Markets had an excellent week, posting gains on all five trading days. The benchmark index jumped on Monday following the central bank’s surprise decision to reduce interest rates. Chinese stocks rallied again on Tuesday following speculation of further rate cuts and faster reforms of state owned enterprises. The Shanghai Composite Index closed at its highest level since Aug 2011 on Wednesday following speculation that central bank’s rate cut will increase earnings. The effect of the rate cut continued today with the benchmark gaining for the sixth successive day.

Qihoo 360 Technology Co Ltd (NYSE:QIHU) reported third-quarter 2014 earnings per ADS of 49 cents, surpassing the Zacks Consensus Estimate by a penny. Trina Solar Limited (NYSE:TSL) reported earnings of 34 cents per American Depositary Shares (ADS) in the third quarter of 2014 compared with 14 cents per ADS in the year-ago quarter.

Last Week’s Developments

Last Friday, the Shanghai Composite Index gained 1.4%, the highest increase since Nov 10. Speculation that measures were being taken by the government to increase liquidity ahead of IPOs slated for the following week boosted shares. 11 companies are slated to launch IPOs which are expected to corner funds worth $261 billion.

There were indications that the People’s Bank of China (PBOC) had injected additional funds into the banking system to ease a cash shortage arising from new share sales. According to a statement on the central bank’s microblog, additional liquidity would be provided when required.

The CSI 300 gained 1.8%, while the Hang Seng added 0.4%. A gauge of financial stocks with the CSI 300 moved up 2.9%, the highest among the index’s industry groups. The Hang Seng China Enterprises Index increased 0.7%, ending five successive days of losses. Profit taking pressure also eased, helping the Shanghai Composite and the CSI 300 gain 0.3% and 0.1% over the week respectively.

Markets and the Economy This Week

The Shanghai Composite Index jumped 1.9% on Monday following the central bank’s surprise decision to reduce interest rates. The country’s central bank decreased the one-year benchmark lending rate by 40 basis points to 5.6%. This is the first reduction in rates undertaken in more than two years. Market watchers were taken by surprise since the PBOC has till recently stuck to more moderate stimulus measures.

Stocks and bonds gained on this decision, with the China 10-Year yield plunging to its lowest level since 2008. The yuan and the seven-day repurchase rate experienced the sharpest decline since September. The Hang Seng China Enterprises Index gained 3.8%, its largest increase in a year. Meanwhile, the Hang Seng moved up 2%. The CSI 300 added 2.6%, closing at its highest level since Feb 2013.

Chinese stocks rallied again on Tuesday following speculation of further interest cuts and an increase in the pace in reforms of state owned enterprises. The Shanghai Composite Index increased 1.4%. The CSI 300 also increased, gaining 1.4%. However, the Hang Seng China Enterprises Index and the Hang Seng lost 0.6% and 0.2% respectively.

Major banks and market watchers alike believe that more rate cuts are in the offing. Monetary easing continues to take place globally with similar measures being introduced in Japan and Europe. The PBOC may go on to reduce reserve requirements for banks which remain unchanged since May 2012.

The Shanghai Composite Index gained again on Wednesday, rising 1.4%. The benchmark closed on a high after financial stocks gained following speculation that central bank’s rate cut will increase earnings. Meanwhile industrial stocks moved up on the prospect of higher investment. The CSI 300 added 1%, with a sub-index of financial stocks gaining 3.3%.

Meanwhile the Hang Seng China Enterprises Index advanced 2.5% while the Hang Seng gained 1.1%. Insurance companies gained on signs that the rate reduction may stimulate sales. Brokerages and cyclical stocks also gained as the positive sentiment had an overall bullish effect.

The benchmark index gained for a sixth successive day today, adding 1%. The Shanghai Composite Index closed at its highest level since Aug 2011 follow the central bank’s rate cut. The benchmark has added 7.3% over the last six days following speculation that the government is taking additional steps to increase liquidity and arrest an economic slowdown. Industrial profits dropped 2% in October, suffering the sharpest monthly decline since Aug 2012.

