China - Emphasis on Stability

Asia continues to weigh on risk sentiment. This follows as a consequence of Friday’s sharp rally in equites driven by BoJ’s surprise move to negative interest rates, as weak China manufacturing PMI reports damaged the risk rally. However, despite additional disappointing data from South Korea (exports fell 18.6% y/y in January weakest read since 2009), Indonesia and Thailand, most of Asia was able to recover with the exception of China. China’s Shanghai Composite fell 1.78%. China’s NBS manufacturing PMI contracted to 49.4 in January from 49.7 prior, and below expectations (non-manufacturing fell 53.5 from 54.4 less relevant but still a positive read), indicating sustained reservations to the outlook. USD/CNY was basically unchanged at 6.5790 suggesting the PBoC's new emphasis on stability over economic growth. The infamous “China Death” is again building momentum and size, indicating the market has a very short memory. Today the RMB fix was slightly lower after six consecutive days of strong fixing. Our CNY forecasts are against consensus with limited expectations for extra significant devaluation. Capital outflow have become destabilising and expectations for further CNY weakness will only accelerate the flight. Yet, with demand still fragile we are expecting two 25bp benchmark rate cuts and fine-tuning with two RRR cuts this year. We remain positive on Asian carry trades as further monetary easing by the BoJ and potential accommodation by the PBoC will keep regional risk appetite supportive. As volatility subsides high-yielding currencies should outperform. Fueling these interest rate differential trades should be the JPY.

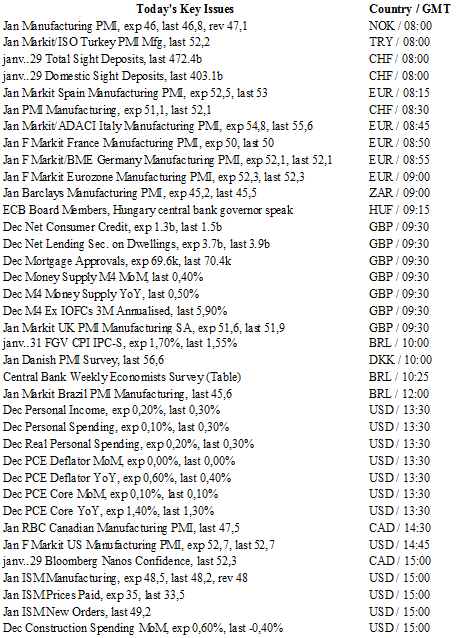

US: soft data expected

Markets have been awaiting the release of the Personal Income and Spending data since the FOMC decided late last week to keep interest rates unchanged at 0.5%. Both should print in lower versus the last available data in November. A Bloomberg Survey puts both releases at around 0.2%m/m. Last week’s Q4 GDP print did not take us by surprise when it came in at a poor 0.7% q/q with the U.S. economy still struggling to enter a path of sustainable growth.

Soft US data will again put in question the Fed’s tightening strategy for this year. All other central banks are currently easing (except for the Bank of Mexico, which is actually carefully following the US rate path in order to avoid any capital outflows that would result from a smaller rate differential). The Fed is therefore alone. We believe that hiking rates too prematurely would have a massive impact on the American economy and drive it again into recession. Yet, the astonishing amount of U.S. debt needs inflation to be reduced over the long haul. If this does not happen then, we are not afraid to say that a QE4 could be in the pipeline. Knowing the Fed’s situation this would be very contradictory but we believe that rates have been raised because the central bank needed to show that it still has control of the situation.

Crude Oil - Growing Bullish Momentum.

The Risk Today

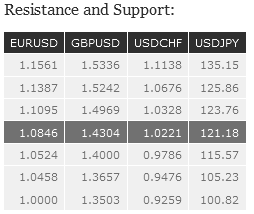

EUR/USD is riding the downtrend channel. Hourly resistance may be found at 1.1096 (28/10/2015 low) while hourly support can be found at 1.0524 (03/12/2015). The medium-term technical structure is clearly negative. Yet, expected to show further very short-term increase. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD has exited the uptrend channel. Hourly resistance can be found at 1.4413 (26/01/2016 high). Another resistance can be found at 1.4969 (27/12/2015 high). Hourly support can be found at 1.4081 (21/01/2015 low). Expected to show further increase. The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is now consolidating after the last week sharp increase. The pair keeps on trading in range. Hourly resistance lies at 123.76 (18/11/2015 high). Hourly support lies can be found at 115.98 (20/01/2016 low). Expected to show further increase toward resistance a 123.76. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF keeps on riding the uptrend channel. Hourly support is located at 0.9876 (14/12/2015 low) and hourly resistance at 1.0199 (26/01/2015 high) has been broken. Stronger resistance can be found at 1.0328 (27/11/2015 high). Expected to show continued strength. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.