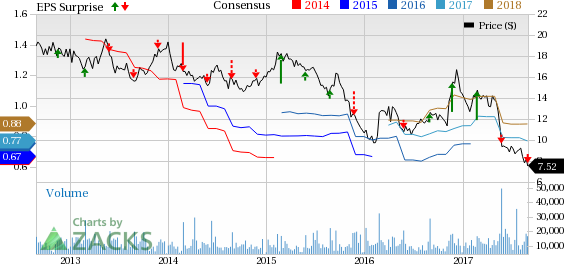

Chico's FAS, Inc. (NYSE:CHS) disappointed the investor community again with dismal second-quarter fiscal 2017 financial results. The company reported lower-than-expected top and bottom line numbers and also lowered comps view for fiscal 2017.

Consequently, shares of the Zacks Rank #4 (Sell) company fell nearly 4% yesterday. Moreover, Chico’s stock has declined a considerable 45.6% year to date, wider than the industry’s decline of 31.6%.

Coming to the quarterly results, Chico’s earnings of 18 cents per share missed the Zacks Consensus Estimate of 21 cents. Moreover, it declined 28% from 25 cents reported in the year-ago quarter.

Net sales dropped nearly 9% year over year to $578.6 million, due to soft comparable store sales (comps). Revenues also fell marginally short of the Zacks Consensus Estimate of $579.6 million.

Comps declined 9% as a result of lower average dollar sale and a fall in transaction count. Segment wise, comps for Chico's, White House Black Market (WHBM) and Soma brands witnessed a drop of 9%, 10.6% and 1.8%, respectively.

Gross profit declined 13.2% to $209.1 million, while gross margin declined 180 basis points (bps) to 36.1% due to store occupancy expenses deleverage of 90 bps and higher promotions to clear spring inventory.

Selling, general and administrative (SG&A) expenses fell about 7% to $173.6 million, due to fall in store operating expenses to match with sales and lower unproductive marketing expenses. However, as a percentage of sales, SG&A expanded 60 bps to 30%.

Consequently, income from operations declined 5.6% to $35.5 million, while as a percentage of sales it increased 20 bps to 6.1%.

Financial Update

Chico’s ended the quarter with cash and cash equivalents of $135.3 million, inventories of $235.2 million, long-term debt of $61.1 million, and shareholders’ equity of $618.4 million.

During the first half of fiscal 2017, the company generated $67.3 million of cash from operating activities.

Further, Chico’s repurchased 1.2 million shares for $11.2 million under its $300 million buyback plan announced in November 2015. As of Jul 29, 2017, the company had $142.9 million worth authorization remaining for repurchase. The company also spent nearly $21.5 million in dividends in first-half fiscal 2017.

Store Update

During the reported quarter, Chico’s closed a total of 10 stores, including nine frontline boutiques across all brands and one WHBM outlet. This was in sync with the company’s ongoing strategy to improve the productivity of store fleet. The company did not open new stores in the quarter. Its total store count is pegged at 1,482 as of Jul 29.

Other Developments

Chico’s continued to make progress with regard to cost control and operating efficiency endeavors which were declared last year. The company expects to achieve annualized savings of $100-$110 million by mid-2018. In this regard, it has achieved savings worth $30 million in fiscal 2016, and anticipates generating $50 million worth of savings in fiscal 2017.

With reduction in SG&A expenses and cost of goods sold, the company has generated $55 million of savings related to the initiatives announced in 2016. Further, it anticipates generating another $25 million savings from these initiatives in the second half, which will primarily be focused on supply chain initiatives and non-merchandise procurement negotiations.

Outlook

Due to the dismal top-line trends, the company lowered comps and gross margin projections for fiscal 2017. However, the company’s SG&A forecast reflects progress on its cost-saving initiatives.

For fiscal 2017, management now expects comps to decline in high single-digits range, compared with the previous guidance of mid-single digit percentage decline. The company stated that the comps projections for fiscal 2017 do not include the additional 53rd week calculations. However, the 53rd week is expected to contribute about $30 million to net sales.

Chico’s now anticipates gross margin to contract about 75-100 bps against the prior range of between flat and growth of 30 bps. SG&A are expected to decline $50-$60 million in fiscal 2017 compared with the previous forecast of remaining flat.

Management now anticipates capital expenditure of $55-$60 million for fiscal 2017, down from the previous guidance of $60-$70 million.

Done with CHS? Find Solace in these 3 Safe Bets

Better-ranked stocks among apparel retailers include Canada Goose Holdings Inc. (NYSE:GOOS) , The Children’s Place Inc. (NASDAQ:PLCE) and Tilly’s Inc. (NYSE:TLYS) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Canada Goose has gained nearly 9.5% year to date. Moreover, it has a long-term earnings growth rate of 34.1%.

Children’s Place has a long-term EPS growth rate of 9%. Further, the stock has returned 26.2% in the past year.

Tilly’s has improved 19% in the past year. Further, the company has delivered an average positive earnings surprise of 83.7% in the trailing four quarters.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Chico's FAS, Inc. (CHS): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Tilly's, Inc. (TLYS): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

Original post

Zacks Investment Research