Not to dwell upon today marking our 500th consecutive Saturday penning of this missive: such milestone is merely a function of the world's accepted mathematical practice of functioning in "base 10". (Were we instead oriented to the octal system of "base-8", this would already be the 764th edition, or via the duodecimal dynamic of "base-12", just the 358th edition).

Still, with dedicated consistency in having missed nary a Saturday, we are now fortunate to write No. 500 for our dedicated readers to whom we are eternally thankful, a blessing as we put "pen to paper" this morning from the wee Mediterranean fishing village of Monaco.

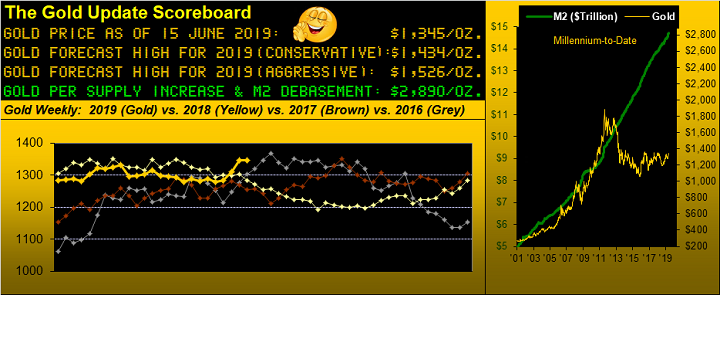

Gold's consistency however when it comes to price throughout our missives has been hardly that. 499 Saturdays ago in writing from San Francisco on 14 November 2009, the price of Gold was 1119. Its extremes since then have been 72% higher at 1923 as well as 7% lower at 1045. With Gold having settled out this past week at 1345, price "net net" is up but a mere 20% across that nearly ten-year spectrum.

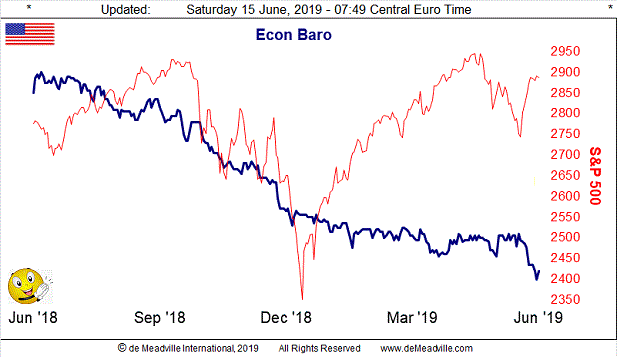

By comparison, the US money supply as measured by M2 is +73% and the National Debt is on pace to have doubled by next year from $12 trillion in 2009 to $24 trillion. The S&P 500 across the same span is +164%, its sputtering earnings performance throughout having seen our "live" price/earnings ratio expand from then 20x to now 31x. (And to return to the business school "normalcy" wherein even 20x might be considered "extreme" would mean a 1000-point haircut -- some 32% -- for the S&P).

Fairly scary stuff that, were to folks to actually to take notice of such present extremes. A charter reader of The Gold Update wrote to us this past week: "It is truly amazing that the investing individual/institutions ignore all the warning signs from the 2000 tech crash, 2008 mortgage/loan scandals and the current debt-to-infinity debacle", and included a quote attributable to Einstein: "Two things are infinite: the universe and human stupidity."

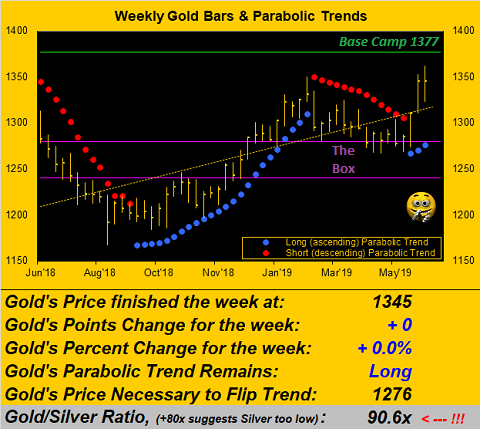

Were wild-haired Al around today, he might add a third thing: market extremes, or so it seems. As above noted, there's been the endless levitation of stock prices whilst earnings lack supportive growth. There's the stagnant price of Gold despite the forever growing 3Ds of dollar Debasement, Debt and Derivatives. There's the money known as Silver that has fallen from the rails in maintaining upside stride with Gold's meager rallies, the Gold/Silver ratio today at a "you gotta be kidding me" exospheric 90.6x. Extremes are the norm, which Funkin' Wagnalls might consider as a descriptor for "perpetual understatement."

