Market Brief

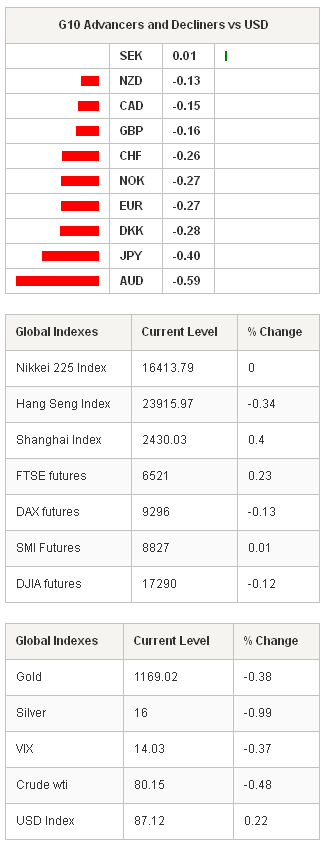

In the forex markets, USD continued to strengthen in the Asian session. EUR/USD fell sharply at the open to 1.2440 due to technical trading strategies getting triggered on the break of 1.2500. But EUR/USD was able to regain most of the early loses to 1.2492 (however demand feels weak). USD/JPY was range-bound between 112.60 and 112.99, unable to break upside resistance. AUD/USD fell to 0.8702 following the China PMI and soft Australian building approval reports. In FX EM, the trend was the same, with USD gaining broadly. In Asia KRW and MYR were the big underperformers while traders will be focused on RUB when Europe opens. Asian equity markets are undecided on risk sentiment. The Nikkei closed while the Hang Seng fell -0.41% and Shanghai rose 0.40%. S&P 500 futures are slightly in the red by 0.2%.

News flow, over the weekend, was light. In the political, front German chancellor Angela Merkel has warned UK prime minister David Cameron that any changes to the guidelines on freedom of movement would prompt her to consider a British exits from the EU. According to the Der Spiegel, Ms. Merkel has made it clear that any effort to restrict immigration from EU member states will result in German removing support of Britain to stay in the union. We see this as a the first opening volley in a battled that will ultimately break up the EU. Britain is already extreme concerned about flow of immigrates, illustrated by the growing prominence of Ukip. While Germany perceivable has the most “at stake” should immigration patterns suddenly shift. While the market reaction has been muted to this verbal war, (EUR/USD unaffected), this particular issue will become a focal point towards the referendum on British EU membership in 2017. Further eroding the markets faith in EUR and helping to entrench longer term EUR/USD bearish trend.

China’s manufacturing PMI fell to 50.8 in October from 51.1 in September, well below expectations at 51.2. The big drop was seen in new orders index which well the most amid the key underlying-indices to 51.6. PMI non-manufacturing activity fell to a nine-month low at 53.8 from 54.0 in September. Overall, consistently soft PMI indices indicate that the scope from additional upside in production is limited. Elsewhere in Asia, Australia’s building approvals collapsed 11.0%m/m, significant worst then -1.0% expected.

On the docket in Europe, we have EA final manufacturing PMI, UK manufacturing, Swedish manufacturing PMI, Swiss manufacturing PMI and Turkish CPI. In the US session traders will be watching ISM Manufacturing and Chicago Fed President Evans (non-voter, dove) & Dallas Fed President Fisher (voter, hawk) speaks.

Swissquote SQORE FX Trade Idea:

G10 Currency Trend Model: Sell AUD/USD at 0.8747.

Currency Tech

EUR/USD

R 2: 1.2896

R 1: 1.2771

CURRENT: 1.2671

S 1: 1.2586

S 2: 1.2520

GBP/USD

R 2: 1.6212

R 1: 1.6185

CURRENT: 1.6089

S 1: 1.5994

S 2: 1.5966

USD/JPY

R 2: 111.20

R 1: 110.65

CURRENT: 109.75

S 1: 108.80

S 2: 108.27

USD/CHF

R 2: 0.9648

R 1: 0.9582

CURRENT: 0.9507

S 1: 0.9441

S 2: 0.9400