Near the start of the present bull market for U.S. stocks, an ultra-accommodating Federal Reserve pushed interest rates lower. In fact, 10-year yields tied to mortgages had journeyed to unbelievably low levels across a four year span; meanwhile, stocks rocketed to all-time records.

Today, we still have an ultra-accommodating central bank. And, historically speaking, interest rates are still exceptionally low. Yet the direction of those 10-year yields has been decidedly higher, ever since the Fed introduced “tapering” to the investing lexicon.

Of course, bull market advocates continue to relish a variety of “absolute” data points. For example, corporate profits are at record peaks, forward price-to-earnings ratios (P/E) of 15 are seemingly reasonable and the 10-year yield of 2.7% is far below its historical average. There are reasons to be concerned about directionality, however. Corporate profits are slowing, P/Es are climbing and the 10-year yield has catapulted 65% since May; the direction of these trends may be more critical than the “absolutes.”

Consider the emerging growth story of the previous decade. Investors willingly paid a 25% premium to own up-n-coming economies like China because of double-digit or high single-digit economic expansion. As China’s economy slowed from 10% to 9% to 8% to 7.5% over the past few years, investors punished the nation due to the potential of a “hard landing” slowdown; ironically, nobody seemed to give credit to the absolute growth levels; everyone became enamored by the idea that electronic money creation must eventually find its way into risk assets whereby the developed markets became more attractive. In fact, developed markets currently trade at a 20%-plus premium to most emergers.

To further illustrate the notion of directionality, SPDR S&P China (GXC) had fallen nearly 20% between January and late June of this year. Investors began to speculate that China’s economy was rapidly deteriorating from 8.0% GDP expansion to a year-end level below 7%. Even worse, a liquidity crisis in the banking sector seemed to be taking root. When the dust settled, GXC’s prospects and economic data began to improve. Perhaps 7.5% was about as low as GDP would go after all. What’a more, Premier Li Keqiang pledged to never let China’s economy grow at a rate slower than 7%. It became a “line in the sand” moment where investors seemed to sense that Chinese leadership would enact stimulus measures if necessary.

Not surprisingly, GXC has been on a roll since the June 24 lows. More recently, this emerging market ETF rose above its 200-day trendline, suggesting that a long-term uptrend may be in its earliest stages.

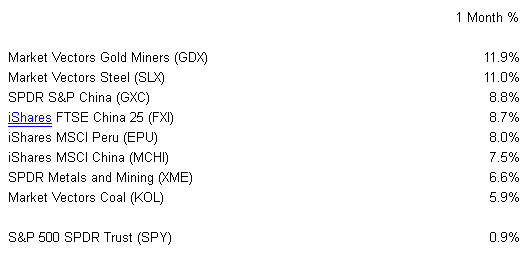

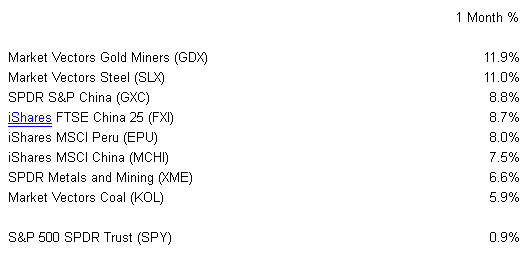

The month-over-month comparison with U.S. equities is worth a look at as well. The seemingly unstoppable momentum that the S&P 500 SPDR Trust (SPY) boasted year-to-date through July appears to be stalling. In contrast, the previously moribund GXC is riding a wave. Could we be looking at a meaningful rotation out of pricier developed market ETFs into cheaper China ETFs? Does the pick-up in Chinese demand bode well for resources-related ETFs? Does the directionality of future stimulus as well as future economic progress hold more sway than “absolute” data? If so, could China-related investments continue to out-hustle the U.S. in the months ahead?

Month-Over-Month Improvements For China ETFs And Resources-Related ETFs

There’s little doubt that momentum over the last month has shifted from domestic ETFs to foreign ETFs. Europe is getting more attention too. The shift may be a function of a greater comfort with the world’s economic prospects or a greater willingness to take equity risk. Similarly, the “rotation” may be due to the directionality of future stimulus and future profitability abroad. Regardless, the upswing in China ETFs and resources-related ETFs is worth watching.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Today, we still have an ultra-accommodating central bank. And, historically speaking, interest rates are still exceptionally low. Yet the direction of those 10-year yields has been decidedly higher, ever since the Fed introduced “tapering” to the investing lexicon.

Of course, bull market advocates continue to relish a variety of “absolute” data points. For example, corporate profits are at record peaks, forward price-to-earnings ratios (P/E) of 15 are seemingly reasonable and the 10-year yield of 2.7% is far below its historical average. There are reasons to be concerned about directionality, however. Corporate profits are slowing, P/Es are climbing and the 10-year yield has catapulted 65% since May; the direction of these trends may be more critical than the “absolutes.”

Consider the emerging growth story of the previous decade. Investors willingly paid a 25% premium to own up-n-coming economies like China because of double-digit or high single-digit economic expansion. As China’s economy slowed from 10% to 9% to 8% to 7.5% over the past few years, investors punished the nation due to the potential of a “hard landing” slowdown; ironically, nobody seemed to give credit to the absolute growth levels; everyone became enamored by the idea that electronic money creation must eventually find its way into risk assets whereby the developed markets became more attractive. In fact, developed markets currently trade at a 20%-plus premium to most emergers.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

To further illustrate the notion of directionality, SPDR S&P China (GXC) had fallen nearly 20% between January and late June of this year. Investors began to speculate that China’s economy was rapidly deteriorating from 8.0% GDP expansion to a year-end level below 7%. Even worse, a liquidity crisis in the banking sector seemed to be taking root. When the dust settled, GXC’s prospects and economic data began to improve. Perhaps 7.5% was about as low as GDP would go after all. What’a more, Premier Li Keqiang pledged to never let China’s economy grow at a rate slower than 7%. It became a “line in the sand” moment where investors seemed to sense that Chinese leadership would enact stimulus measures if necessary.

Not surprisingly, GXC has been on a roll since the June 24 lows. More recently, this emerging market ETF rose above its 200-day trendline, suggesting that a long-term uptrend may be in its earliest stages.

The month-over-month comparison with U.S. equities is worth a look at as well. The seemingly unstoppable momentum that the S&P 500 SPDR Trust (SPY) boasted year-to-date through July appears to be stalling. In contrast, the previously moribund GXC is riding a wave. Could we be looking at a meaningful rotation out of pricier developed market ETFs into cheaper China ETFs? Does the pick-up in Chinese demand bode well for resources-related ETFs? Does the directionality of future stimulus as well as future economic progress hold more sway than “absolute” data? If so, could China-related investments continue to out-hustle the U.S. in the months ahead?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Month-Over-Month Improvements For China ETFs And Resources-Related ETFs

There’s little doubt that momentum over the last month has shifted from domestic ETFs to foreign ETFs. Europe is getting more attention too. The shift may be a function of a greater comfort with the world’s economic prospects or a greater willingness to take equity risk. Similarly, the “rotation” may be due to the directionality of future stimulus and future profitability abroad. Regardless, the upswing in China ETFs and resources-related ETFs is worth watching.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.