We woke up this morning to find oil prices weighing on the market… again… with China suffering the biggest losses. Oil prices have already kept stocks at bay in the best time of the year.

Funny how this “Santa Claus” rally that I predicted wouldn’t happen this year, didn’t. The last time was in 2007 and 2008 – the last years the stock market crashed.

I’ve been looking at how low oil prices will be the first trigger in the next crisis. Although it helps consumers a bit, low prices kill the $1 trillion QE-driven fracking industry that’s been such a stalwart of this bubble economy. And it’s already causing junk bonds to fall further in value, as energy-related bonds have been as high as 20% of that market recently.

But the second and biggest trigger I’ve been warning about is China’s unprecedented real estate bubble collapsing…

Recall the Japanese at the top of their stock and real estate bubble in 1989. They were buying real estate hand-over-fist, from Pebble Beach to Rockefeller Center to London. Then, after bidding them up, they ended up selling those holdings at big losses.

The Chinese make the Japanese look prudent!

Chinese buyers are bidding up the high end of the top coastal cities in English-speaking countries like they’ll never go down and like they can’t get enough.

We’re talking Sydney, Melbourne, Brisbane, Auckland, Singapore, San Francisco, L.A., Vancouver, Toronto, New York, London…

These markets are considered “Teflon-proof.” They’re not! In fact, they’re some of the greatest bubbles that exist today. China’s leading cities – like Shanghai, Beijing and Shenzhen – are up 700% or more since 2000!

Guess what happens when the bubble wealth in real estate that has built up in China finally collapses?

So does the capacity of the more affluent Chinese to buy real estate around the world. And these are the guys who have by-and-large been driving this global real estate bubble at the margin on the high end!

Bear in mind that Chinese real estate has been slowing and prices falling for over a year. That is precisely why China’s stock market bubbled up 160% in less than one year. When Chinese investors realized they could no longer make easy money in the real estate bubble, they turned to stocks. And after the dumb money piled in, the Shanghai Composite stock index fell 42% in just 2.5 months!

