A few major chemical companies are scheduled to report their quarterly numbers on Jul 27. The chemical industry is back on track after bearing the brunt of the global economic crisis. Chemical companies continue to shift their focus on attractive, growth markets in an effort to whittle down their exposure to other businesses that are grappling with weak demand. The industry is also seeing a pick-up in consolidation activities -- exhibited by a wide swath of deals in the recent past -- as chemical makers are increasingly looking to diversify their business and enhance operational scale.

While the industry remains saddled by several challenges including concerns over China’s economy and weak demand in the energy space, its momentum is expected to continue through 2017, supported by continued strength across key end-use markets, an upswing in the world economy and significant shale-linked capital investment.

Strategic initiatives including continued focus on cost and productivity, operational efficiency improvement and expansion of scale through acquisitions should help chemical makers weather macroeconomic and industry-specific headwinds.

As per the Zacks Industry classification, the chemical industry is grouped under the broader Basic Materials sector. Overall Q2 earnings for the sector are projected to rise 1.5% while revenues are expected to increase 2.8%, based on the latest Earnings Outlook.

We take a sneak peek at four chemical companies that are gearing up to report second-quarter results on Jul 27.

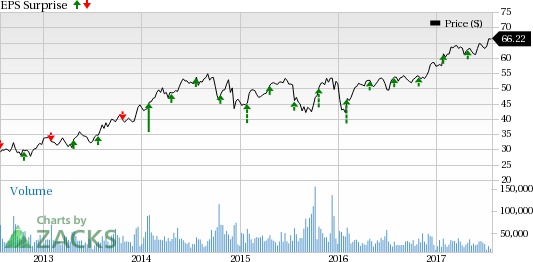

The Dow Chemical Company (NYSE:DOW) will report its results ahead of the bell. The company has an Earnings ESP of -1.98% as the Most Accurate estimate stands at 99 cents while the Zacks Consensus Estimate is pegged at $1.01. The stock carries a Zacks Rank #4 (Sell). We caution against Sell-rated (Zacks Rank #4 or 5) stocks going into the earnings announcement. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The U.S. chemical kingpin has an impressive surprise history, having surpassed the Zacks Consensus Estimate in all the trailing four quarters at an average beat of 10.77%. Dow faces feedstock cost pressure which may continue to hurt its downstream margins. Moreover, higher maintenance costs may affect margins in its plastics business. Dow is also facing challenges in its agriculture business. Nevertheless, the company is gaining from cost-cutting and productivity actions and continued focus on consumer-driven markets, which should continue to support its results in the second quarter. (Read more: Dow Chemical Q2 Earnings Preview: Will it Disappoint?)

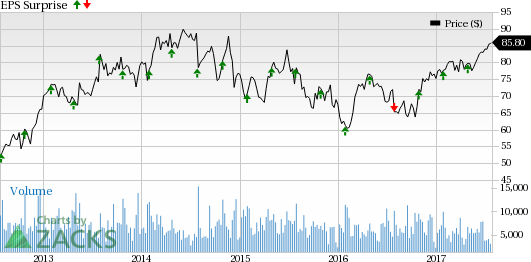

Eastman Chemical Company (NYSE:EMN) will report after the close. It has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at $1.89. While the stock carries a Zacks Rank #2 (Buy), its 0.00% ESP makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Eastman Chemical surpassed the Zacks Consensus Estimate in three of the trailing four quarters with an average beat of 4.21%. While Eastman Chemical faces pricing and currency headwinds, it should gain from synergies of acquisitions, cost-cutting actions and continued momentum in its specialty businesses. (Read more: Eastman Chemical Q2 Earnings: What's in the Cards?)

Praxair Inc. (NYSE:PX) will report before the bell. It has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at $1.42. While the stock carries a favorable Zacks Rank #3 (Hold), its 0.00% ESP makes surprise prediction difficult.

The company posted better-than-expected results in three of the last four quarters and in-line numbers in one. Average earnings surprise was a positive 1.67% over this period. Praxair is expected to leverage benefits from better operating conditions in the machinery industry in the to-be-reported quarter. Rise in demand for industrial machineries is also likely to boost the need for industrial gases required in the various stages of manufacturing processes. (Read more: Praxair to Report Q2 Earnings: What's in the Cards?)

Huntsman Corporation (NYSE:HUN) will report ahead of the opening bell. The company has an Earnings ESP of +7.46% as the Most Accurate estimate stands at 72 cents while the Zacks Consensus Estimate is pegged at 67 cents. The stock carries a Zacks Rank #4.

The company surpassed the Zacks Consensus Estimate in each of the trailing four quarters. It has delivered an average positive surprise of 20.12% over this timeframe.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Eastman Chemical Company (EMN): Free Stock Analysis Report

Praxair, Inc. (PX): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Original post

Zacks Investment Research