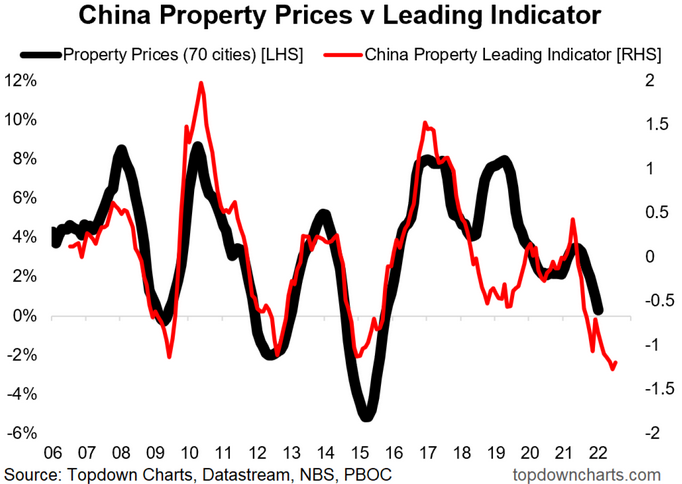

China Property Prices: The Chinese property market downturn extended through January, with the majority of cities seeing prices fall vs December, and close to 50% of cities seeing house prices decline vs this time last year. On top of that, the composite leading indicator (money supply, interest rates, property stocks) continues to point to further downside for property prices.

I remain of the view that this is perhaps the most important chart for China macro, emerging markets, and commodities. It highlights the risks and downdrafts currently facing the Chinese economy, but also points to the imperative for policy easing.

With Chinese inflation gauges beginning to taper off, clear softening in the macro pulse (+wobbles in the global growth picture), and downside risks to property… along with the fact that this is basically an “election year” for Xi Jinping (his 3rd 5-year term is scheduled to be confirmed later this year—stability is top of mind): all signs point to more stimulus.

Key point: Expect stepped-up monetary/fiscal/credit stimulus in China this year.