Chimerix, Inc. (NASDAQ:CMRX) reported net loss from continuing operations of 36 cents per share in the second quarter of 2017, compared to net loss of 39 cents a year ago. Moreover, the reported loss was narrower than the Zacks Consensus Estimate of a loss of 41 cents.

Revenues

In the second quarter, Chimerix reported Contract revenues of $0.7 million, down 61.1% year over year from $1.8 million. The year-over-year decline was due to a fall in reimbursable expenses related to the company’s BARDA developmental contract.

Research and development expenses totaled $11.6 million, down 15.9%, while general and administrative expenses amounted to $6.3 million, down 4.5% year over year. Consequently, loss from operations came in at $17.2 million, highlighting an improvement from the operating loss of $18.5 million in the prior-year quarter. However, the operating loss may be attributed to a significant year-over-year decline in revenues.

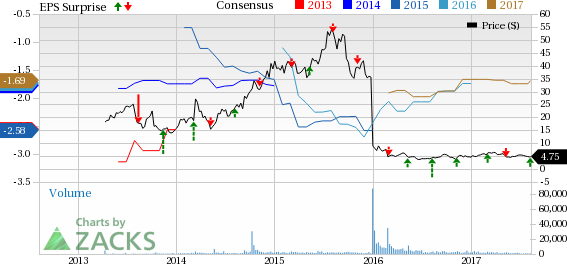

Chimerix, Inc. Price, Consensus and EPS Surprise

Financials

Chimerix exited second-quarter 2017 with cash and cash equivalents and short-term investments of $148.5 million, compared with $161.7 million recorded at the end of the first quarter.

Our Take

Chimerix exited the second quarter on a positive note with narrower-than-expected loss. However, revenues declined year over year.

Nonetheless, we are encouraged by the company’s progress in the second quarter, courtesy of its advancement with the lead product candidate brincidofovir. The company witnessed encouraging enrollments in its multiple ascending dose study of IV BCV. Further, Chimerix anticipates several important developments in the second half of 2017 like the starting of first in-human study of CMX521, initiation of AdAPT as well as data from IV BCV and AdVance.

Zacks Rank & Other Key Picks

Chimerix currently has a Zacks Rank #2 (Buy). A few other top-ranked medical stocks are Edwards Lifesciences Corp. (NYSE:EW) , Myriad Genetics, Inc. (NASDAQ:MYGN) ) and Align Technology, Inc. (NASDAQ:ALGN) . While Edwards Lifesciences and Align Technology carry a Zacks Rank #1 (Strong Buy), Myriad Genetics carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences’ second-quarter 2017 adjusted earnings improved a 42.1% year over year, primarily driven by strong sales growth at the company’s transcatheter heart valves business. The stock has gained around 5.1% over the last three months.

Align Technology’s second-quarter 2017 adjusted EPS of 85 cents was up 37.1% year over year. Revenues grew 32.3% year over year to $356.5 million. The stock has rallied roughly 28.3% over the last three months.

Myriad Genetics reported adjusted EPS of 30 cents in the fourth quarter of fiscal 2017, down 17% year over year .Also, total revenue rose 8% year over year to $201 million in the fourth quarter. The stock has rallied roughly 22.3% over the last three months.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Chimerix, Inc. (CMRX): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post