Markets rebounded from a week of record losses after China’s central bank introduced further stimulus measures. Stocks moved up to their highest level in four weeks on Monday after the central banks cut rates for a third time. The Shanghai Composite gained again on Tuesday following expectations that stimulus measures would increase domestic consumption and economic growth.

However, markets moved lower on Wednesday, bringing to a close the strongest three-day rally recorded so far this year. The benchmark index gained again on Thursday despite worrying data on loans and aggregate financing.

Petrochina (NYSE:PTR) and China Petroleum & Chemical Corp (NYSE:SNP) or Sinopec's (HK:0338)’s oil and gas pipelines will reportedly be spun off into new companies. Alibaba's (NYSE:BABA) fourth quarter revenues of $2.81 billion increased 45% year over year and also topped analysts’ expectations.

Last Week’s Developments

Last Friday, the Shanghai Composite rebounded, gaining 2.3% and bringing to a close three consecutive days of losses which together amount to 8.2%. Dismal trade data increased speculation about additional economic measures to boost the economy, helping stocks move upward. Investors were also enthused by speculation that a Hong Kong-Shenzhen exchange link would begin this year.

The CSI increased 2%. The Hang Seng China Enterprises Index also gained 2% while the Hang Seng advanced 1.1%. The ChiNext shot up by 6% to record levels while the Shenzhen Composite added 4.2%.

The Shanghai Composite declined 5.3% over the week, the largest loss since Jul 2010. Fears that new share sales would divert funds from existing stocks were responsible for such heavy losses. Additionally, valuations increased to their highest level in five years, adding to investor concerns.

Markets and the Economy This Week

Stocks moved up to their highest level in four weeks on Monday. Financial and tech stocks led gains as the benchmark index surged 3% following a cut in interest rates. The decision was possibly prompted by dismal export and inflation data as well as record weekly losses by the benchmark. Concerns over a slowdown in the economy have led the central bank to provide a number of stimulus measures this year.

The country’s central bank reduced the one-year lending rate by 0.25 percentage point to 5.1%. Additionally, the one-year deposit rate was also reduced by 0.25 percentage point to 2.25%.

The CSI 300 advanced 2.9% while the H-share index added 1%. Sub-indices of utility and tech stocks within the CSI 300 gained a minimum of 4.1%. The Hang Seng increased 0.5% while the ChiNext surged 5.8% to a record level.

The Shanghai Composite increased 1.6% on Tuesday. Gains were led by tech and consumer shares, following a decline in borrowing costs. This in turn is expected to increase domestic consumption and stimulate economic growth. Meanwhile, a measure of retailers and department stores within the benchmark index increased 4.2%, emerging as the highest gainer among the five industry groups.

The CSI 300 gained 1.2%. However, the Hang Seng China Enterprises Index lost 1.5%. The Hang Seng declined 1.1% as property and auto stocks led losses on the Hong Kong exchange. Meanwhile, Shenzhen’s GDP surged 7.8% during the first quarter, the strongest pace of growth among China’s cities. This is another signal that the country’s economy is transforming from one powered by foreign investment and low labor costs into one driven by innovation.

Markets moved lower on Wednesday, bringing to a close the strongest three-day rally recorded so far this year. Energy and financial stocks took losses following disappointing fixed-asset investment data. The Shanghai Composite declined 0.6% after gaining 6.8% over the three previous days.

A report on industrial output indicated that the impact of monetary stimulus was slowly being felt by the economy. However, this may also be a signal that further easing is required to fuel growth. Meanwhile, according to official data released on Wednesday, retail sales increased 10% in April, a shade lower than estimates.

The CSI 300 declined 0.6% while the ChiNext lost 1.8%. The Hang Seng China Enterprises lost 0.8% while the Hang Seng declined 0.6%. Sub-indices of energy and utility stocks within the CSI 300 led the decliners, losing as much as 1.9%.

The Shanghai Composite gained 0.1% as stocks closed mixed on Thursday. Data released after the closure of trading on Wednesday showed that new yuan loans plummeted in April. Aggregate financing also declined over the month while M2 money supply came in below estimates.

The CSI 300 declined 0.4% even as a sub-index of material stocks increased 2.2%. Stocks in Hong Kong moved considerably lower following dismal volumes. Declines were a result of fears that stimulus measures were failing to increase the pace of economic growth. The Hang Seng declined 0.1% while the Hang Seng China Enterprises Index lost 0.6%.

Stocks in the News

PetroChina Co. Ltd. and China Petroleum & Chemical Corp., or Sinopec’s oil and gas pipelines will reportedly be spun off into new companies. Per the Bloomberg report, China’s National Development and Reform Commission (NDRC) is leading the discussions on this issue.

