The US Market has hit a speed bump and is moving sideways in a range. The Chinese market had been following suit, moving sideways as well. Trade tensions with the US and rambunctious neighbors make for a recipe for more of the same to come. But a funny thing happened last week. The Shanghai Composite broke out of that range to the upside. It ended the week at its highest close since the end of 2015.

Last night its neighbor North Korea launched a missile over Japan. World market dropped on this news. All markets except for the Shanghai Composite that is, which ended up another 3 points. Will this continue and if so how far will it go? And is it too late to get involved? Lets look at the chart.

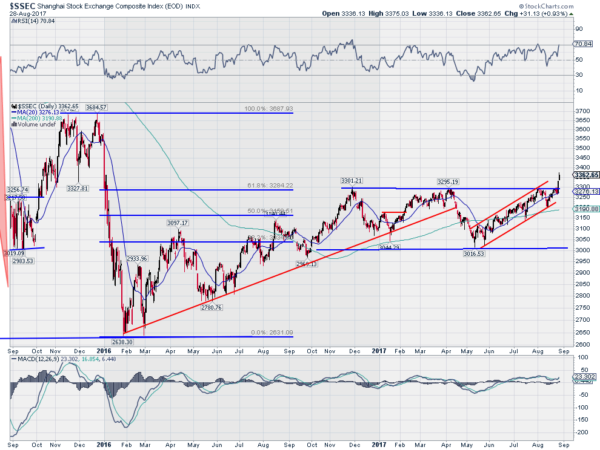

The chart above shows the last 2 years of price action in the Shanghai Composite. Starting at the left there is the swift fall from a double top at the end of 2015. That was followed by a rising trend into early 2017 that morphed into that sideways channel. The channel itself was bounded by a 38.2% retracement and a 61.8% retracement of the early 2016 drop. This is a very technical range.

With the Composite moving in the channel for about a year, a move out of it could also last for a long time. A couple of measures suggest a retracement to the 2015 high at least. Adding the channel width to the break out gives a target to 3600 is one. A second is the 400 point move from the bottom into the channel added to the break out to get a target of 3700. Those are substantial moves and with only about 65 [points already gone, offer good reward to risk ratios to participate.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.