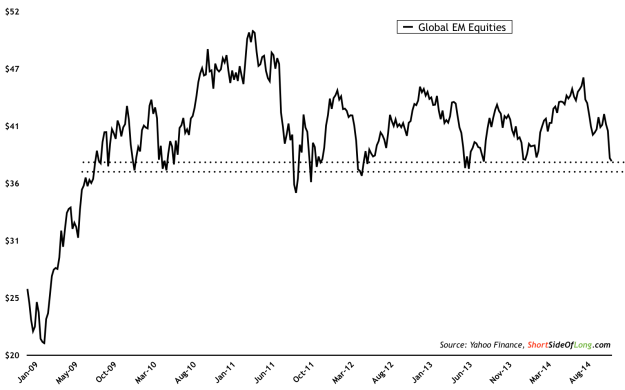

Chart 1: GEM stocks are trading at October 2009 levels

During the recent stock market sell off, the MSCI Emerging Markets Index fell by almost 20% from its intra day high peak to the intra day lows. As we can clearly see in Chart 1, the index is now trading at the same level as it did in October 2009 (not including dividends). We find prices oversold in the short term and sitting at an important support level. With the VIX spiking a bit too quickly over the last several days, I wouldn’t be surprised to see a rebound in global stocks including the MSCI EM ETF (ARCA:EEM).

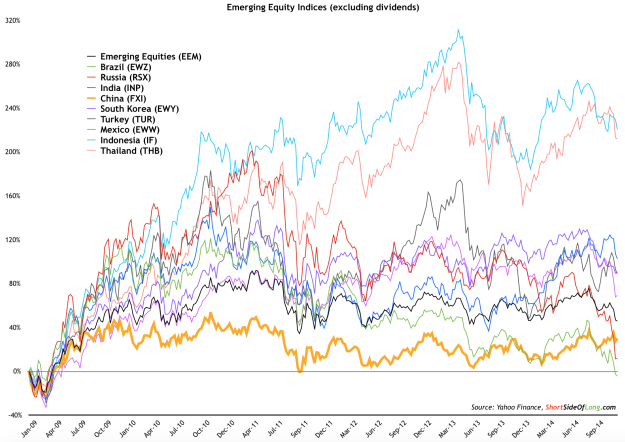

Furthermore, one of the most interesting developments during the current sell-off has been the fact that China hasn't gone down as much as other emerging markets. As a matter of fact, China (via iShares FTSE/Xinhua China 25 Index (ARCA:FXI)) outperformed just about every EM index on relative basis and currently sits very close to its 52 week highs. Compare this to the likes of Brazil (via iShares Brazil Index (ARCA:EWZ)), Russia (MarketVectors TR Russia (NYSE:RSX)), Mexico (via iShares MSCI Mexico (ARCA:EWW)) and a couple of other EM countries, all of which are at or near their 52 week lows. This is most likely due to China being an underperformer for such a prolonged period of time (refer to strong orange line Chart 2, below, again).

Chart 2: During recent sell-off China has shown strong out-performance

Personally, I continue to hold the view that Chinese shares are a good investment opportunity right here, right now (obviously with a tight stop loss as previously discussed). On the other hand, markets such as US large caps (S&P 500) seem overvalued to me on many different metrics. While US equities might also continue to rally and become even more overvalued, I would prefer to be invested in markets that have lagged behind and appear cheap.

Chinese stock out-performance most likely hints that there is a possibility of further interest rate cuts by the PBOC, while the current crash in crude oil should benefit the slowing economy – all of this hopefully pushing stocks higher.