Indeed try this spectrum of extremes: the United States (327 million population spread over 9.8 million square kilometres) reels en route toward $24 trillion in debt and an eight-month budget deficit that just exceeded $3 trillion for the first time ever. At the opposite end we've Monaco (39,000 population spread over 2.2 square kilometres -- that's 544 acres) which rocks with a fully-funded surplus such that were the Principality's progress to ever (albeit improbably) grind to a halt, the government and its services could carry on for five years: on a global basis, that's an impressive exemplary extreme ... which here is simply taken as the norm.

'Course the unwinding of markets' extremes as history repetitively demonstrates is the inevitable regression to respective means. And for Gold that means price catching up to dollar Debasement, which by today's Gold Scoreboard would be 2890, an advance from here of +115%, (and a price uncannily near today's overblown S&P level of 2887). Put most bluntly: to regress to their respective means means a halving of the stock market and a doubling of Gold.

"But isn't stock ownership much broader than it used to be, mmb? ... Congrats on 500 by the way..."

Well thank you, Squire, and as well for your valued support throughout. The percentage of US families with either direct or indirect holdings of stock has been fairly stable 'round 50% throughout these past 10 years. But "studies say" 'tis the top ten percent fat cats that own some 84% of it all. And upon the throes of means regression kicking in, watch for the stock price inflation from fat cats morph into stock price deflation in fat splats.

As for the ability for Gold's price to double, it so did (from 270 to 541) during 2001 to 2006, to then double again (from 541 to 1085) in half the time during 2009 to 2009. Then in half that time it nearly again doubled (from 1085 to 1900) come 2011. Said "barbarous relic" can and shall again adroitly move: so be there, or be bare.

Not so barely inching higher has been Gold since the commencement of the weekly parabolic Long trend just three weeks ago as we below see, yesterday recording the year's high-to-date of 1362 before knee-jerk selling off (as if 'twere all planned) to 1345. Remember the 1360s "double top" of the past two years? Remember, too, the title of last week's missive "Gold Gains Pace; Shall it Fail at the Same Place?" Well, Yogi, here we are at déjà vu all over again. And all with Base Camp 1377 temptingly waiting in the balance, barring the range-bounders shoving price back down yet again. 'Tis quite the moment of pricing truth for Gold right now:

How about the truth revealed by the Economic Barometer? To be sure, May's Industrial Production whirled 'round from negative to positive, whilst the month's Retail Sales grew at a robust +0.5% for the second consecutive month. "We're in the money, we're in the money..."But then there's the ugliness, including the noted record increase to the Trade Deficit, Export Price deflation, sliding results in the University of Michigan's June Sentiment Survey and burgeoning Business Inventories. Then in their behind-the-curve wisdom we've the Federal Reserve Bank of Atlanta cutting their Q2 Gross Domestic Product annual growth pace to just +1.4%; (less than half Q1's 3.1% pace). Do you really wanna stay invested in that extreme S&P 500 red line, which as proven time and again ultimately regresses to the level of the blue line? Take a look:

