Well… I had planned to put this note out earlier in the week but was too busy —and as you probably saw, one of these upside risks has already in-part played out with markets responding in spectacular fashion (S&P 500 up almost 10% yesterday).

But rather than getting bogged down in the froth and frenzy of the daily news cycle and tail-chasing, I thought it would still be useful to take a step back and take stock of potential upside risks.

I will preface this by noting that much of what I talked about in the latest Weekly ChartStorm still stands and has not been negated by the 90-day tariff pause (cyclical downside risks; previous topping signals still running their course, recession risk still high (damage is already done), valuations still elevated, mixed sentiment signals, global vs US unwind, etc) —and if pressed I would still say that the bull market is over but to keep myself from fixating too much on the bearish side, and to help keep things in perspective, let’s look at the upside case.

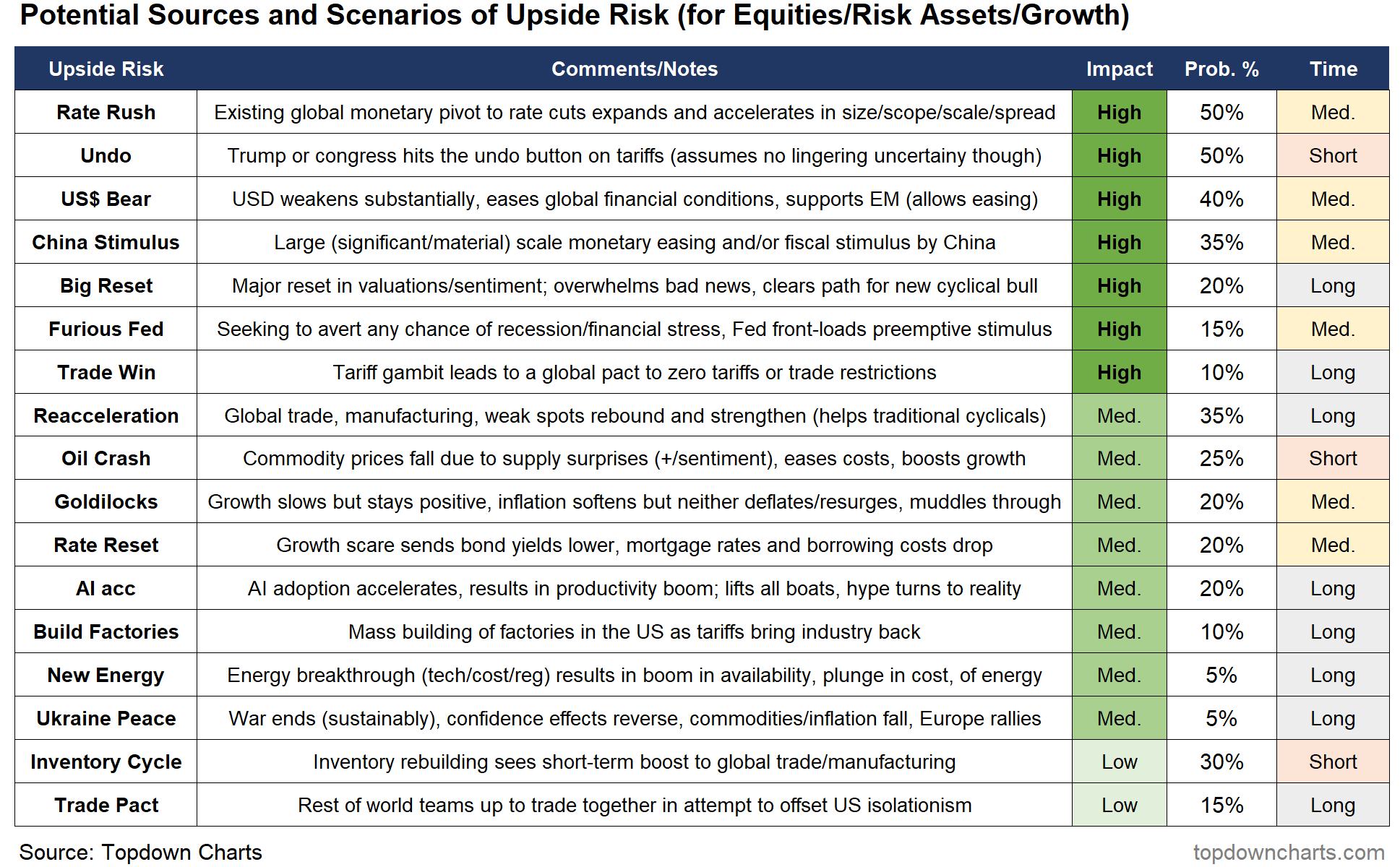

The table below was featured in my Monday note to clients and is something I have turned to several times in the past (most often at turning points). I feel it is a useful framework and exercise to go through by itemizing and specifying estimated impact, probability, and timing (immediate vs further out) of upside (and downside) risks.

Rather than dwell on each specific item, here are the broad themes:

-

Stimulus: Central banks around the world respond to the worsening growth outlook, market volatility, and financial stability risks (in extension and addition to the existing significant easing already undertaken).

-

Financial Conditions: the upside of falling oil prices, lower(?) bond yields, and a weaker US dollar are easier financial conditions (lower costs; tailwind to growth and economic activity).

-

Policy Change: Being that the tariff aspect is a self-imposed unilateral policy change, the upside would be a major change back from that or countervailing measures such as tax cuts, fiscal stimulus, or even a positive resolution to the trade war.

-

Market Cycle: The combination of recession risk and (geo)political shocks sends the market lower in a form of catharsis that fixes previous overvaluation and frothy sentiment, clearing the path for a new cyclical bull market to begin.

-

Economy: The economy avoids recession, and either stays in the goldilocks zone of positive growth but no inflation resurgence, or indeed the global economy reaccelerates after a period of weakness (e.g. China, Europe recover from their slowdowns).

-

Tails: Adding in things that are lower probability but still could credibly happen, like breakthroughs in geopolitics or technology.

As you can gather from this, it’s not always all doom and gloom (even when it is), and there are credible scenarios for the upside in the immediate term and further out. That doesn’t mean throw caution to the wind (remember we want balance in the view, an even keel), but rather don’t get too wedded to your views and don’t get over-leveraged to market positions that could come unstuck if the seemingly unthinkable happened on the good OR bad side.

Key point: Despite the risks, there are credible sources of upside risk.