China's Shanghai Index (SSEC) heats up in anticipation of the signing of the new U.S./China Phase I Trade Deal, expected on January 15, 2020.

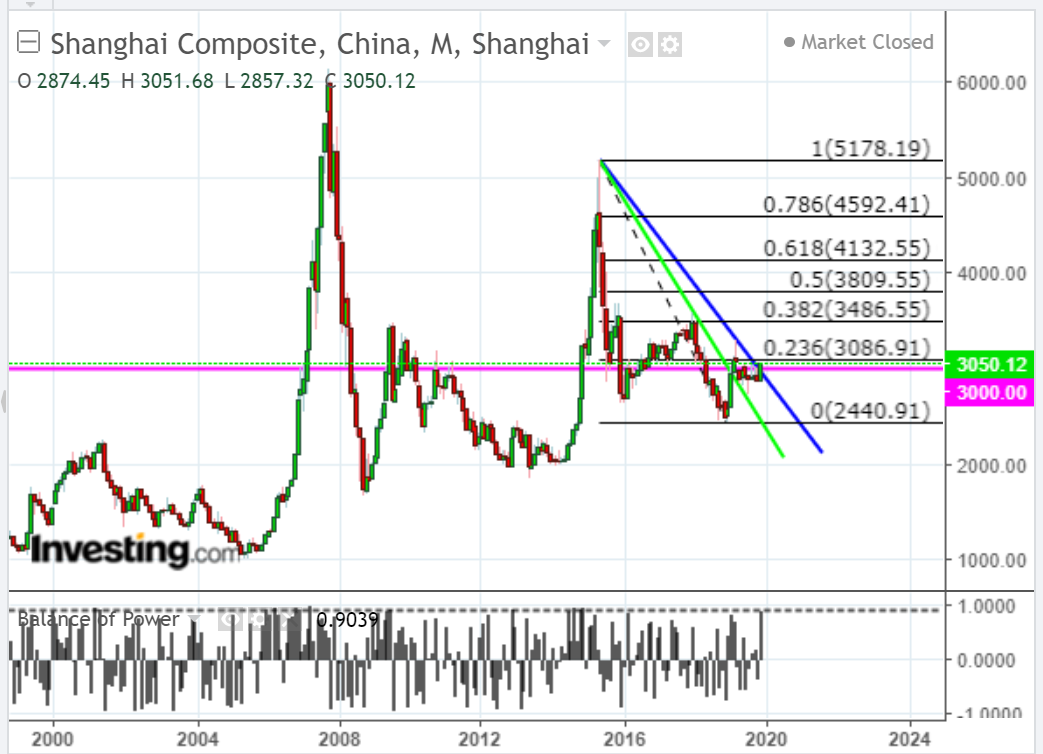

The monthly chart of the SSEC shows price has just broken above a downtrend line that began at the highs of June 2015.

Major resistance lies at 3086.91 (a 23.6% Fibonacci Retracement level), while major price support sits at 3000.

The Balance of Power on this timeframe favors the buyers and is nearing an all-time high set back in April 2007, after which price spiked up from 3197 to 6124 by the end of October that year, for a gain of 2,927 points during that 7-month time period.

If price breaks and holds above 3087, its next major resistance (40% Fib) level is 3486.55...a level not seen since January 2018.

However, if, for some reason, the Phase I Trade Deal is not signed, and if the SSEC breaks and holds below 3000, then I'd look for a drop to new lows to, at least 2700, or lower.