After rallying 55% above its long term average, Chinese stocks are now 20% below it

Regular readers should remember our warning of more downside for Chinese mainland shares (via Deutsche X-Trackers Harvest CSI 300 China A-Shares (NYSE:ASHR)) which we have been dishing out for several months now. One of our main views was expressed in July of this year:

Historically, periods when asset prices trade excessively above the mean, are usually followed by a reversion where prices also trade below that mean. In plain English, I believe that a best case scenario for the Shanghai Composite will be a period of consolidation, as the index waits for its moving average to play catch up, testing its recent bottom at 3300 points, established Wednesday last week. Vigilant investors among you should notice that the index is still trading more than 16% above the 200 day MA and if history is of any guide, price will eventually find its way below this mean. Several investment banks that missed almost the entire rally, as they stubbornly carried on with their neutral outlook (code word for remaining bearish) through the 2013-14 bottoming period, have recently started recommending their clients “to bottom fish” the crash. Majority of these investment bankers are usually too early to buy the fall and always too late to participate in the new rally.

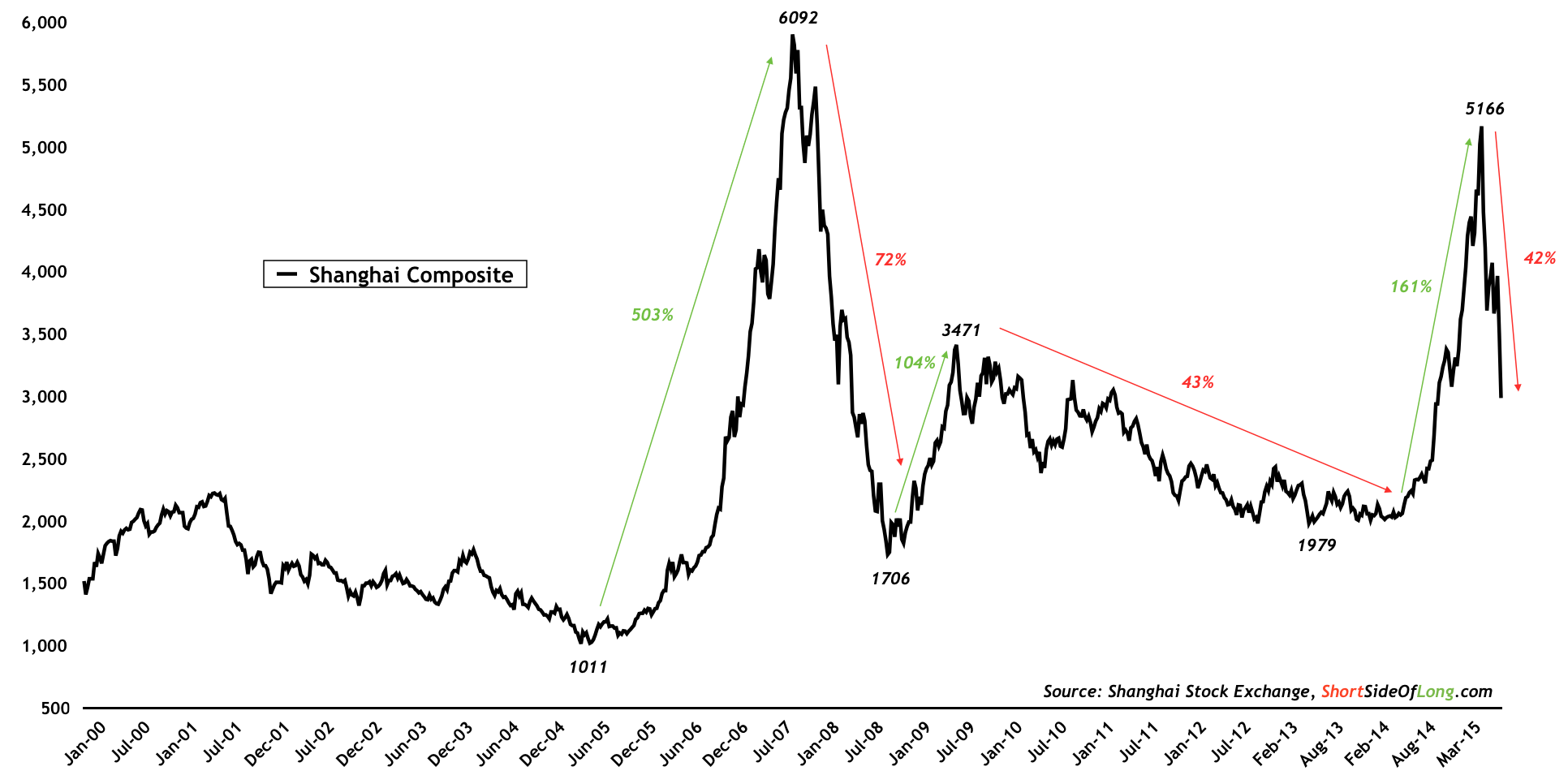

Well… here we are. The Shanghai Composite is now down over 25% in 7 days alone and down over 42% in the last two and half months. A notion that the Chinese government (or any other for that matter) had the capacity and capability to backstop the crash was a ludicrous idea in our view. Traders should remember that real bottoms, proper bottoms, sound bottoms are always made when markets are allowed to clear and reset. A major buying opportunity is approaching, but it is prudent to let the current panic turn into outright selling climax.