Risk on sentiment returned briefly yesterday as markets retraced some of Monday’s selloff but sentiment in Asia has declined overnight. The PBOC cut the onshore reference rate for the Yuan as trade tensions escalate, in an effort to stay ahead of tariffs and a weakening currency due to trade concerns. The PBOC also said they will seek to reduce holdings of US Treasuries. President Xi warned the country to prepare for a full scale trade war. The Chinese are expecting further escalation from the US after earlier announcements this week that the US would limit foreign investment despite some row back from officials. The Shanghai Composite Index fell into bear market territory, which is a fall of 20% from its high with the Chinese A50 Index down -2.28% to 11471.44.

Oil rallied above $70.00 a barrel yesterday as Private Inventories data showed a bigger than expected draw in stocks. Today’s Inventory data will shed further light on the storage situation in the US with an expected draw of -2.481M expected from -5.914M last week. The USD gained as the tension eased yesterday and it is consolidating those gains for now.

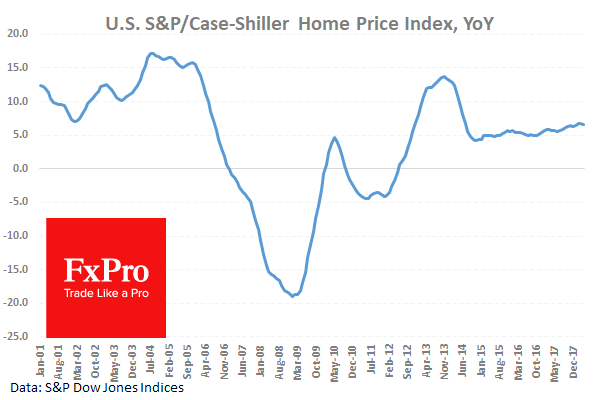

US S&P/Case Schiller Home Price Index (YoY) (Apr) was 6.6% against an expected 6.8% from a prior reading of 6.8%. This measure has been holding a steady improvement since the late 2014 low, with today’s data largely in line with expectations. USD/JPY fell from 109.686 to 109.553 as a result of this data.

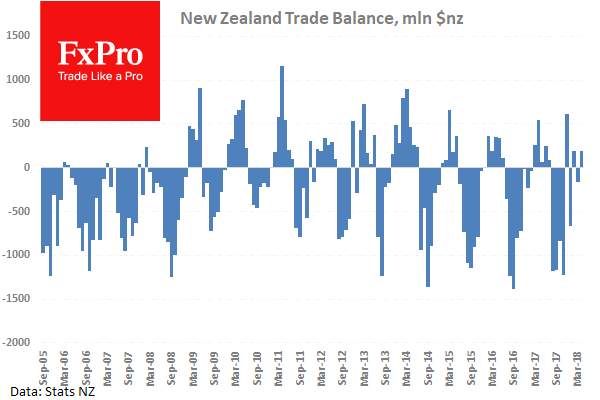

New Zealand Trade Balance (MoM) (May) numbers was released coming in at $294M (MoM) and $-3.60B (YoY) against an expected $100M (MoM) and $-3.74B (YoY) with prior numbers of $-1,193M (MoM) and $-3.76B (YoY) which were $193M (MoM) and $-3.83B (YoY). Imports (May) were $5.12B against an expected $5.10B from $4.79B previously which was revised down to $4.77B. Exports (May) were $5.12B against an expected $5.25B from $5.05B previously which was revised down to $4.96B. This data caused NZD/USD to move up from 0.68497 to 0.68588 before reversing and selling off to 0.68114.

EUR/USD is up 0.09% overnight, trading around 1.16563.

USD/JPY is down -0.15% in the early session, trading at around 109.848

GBP/USD is up 0.03% this morning trading around 1.32217

Gold is down -0.21% in early morning trading at around $1,256.10

WTI is down -0.16% this morning, trading around $70.24

For more in-depth analysis and market forecasts visit our FxPro Blog.