Investing.com’s stocks of the week

Retirees and near-retirees pleading for higher interest rates received some bad news on Wednesday when the Fed released its September FOMC meeting minutes.

Markets learned that the Fed is becoming concerned about weak global growth and a stronger US Dollar.

Of course, it shouldn’t be a surprise to anyone that the Fed wouldn’t like a “King Dollar.”

On the contrary, the dollar is being talked down, and rate increases are effectively being pushed back.

Accordingly, the S&P 500 spiked once the minutes were released and continued higher into the close of trading. (Breaking news: The stock market loves continued stimulus!)

In fact, Wednesday’s gain of 1.7% was the largest thus far in 2014.

Despite the market’s strong gains, though, the overarching message sent by the Fed isn’t a positive one…

We’re trapped.

Think about it. If just the talk of rate increases jacks up the dollar, thereby reducing the cost of imported goods and holding inflation below the Fed’s 2% objective, then it’s going to be very difficult for our central planners to raise short-term interest rates.

That being said, if the Fed has, in fact, trapped us in a low-interest rate environment, certain investments become even more attractive…

Preferred Opportunities

Preferred stocks are hybrid securities that tend to be relatively interest-rate-sensitive due to their bond-like characteristics.

The Nuveen Preferred Income Opportunities Fund (JPC) is a closed-end fund (CEF) that invests at least 80% of its managed assets in preferred securities, and the remainder opportunistically in income-oriented securities.

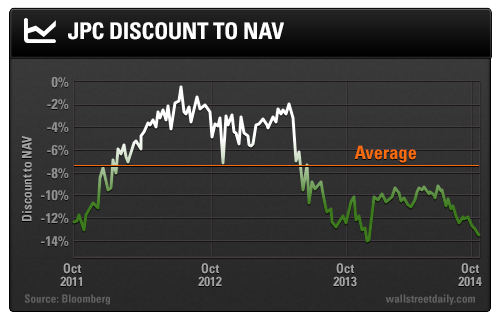

JPC is currently trading at a 12% discount to its net asset value (NAV), and as you can see below, this discount is among the deepest (cheapest) the fund has experienced over the past three years.

Due to its discount to NAV and modest leverage, JPC carries a yield of 8.2%. The fund also has monthly distributions, which appeal to many income seekers.

The baseline expense ratio for JPC is a bit high at 1.24%, but fees are one of the reasons why we have to insist on buying CEFs well below their NAVs. Over time, management fees will be more than offset if we harvest gains – buying big discounts and selling small discounts (or even premiums).

With the end of the year quickly approaching, more and more investors will realize that the Fed funds rate won’t be raised in 2015.

In this environment, closed-end preferred funds trading at steep discounts to NAV, such as JPC, are excellent ways to safely add yield to our portfolios.

The carnage in energy trusts and master limited partnerships (MLPs) in the past few months demonstrates the outcome when one searches for yield in the wrong places.

Safe (and high-yield) investing,

by Alan Gula, CFA