Financial and energy shares helped the CSI 300 increase 1.2%. A sub-index of financial stocks increased 2.8%, gaining the highest among the CSI 300’s 10 industry groups. Meanwhile, the Hang Seng China Enterprises Index and the Hang Seng Index lost 0.3% and 0.5% respectively.

Stocks in the News

Qihoo 360 reported third-quarter 2014 earnings per ADS of 49 cents, surpassing the Zacks Consensus Estimate by a penny due to higher revenues. Qihoo’s total revenue was $376.4 million, up 18.4% sequentially and 100.3% year over year. Reported revenues were above management’s expected range of $360 to $365 million and beat the Zacks Consensus Estimate of $363 million.

Non-GAAP net income was $64.14 million or 49 cents per ADS, compared with $43.45 million or 30 cents in the prior quarter. Reported gross margin for the quarter was 77.3%, down 170 basis points (bps) sequentially and 890 bps from the year-ago quarter.

Qihoo reported operating expenses of $225.5 million, which soared 102.8% from $111.2 million reported in the year-ago quarter. Operating margin came in at 18.1%, down from 27% in the year-ago quarter. Non-GAAP net income was $64.14 million or 49 cents per ADS, compared with $43.45 million or 30 cents in the prior quarter.

For the fourth quarter of 2014, Qihoo expects revenues between $410 million and $415 million, representing an increase of 85–87% year over year and 9–10% sequentially. The Zacks Consensus Estimate for revenues is $408 million.

Trina Solar Ltd. reported earnings of 34 cents per American Depositary Shares (ADS) in the third quarter of 2014 compared with 14 cents per ADS in the year-ago quarter. With this the bottom line was ahead of the Zacks Consensus Estimate by a whopping 126.7%.

Trina Solar posted revenues of $616.8 million in the third quarter, up 12.5% from the prior-year quarter and 18.8% sequentially owing to higher shipment volume to meet growing demand from Japan and the U.S. However, the quarterly figure missed the Zacks Consensus Estimate of $634 million by 2.8%.

Solar module shipments in the reported quarter totaled 1,063.8 megawatts (“MW”), compared with 774.6 MW in the year-ago quarter and 943.3 MW in the second quarter 2014. This was attributable to increasing demand from prime geographical regions, mainly China, Japan and the U.S.

Trina Solar lowered its 2014 module shipment forecast to 3.61–3.66 gigawatts (“GW”) from 3.6–3.8 GW. The cut weighed significantly on the share price as it lost about 5.2% on Nov 24, 2014.

Yingli Green Energy Holding (NYSE:YGE) or Yingli Solar reported an operating loss of 10 cents per American Depository Share (“ADS”) or RMB 0.62 per ordinary share in third-quarter 2014 compared with a loss of 24 cents per ADS (RMB 1.45) in the year-ago quarter. Yingli Solar’s loss per share in the reported quarter was narrower than the Zacks Consensus Estimate of a loss of 13 cents.

Total net revenues were $551.5 million (RMB 3,385.2 million), down 6.8% from $591.6 million (RMB 3,649.4 million) in the third quarter of 2013. Revenues declined due to lower sales at the PV modules and PV systems segment. Yingli Solar’s revenues also fell short of the Zacks Consensus Estimate of $623 million.

Gross margin in the reported quarter expanded 720 basis points year over year to 20.9%. Improvement in margins reflected the reduced costs of the PV modules on account of the company’s cost-containment initiatives.

Operating expenses were $82.5 million (RMB 506.4 million) compared with $92.3 million (RMB 569.1 million) in third-quarter 2013. Operating income in the third quarter of 2014 was $32.5 million (RMB 199.7 million) compared with an operating loss of $11.4 million (RMB 70.3 million) in the year-ago quarter.

Yingli Solar revised its 2014 shipment volumes downwards to within 3.30–3.35 GW (including 200–240 MW shipment for PV systems) for 2014. This is lower than the previous expectation of 3.6–3.8 GW (including 400–600MW shipment for PV systems).

