A couple of chemical companies are lined up to report their quarterly results on Nov 7. As per the Zacks Industry classification, the chemical industry is grouped under the broader Basic Materials sector.

Based on the earnings scorecard as of Nov 2, 75% of the sector participants on the S&P 500 index have already reported their quarterly numbers. Earnings for these companies have increased 7.5% from the same period last year while revenues are down 2.2%, per the latest Earnings Outlook. Overall earnings for the sector are expected to rise 3.7% on 3.2% lower sales.

The chemical industry remains on the road to recovery, gaining from healthy momentum across automotive and construction markets. Chemical makers are benefiting from strategic measures including expansion into high-growth markets, aggressive cost management, acquisitions and investment on capacity expansion.

However, the chemical industry remains besieged by a number of challenges including depressed demand in agricultural and energy markets, a sluggish Chinese economy and headwinds from a strong dollar.

We take a sneak peek into two chemical companies that are gearing up to report their third-quarter results on Nov 7.

International Flavors & Fragrances Inc. (NYSE:IFF) , which will report after the bell, carries a Zacks Rank #2 (Buy). However, we cannot predict a likely earnings beat as both the Most Accurate estimate and the Zacks Consensus Estimate stand at $1.41, resulting in an Earnings ESP of 0.00%. Please check our Earnings ESP Filter that enables you to find stocks that are expected to come out with earnings surprises.

In the four trailing quarters, International Flavors & Fragrances reported better-than-expected results in three while lagged in one, resulting in an average positive earnings surprise of 0.70%. The company is expected to gain from a solid product portfolio, large client base, capital allocation policy and its acquired assets in the past few quarters. (Read more: International Flavors Q3 Earnings: What to Expect?)

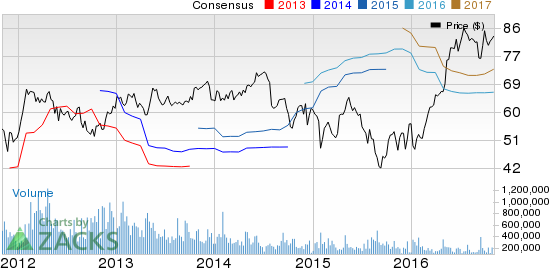

Albemarle Corporation (NYSE:ALB) , which will report after the close, has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at 81 cents. Since this results in an Earnings ESP of 0.00%, surprise prediction becomes difficult in spite of the company’s Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks' Best Investment Ideas for Long-Term Profit

Today you can gain access to long-term trades with double and triple-digit profit potential rarely available to the public. Starting now, you can look inside our stocks under $10, home run and value stock portfolios, plus more. Want a peek at this private information? Click here >>

ALBEMARLE CORP (ALB): Free Stock Analysis Report

INTL F & F (IFF): Free Stock Analysis Report

Original post

Zacks Investment Research