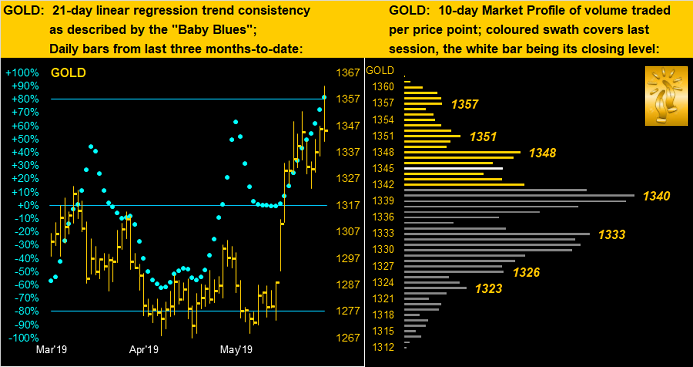

Let's next turn to our two-panel Gold graphic of the daily bars for the past three months-to-date on the left and 10-day Market Profile on the right. And upon those baby blue dots not breaking below their 0% axis some three weeks ago (price then at 1284) as would otherwise be the norm, Gold today at 1345 is 4.8% higher. Indeed as another great friend of The Gold Update wrote to us just last evening, the charts of Newmont Mining (NYSE:NEM) and royalty roller-coaster Royal Gold (NASDAQ:RGLD) across the same stretch show their prices as +12.6% and +10.3% respectively: the lovely leverage of equities at work there! (Yet ugly when undoing). As for the Profile, 'twould be nervous-Nellie time should price break below 1330 without swift upside recoil, the notion of the 1360s "double top" extending to that of a triple:

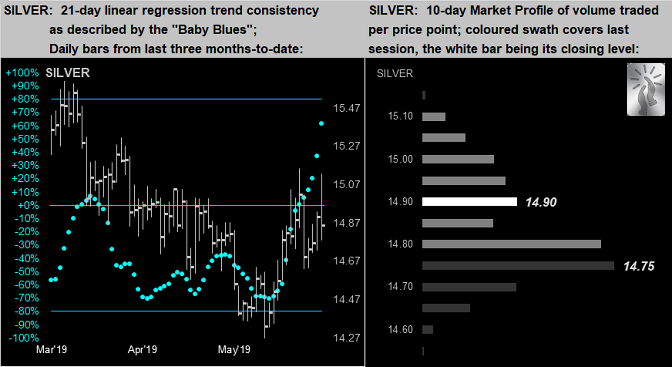

Then we've the like graphic for Sister Silver, her performance over the past three weeks a comparatively subdued +2.1% in spite of her own "Baby Blues" (below left) accelerating to the upside. Meanwhile per her Profile (below right), 'tis all about holding above 14.75:

Let's thus wrap No. 500 with the Gold Stack. Note the bulleted bits as they highlight price's recent run into the resistive 1360s, above which for the ad-nauseath time lies Base Camp 1377, it being the real threshold toward materially higher levels. Beyond Gold's vast undervaluation today, the other cited extremes are the norm ... until their regressive storm. So hang onto your Gold! Here's the stack followed by a closing note to you:

The Gold Stack

Gold's Value per Dollar Debasement, (from our opening "Scoreboard"): 2890

Gold’s All-Time High: 1923 (06 September 2011)

The Gateway to 2000: 1900+

Gold’s All-Time Closing High: 1900 (22 August 2011)

The Final Frontier: 1800-1900

The Northern Front: 1750-1800

On Maneuvers: 1579-1750

The Floor: 1466-1579

Le Sous-sol: Sub-1466

Base Camp: 1377

2019's High: 1362 (14 June)

10-Session directional range: up to 1362 (from 1311) = +51 points or +3.9%

The 1360s Double-Top: (1362 in Sep '17 and 1369 in Apr '18)

Trading Resistance: 1348 / 1357

Gold Currently: 1345, (expected daily trading range ["EDTR"]: 14 points)

Trading Support: 1340 / 1333 / 1323

10-Session “volume-weighted” average price magnet: 1337

Neverland: The Whiny 1290s

The Box: 1280-1240

The Weekly Parabolic Price to flip Short: 1276

The 300-Day Moving Average: 1269 and rising

2019's Low: 1267 (02 May)

So there 'tis, No. 500. Thank you readers One and All and Everywhere! As well, our risk in individually thanking all of you throughout this past decade who directly link to The Gold Update and/or republish it is that we'll leave someone out. But each and every one of you knows who you are out there, for whom we steadfastly remain thankful and grateful. Nonetheless, we'll wrap it for this week with the initials of one JGS, without whose support and interest in Gold via a single question posed so many years ago was the germination of that into which this has grown. Thank you, man. As you've on occasion quipped throughout: "We'll watch it together."