JinkoSolar Holding Company Limited (NYSE:JKS) reported third-quarter 2014 non-GAAP earnings per American Depositary Share (ADS) of $1.36 (non-GAAP earnings of 34 cents per share), well ahead of the Zacks Consensus Estimate of 71 cents by 91.5%. However, reported earnings were in line with the year-ago figure.

JinkoSolar’s total revenues of $417.3 million were short of the Zacks Consensus Estimate of $445 million by 6.2%. On a year-over-year basis, the top line increased 30.5% primarily on the back of higher shipments as well as electricity revenues from solar projects. Total revenues improved 5.3% sequentially due to a rise in solar module shipments.

In the third quarter of 2014, total solar product shipments stood at 708.2 megawatts (MW), up 36.5% year over year. Third-quarter gross profit climbed 20.4% year over year to $86.1 million mainly due to stepped up operating efficiency. Steady cost curtailment for polysilicon and auxiliary materials also led to the upside.

JinkoSolar provided fourth-quarter 2014 total solar module shipment guidance in the range of 1,030–1,120 MW. For 2014, the company expects total solar module shipments in the band of 2.9–3.2 gigawatts (GW). JinkoSolar expects 600 MW of total project development in 2014 on the back of its downstream business.

Alibaba Group Holdings Ltd (NYSE:BABA) announced a public offering of bonds aggregating $8 billion. Reportedly, these bonds have been issued in six tranches, with a coupon rate of 3.6% and 4.5% for 10-year and 20-year notes, respectively. The company, which raised a record $25 billion in its September IPO, stated that the transaction proceeds will be used to repay an $8 billion bank loan.

The bonds have been rated 'A+' by Standard & Poor’s and 'A1' by Moody’s Investors Service. The $8 billion sale surpassed the $6.5 billion issue last month from the Bank of China Ltd. making it the biggest dollar offering by an Asian Company.

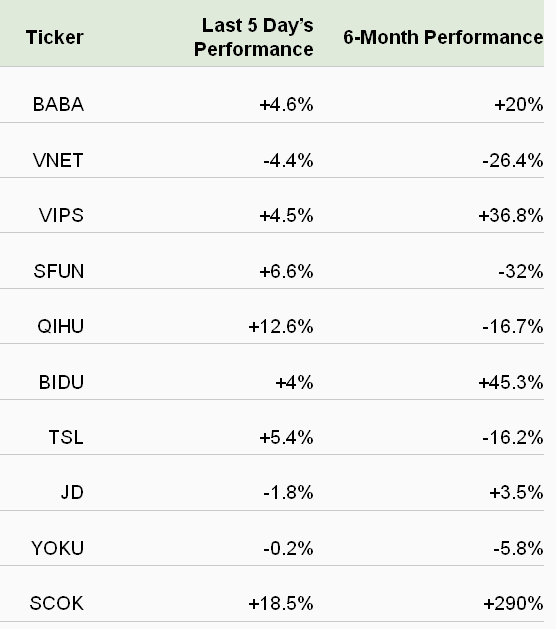

Performance of Most Actively Traded US-listed Chinese Stocks

The table given below shows the price movements of 10 Chinese companies with the highest three-month average trading volume on U.S. exchanges. Price movements over the last five days and during the last six months have been included.

Next Week’s Outlook:

Stocks have gained on every day of the week following the central bank’s decision to cut the one-year benchmark lending rate. Investors have also been enthused by the central bank’s measures to combat a cash crunch arising from several new share sales. These steps have boosted markets and increased speculation of further cuts in the days ahead.

The possibility of an increase in the pace of reforms of state-owned enterprises has also boosted stocks. Negative data, such as a fall in industrial profits has been largely ignored. Next week features some important economic reports. These include data on both the manufacturing and services sector. Good news on this front and indications of further reform will help to sustain the current rally in the days ahead.