Investing.com’s stocks of the week

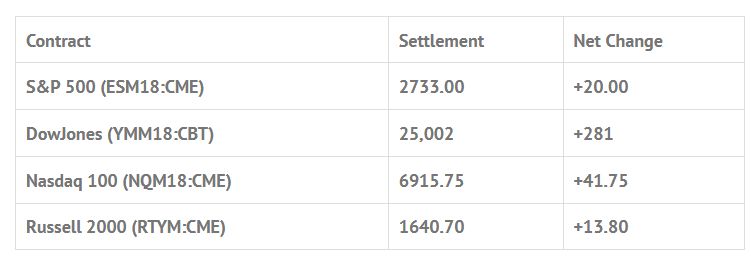

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 5 out of 11 markets closed higher: Shanghai Comp +0.02%, Hang Seng +0.60%, Nikkei -0.18%

- In Europe 10 out of 13 markets are trading higher: CAC +0.07%, DAX +0.38%, FTSE +0.14%

- Fair Value: S&P -0.29, NASDAQ +4.84, Dow -10.49

- Total Volume: 942k ESM & 793 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Redbook 8:55 AM ET, and the Richmond Fed Manufacturing Index 10:00 AM ET.

S&P 500 Futures: China And Mutual Fund Monday

Mondays trade in the S&P 500 futures started with a Globex range of 2724.25 tp 2736.25, with volume of 115,000 contract traded. On the 8:30 CT bell the ES printed 2729.50, rallied up to 2637.00, and then traded 1 tick under the vwap down to 2731.25. After the small drop the ES traded up to a new at 2739.25, and then dropped 14 handles down to 2725.25.

Just after the drop a headline came out saying “LIU HE SAYS CHINA WILL ACTIVELY INCREASE IMPORTS,” and the ES rallied up to 2735.50, pulled back to 2731.50, and at 12:10 traded back up to 2736.25. From there, the futures traded sideways for the next 45 minutes before dropping down to the 2728.00 level as the MiM went from $260 million to sell to $433 million to sell.

The futures then rallied back up to 2733.50, sold off again down to the 2728.00 level, and then traded 2729.50 on the 2:45 cash imbalance reveal as the MiM flipped to $47 million to sell. On the 3:00 cash close the ES traded 2732.00, and went on to settle at 2733.00 on the 3:15 futures close, up +20.75 handles, or +0.77 % on the day.

In the end, the ES did finish in the black, but the days trade was filled with lot of ‘drops and pops’. In terms of volume, Monday’s tend to be the lowest volume day of the week, and the ES barely did 1 million contracts. Considering the big range on Globex, and all the ups and downs, it seems like it should have been higher. In terms of the overall tone, it did close up almost +21 handles, but it seemed to lack buying power throughout the day.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.