Investing.com’s stocks of the week

The United States government is in the process of debating both a budget as well as a debt ceiling increase. Neither Republicans in the House of Representatives nor the president himself appears eager to pursue a “grand bargain” or a “mini bargain.” Meanwhile, Angela Merkel may have won a resounding victory in Germany’s recent election, but the euro-dollar came under pressure against world currencies on concerns that it may take Ms. Merkel many months to form a coalition. In other words, stalemates in developed countries abound.

In contrast, there seems to be little uncertainty about where China is heading. Recent manufacturing activity showed economic expansion at a six-month high. Indeed, just a few moths prior, investors had been abandoning the world’s second largest economy on fears of a slowdown/hard landing accompanied by a housing bust. Doom-n-gloomers on China’s prospects are — for lack of a better analogy — eating slices of humble pie.

The Drivers

In early August, I noted that a meaningful rotation into China ETFs was well under way, even though money flow data did not support my contention. What did support it? Price performance, a series of “higher lows” on charts, improving economic fundamentals as well as a new leader who tied government policy to GDP growth at 7% or higher. The “higher lows” on SPDR S&P China (GXC) can be seen in every month since a bottoming out in late June.

Granted, quantitative easing (QE) stimulus may be the elixir that everyone clamors for in the shorter-term; stock investors certainly appear to blindly reward markets where a central bank buys bonds to ensure unnaturally low interest rates. Still, like any addiction, one needs more and more of a drug to maintain the same “high.” Any Fed tapering may be viewed with trepidation, not just for bonds, but for stocks as well. It follows that China’s more modest use of conventional and/or unconventional stimulus measures is likely to reward believers in the prospects for Chinese equities.

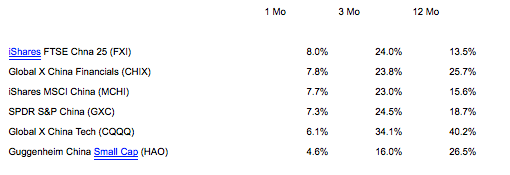

In spite of an exceptionally rough start to 2013, and in spite of significant under-performance over the last 2 1/2 years, China ETFs have been looking rather sharp over the one-month, three-month and 12-month period. Here are some of the more popular exchange-traded investments:

A Recent Look At China's ETFs

Why China And Not The U.S.?

Why should investors think about China ETFs when the U.S. market boasts a “never-say-die” uptrend? One reason is that the U.S. equity uptrend may be losing steam. The three “higher highs” that have occurred since May have done so with less stocks above long-term 200-day moving averages. The percentage of S&P 500 stocks above the key trendline has been declining since May; waning participation may be a signal that the upside is limited.

In truth, the time it takes for U.S. politicians to forge a temporary agreement on the budget and the debt ceiling will likely drive market direction, even more so than upcoming earnings. Nevertheless, China ETFs are cheap relative to U.S. stocks and political headwinds do not exist in China today. For new money, you may wish to consider exposure to China.