There are a lot of people in China. Almost a fifth of the global population, in fact. That’s pretty staggering. Especially when you put it in this context...

The Chinese working population is bigger than the populations of the U.S. and Europe combined.

This nation of 1.3 billion wields heavy influence on the global economy. Yet most American investors know very little about China’s internal market trends.

It’s true that China is dealing with a stock market slump and a couple years of slow GDP growth. But the Chinese are still seeing a rapid rise in standards of living.

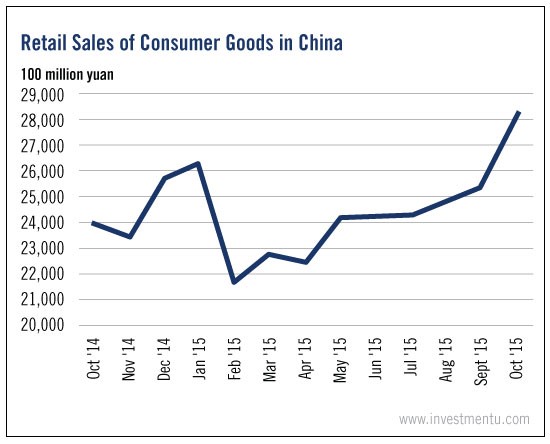

In recent years, growth in consumer spending has been explosive. In 2015, retail sales in China totaled $4.574 trillion. That’s only 4.5% less than U.S. retail sales for the same year.

Within a year or two, Chinese consumers are expected to overtake Americans as the world’s biggest shoppers.

Behind this change, as I mentioned, is China’s growing middle class.

Incomes continue to rise among city dwellers. The recent financial downturn hasn’t really hurt their spending habits, either.

The impact of Chinese urbanites extends far beyond China’s economy. In fact, it extends beyond all of Asia...

Their spending influences commodity futures, trade balances and even Western businesses. Apple Inc (NASDAQ:AAPL) billionth iPhone was sold in Beijing - at one of China’s 41 Apple (NASDAQ:AAPL) Stores.

In past decades, economists and investors focused on China’s exports. Now it’s becoming equally important to pay attention to China’s imports.

In my next few posts, I’ll explore some of the biggest trends among Chinese consumers today. These include a growing taste for foreign travel, designer clothing and professional sports.

Learning about the wants of this powerful middle class could lead you to huge profits. Stay tuned.