Biotech stocks have taken a beating the last few months, down roughly 35% since peaking in July of last year. And for good reason I think. Biotech at the top was sporting a pretty rich multiple, 25 times forward earnings for the biotech stocks in the S&P 500 and a lot more than that for the ones that aren’t. Now, having lopped 35% off the top, the forward P/E for the large cap, S&P 500 biotechs is just a bit over 12 (according to Ed Yardeni’s research). For the iShares Nasdaq Biotechnology (NASDAQ:IBB) ETF, the trailing P/E is around 21. Unfortunately they don’t offer a forward number, but considering the expected growth rates for most of these stocks – roughly 19% for the industry as a whole – the trailing multiple is about right.

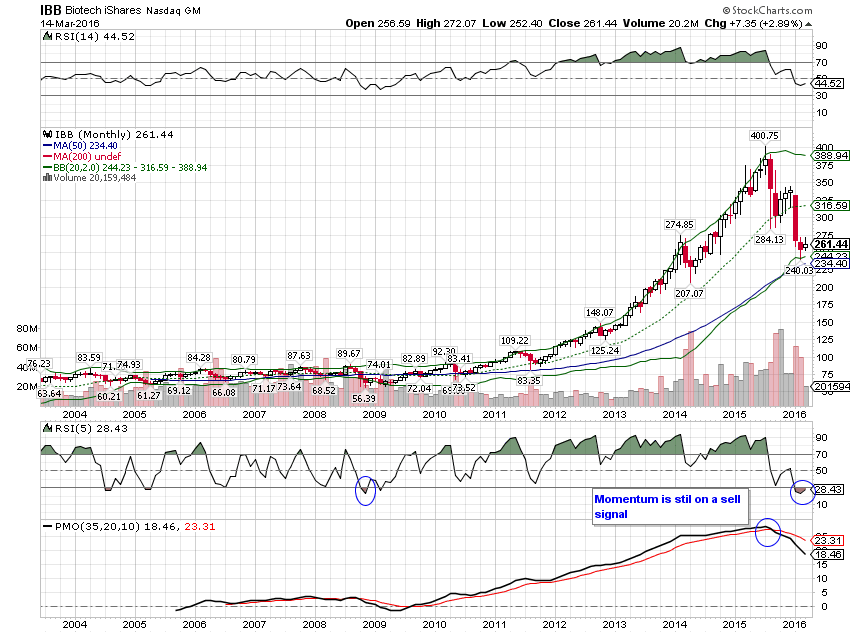

This is a volatile sector with standard deviation in the mid-20s, so it isn’t for the faint of heart, but if you believe in the power of technology you have to at least start considering these. From a technical perspective the iShares Biotechnology ETF (IBB) is as oversold as it was at the end of 2008. Our preferred long-term momentum indicator has not turned up yet though, so caution is warranted. The intermediate version is still on a sell too, although short-term momentum has turned positive.