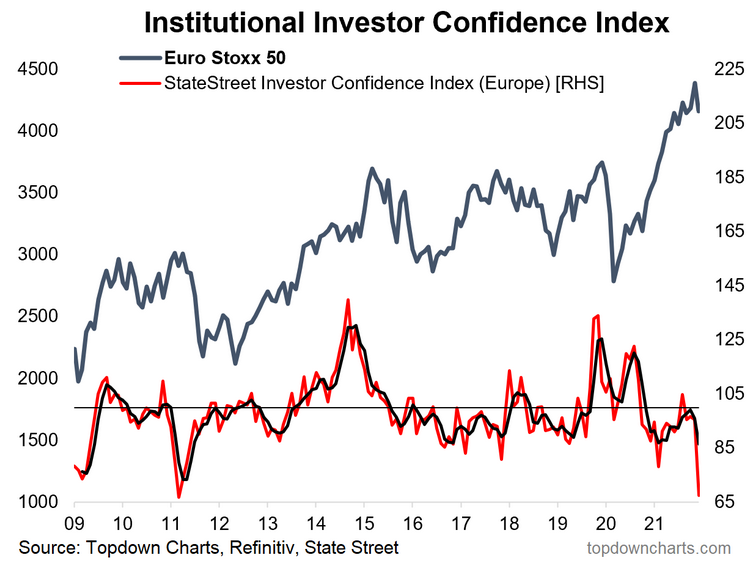

European Institutional Investor Confidence Plunged: As noted in the latest Weekly Insights report, the State Street global Investor Confidence index plunged in December—but most notable was the huge drop amongst European investors as the chart below, utilizing the Euro Stoxx 50 index for comparison, shows.

As a reminder the index:

“...measures investor confidence or risk appetite quantitatively by analyzing the actual buying and selling patterns of institutional investors. The index assigns a precise meaning to changes in investor risk appetite: the greater the percentage allocation to equities, the higher risk appetite or confidence. A reading of 100 is neutral; it is the level at which investors are neither increasing nor decreasing their long-term allocations to risky assets.“

The key driver of the drop was likely the Fed pivot to accelerating taper and acknowledgement of likely rate hikes in 2022. But especially for Europe the Omicron variant of COVID triggered market volatility with many countries reintroducing restrictions as case counts surged.

Despite those issues though, 2022 does appear to have a incrementally more headwinds to contend with e.g. monetary stimulus removal, inflation, and fiscal tightening. So perhaps the late-year de-risking makes a bit of sense in that context.

Key point: European institutional investors significantly reduced risk in December.