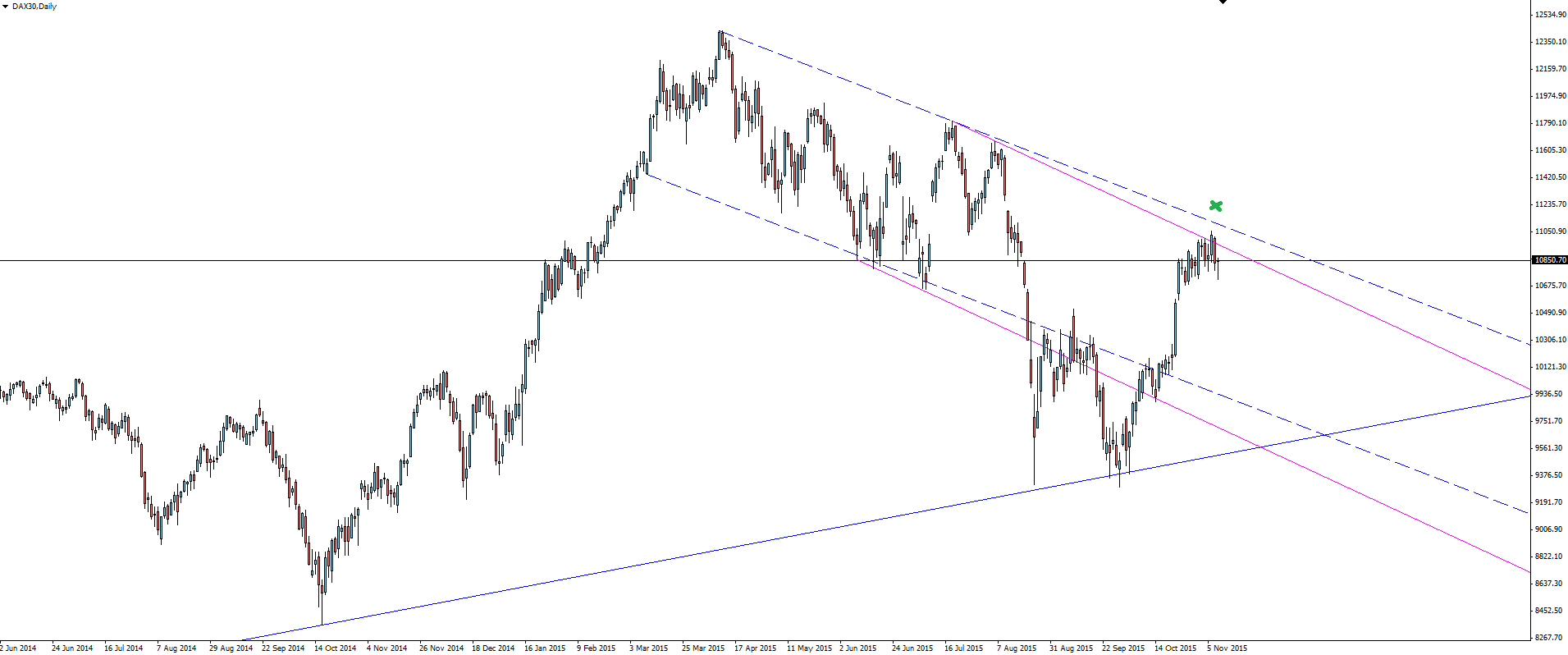

Chart of the Day:

Sticking with indices in today’s chart of the day, we move across to our old friend the DAX.

DAX30 Daily:

Click on chart to see a larger view.

I’ve re-drawn the channel in purple using the previous 2 highs, refreshing the channel and making it more relevant. Just like horizontal support/resistance zones can move slightly over time when more recent swing lows/highs form, the same can be said for trend lines.

After tucking back into its short term channel, the DAX has reached resistance again. Maybe a little bit early, but Deutsche Bank’s DAX forecast seem to be on point!

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian regulated FX broker Vantage FX Pty Ltd does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, FX News Centre research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and No Dealing Desk Forex Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.