The move would be in line with the reforms initiated by President Xi Jinping to provide markets with a greater role in the country’s economy. According to the report, the NDRC has been holding discussions on this issue since 2014. One estimate values these assets at around $300 billion.

Alibaba’s fourth quarter revenues of $2.81 billion increased 45% year over year and also topped analysts’ expectations. The company reported fiscal fourth quarter non-GAAP diluted EPS of 48 cents per share, a 7% year-over-year increase.

On Friday, Alibaba purchased about 4.8 million Zulily (NASDAQ:ZU) Class A shares for $56 million approximately. Zulily is an online store, selling apparel and accessories for moms, babies, and kids. It is known for hosting "flash" sales. According to the Wall Street Journal, Alibaba now holds a sixth of Zulily's Class A stock, representing a 9.2% stake in the company.

Jd.Com (NASDAQ:JD) reported loss of 4 cents in first quarter 2015, wider than the loss of 1 cent reported in the earlier quarter. Revenues came in at $5.9 billion, higher than last quarter figures of $5.6 billion. This also represents a 62% year-over-year increase. The company reported net loss of $114.6 million and a negative net margin of 1.9%.

Fulfilled orders increased 76% year-over-year to 227.2 million during the quarter. The mobile component of this metric made up 42% of total orders. This represents a year-over-year increase of 329%. JD.com’s annual active customer jumped to 105.2 million for the year ended Mar 31, 2015 from 55.5 million a year ago. This represents an increase of around 90%.

Mindray Medical International (NYSE:MR) reported adjusted earnings of 31 cents in the first quarter 2015, which missed the Zacks Consensus Estimate by 7 cents. Adjusted earnings per share (EPS) decreased 8.8% year over year, primarily owing to lower gross and operating margins.

Net revenue increased a modest 2.9% year over year to $272.5 million. China revenues (representing 44.8% of net revenue) grew 5.3% from the year-ago quarter to almost $122 million, while international revenues were up 1.1% to $150.5 million. Asia Pacific net revenue surged 25% on a year-over-year basis. Mindray Medical estimates net revenue for 2015 to grow in mid-single digits percentage over 2014 figures.

China Telecom (NYSE:CHA) declared an annual dividend on May 11. The company said shareholders on record as of Jun 1 will receive a dividend of 1.283 per share on Jul 27. This amounts to a yield of 1.8%. The ex-dividend date for the dividend is May 28.

In another development, China Telecom Global has entered into an agreement with Tata Communications. This partnership will enable China Telecom Global to utilize Tata Communications’ Global Video Network in order to provide live coverage of China’s sporting events. This represents a potential market worth $2.57 billion.

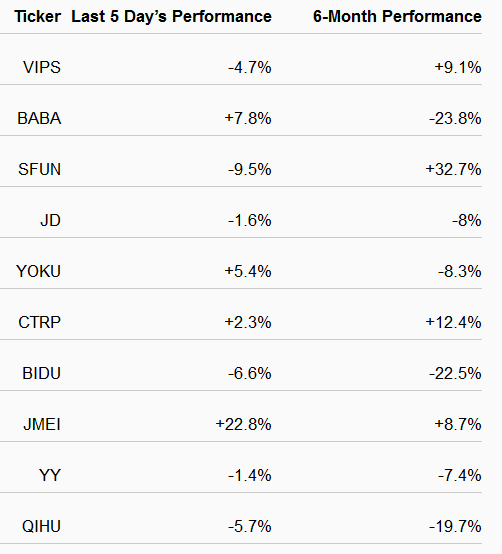

Performance of Most Actively Traded US-listed Chinese Stocks

The table given below shows the price movements of 10 Chinese companies with the highest three-month average trading volume on U.S. exchanges. Price movements over the last five days and during the last six months have been included.

Next Week’s Outlook:

Stocks have recovered considerably following a week of record losses. Gains have been led by new economy companies. This indicates that President’s Xi’s attempts to transform the country’s economy are bearing fruit. However, a third round of rate cuts has highlighted concerns over China’s economy.

Economic data has continued to be disappointing in nature. Fixed asset investment, new yuan loans, industrial output and retail sales all indicate that the health of the economy is far from satisfactory. This in turn leads to speculation about additional stimulus and boosts stocks.

However, analysts continue to believe that the Bull Run is far from over. Next week features data on housing prices and manufacturing. If any of these indicate that a slow recovery is underway, it could go a long way in reducing the current degree of market volatility.