Emerging markets have been off to the races in 2017 and China has played a huge role in fueling that growth. The world’s second largest economy felt the heavy contraction that plagued many stock markets throughout 2015 as commodity and currency volatility took their toll. However, its turning point coincided with a global rally in risk assets that has been persistently strengthening over the last eighteen months.

The largest and most heavily traded among the exchange-traded funds that track this market is the iShares China Large-Cap (NYSE:FXI). This ETF has $3.37 billion dedicated to a concentrated mix of 50 mega-corporations that are domiciled in China and traded as ADRs in the United States.

FXI demonstrates a multi-sector mix of stocks within its country-specific portfolio. Additionally, the market-cap weighted structure ensures that 10 largest holdings control over 55% of the assets. The top-ranked stock in this ETF is Tencent Holdings Ltd ADR (OTC:TCEHY), which is a vast technology related conglomerate.

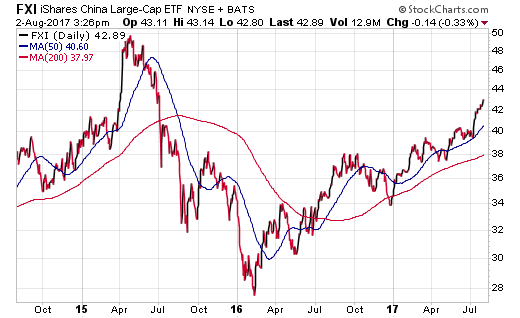

As you can see on the chart below, FXI just recently surged to new 52-week highs and is one of the best performing global markets in the month of July. This ETF has now gained +24.43% year-to-date and is up nearly 60% from its February 2016 low.

While in this short-term this fund may be stretched to the upside and worthy of a pullback, it’s overall trend remains quite healthy.

ETF investors who prefer a stronger dose of diversification may be more comfortable with the iShares MSCI China (NASDAQ:MCHI) or the SPDR S&P China ETF (MX:GXC). These funds rank number two and three respectively based on asset size and offer modestly lower expense ratios than FXI as well.

MCHI tracks 150 Chinese stocks with a management fee of 0.64%, while GXC owns 350 holdings with an expense ratio of 0.59%. Both funds have beat FXI over the last year largely because of their smaller company exposure boosting net returns.

Those who have experience with the intricate nature of the Chinese stock market also are aware of a special class of shares known as “A-shares” that have historically only been available to mainland residents. Over the last several years, these stocks have been de-regulated to the extent that they can be owned and packed into an ETF wrapper.

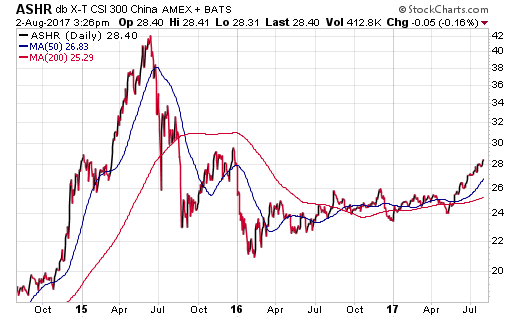

The largest and most well-known fund in this group is the Deutsche X-trackers Harvest CSI 300 China A-Shares (NYSE:ASHR) This fund exclusively tracks 300 large and mid-cap A-share stocks in China that provide a differing portfolio dynamic than the ETFs mentioned previously.

As you can see on the 3-year chart above, the volatility of this group (as represented in ASHR) is nothing to scoff at.

The Bottom Line

The use of single country ETFs can be helpful for investors who are interested in building a global portfolio with flexible momentum or regional capabilities. Nevertheless, like investing in individual sectors, there is a “hit-or-miss” component that is inherent in trying to forecast the direction of a specific foreign market.

More diversified exposure in emerging market or even broad international funds may provide enough China exposure to satisfy most risk and return profiles. These can be found in alternatives such as the Vanguard FTSE Emerging Markets (NYSE:VWO) or the iShares Core MSCI Total International Stock (NASDAQ:IXUS).

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.