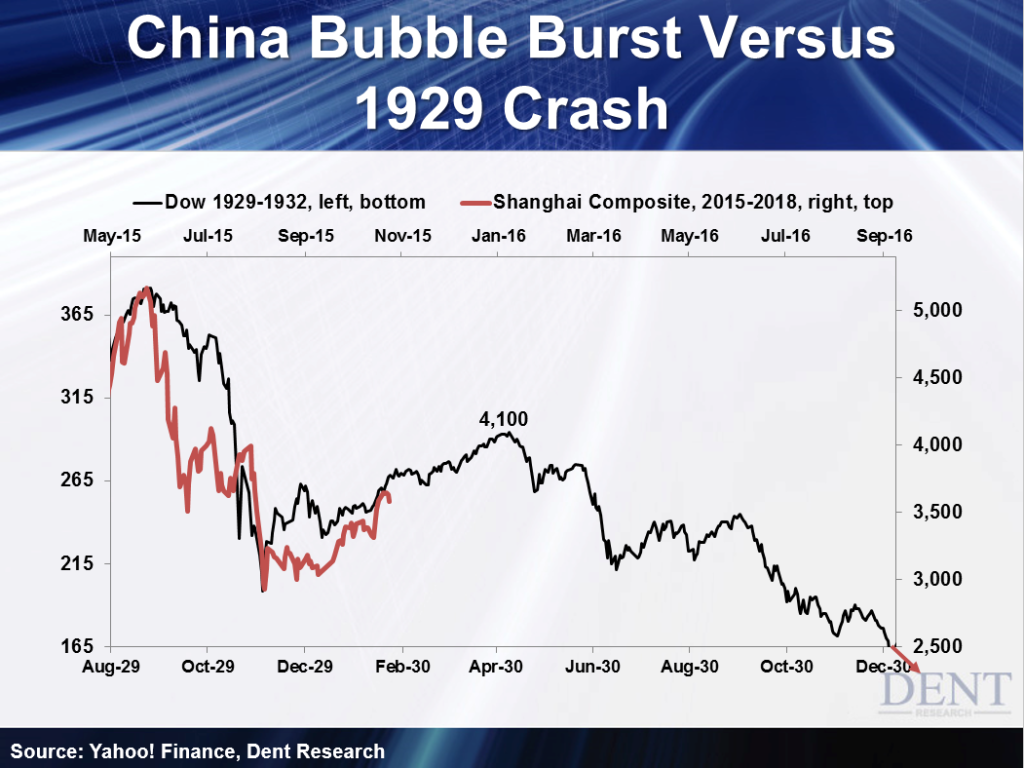

What did the Chinese government do? What any government in denial would do – buy its own stock market with hundreds of billions of dollars! That’s what the U.S. government did when its stock market crashed in late 1929. And sure enough, China’s stocks are following the same pattern to a tee:

If that pattern continues, the Shanghai Composite could peak in its bear market rally by mid- to late-January, as high as 4,100 – if it lasts that long.

Then it would collapse again, with the next target between 2,000 and 2,400… and its ultimate target at 1,000. Yes, an 80%-plus crash ultimately ahead!

After that first crash, Chinese investors already pulled back on their speculation in markets like New York and London. When you doubt your own economy, you feel less okay about speculating in others. It’ll only get worse when their stock market drops dramatically again.

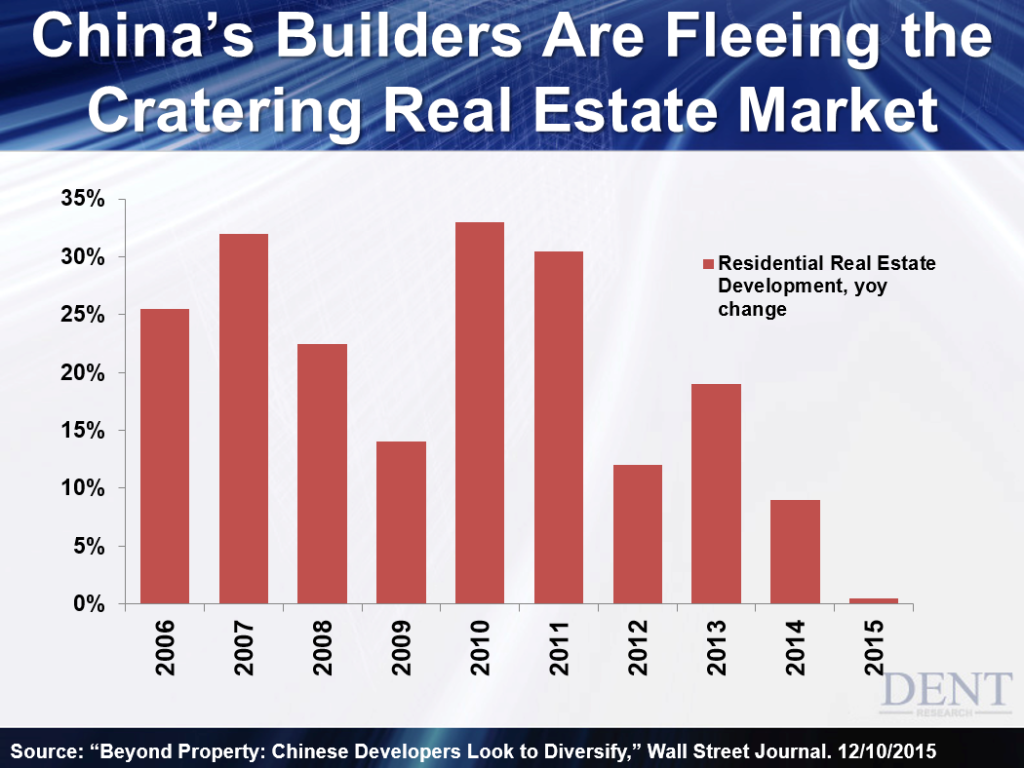

But broader, look at the steady decline in residential investment in China since 2010. This is the leading indicator of China’s slowdown, which is greatly understated by its government-manipulated statistics. It’s gone from about 34% in 2010, down to near-zero in 2015 year-to-date.

China is going down. The China Beige Book (which is much more accurate) recently showed that, across the board, economic conditions are unraveling.

There will be no soft landing in China. It will bring down the entire world’s unprecedented debt and real estate bubble. And it’s only a matter of time, and likely only a month away at this point.