China is the land of control. A place where the planned economy is just getting a jump start from well educated capitalists. We see the cities but much of the population still lives in rural areas and the infrastructure is 20th century at best.China is one of, if not the biggest, user of coal to fuel their growth. So why is it that the Chinese stock market is not only benefiting form the drop in Crude Oil prices, but doing so in lock step?

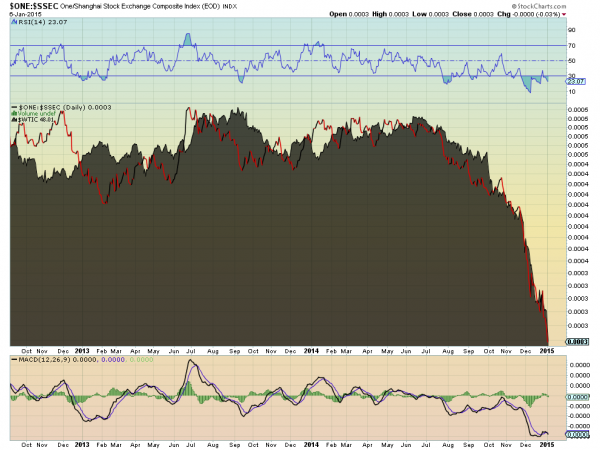

The chart above shows the price of West Texas Intermediate Crude Oil: USO, CL_F) as the grey area, and the inverse of the Shanghai Composite: (ASHR, PEK), as the line chart. The correlation is incredibly strong. Will a bounce in crude finally derail the Chinese market? Or will the explosion in China continue and drag crude down further? No correlation goes on forever, but it is worth watching this one to see how these two large Macro markets may continue going forward.

Disclaimer:The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.