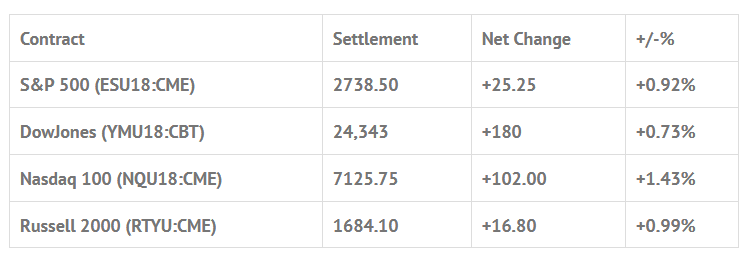

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed higher: Shanghai Comp +0.46%, Hang Seng +0.47%, Nikkei +1.12%

- In Europe 10 out of 13 markets are trading lower: CAC -0.14%, DAX -0.09%, FTSE -0.40%

- Fair Value: S&P +1.49, NASDAQ +18.50, Dow -13.52

- Total Volume: 1.15mil ESU & 624 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Employment Situation 8:30 AM ET, International Trade 8:30 AM ET, EIA Natural Gas Report 10:30 AM ET, Baker-Hughes Rig Count 1:00 PM ET, and Treasury STRIPS 3:00 PM ET.

S&P 500 Futures: Choppy Higher Trade After The 4th

Yesterday, Asian markets closed mixed to lower and Europe was up sharply at midday as the S&P 500 futures traded up to 2735.75 on Globex at 7:32 am. On the 8:30 open the ES traded 2728.50, up +22.25 handles, and at 9:38 dropped down to the vwap at 2726.00. Over the next 45 minutes the ES traded sideways between 2730.50 and 2725.00, and then got hit by several sell programs pushing the futures down to 2727.00 at 10:00.

As Beijing has warned, the US will shoot itself and others in the foot if it presses ahead with plans to impose $34 billion in tariffs, saying that almost two-thirds of those goods are made by foreign companies, including American-owned firms, in China.

After the drop, the ES rallied back up to 2735.25 at 11:25 CT, pulled back to the 2731.00 after the fed minutes were released, and then made a new high at 2737.50 on the FOMC minutes reaction. After that, the futures reversed and sold off down to 2725.00 at 1:15, and then rallied back up as the MiM came online showing firm on the buy side. The ES then pushed up to 2733.00 before 2:00 buy programs thrust the index futures higher up to 2737.25, missing the earlier high by a tick, and then rallied to 2739.50 before printing 2738.75 on the 3:00 close, and settling the day at 2738.50, up +25.25 handles, or 0.93%.

In the end there were some ups and downs, but it was a fairly quiet trading session. Up on Globex, early pull back, dump after the fed minutes, and then a rally back to the highs as the MiM started showing to buy. In terms of the ES’s overall tone, it seemed like more short covering than new buying, In terms of the days overall trade, volume was 1.15 million contracts, which was not that bad considering it was the day after the 4th of July.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.