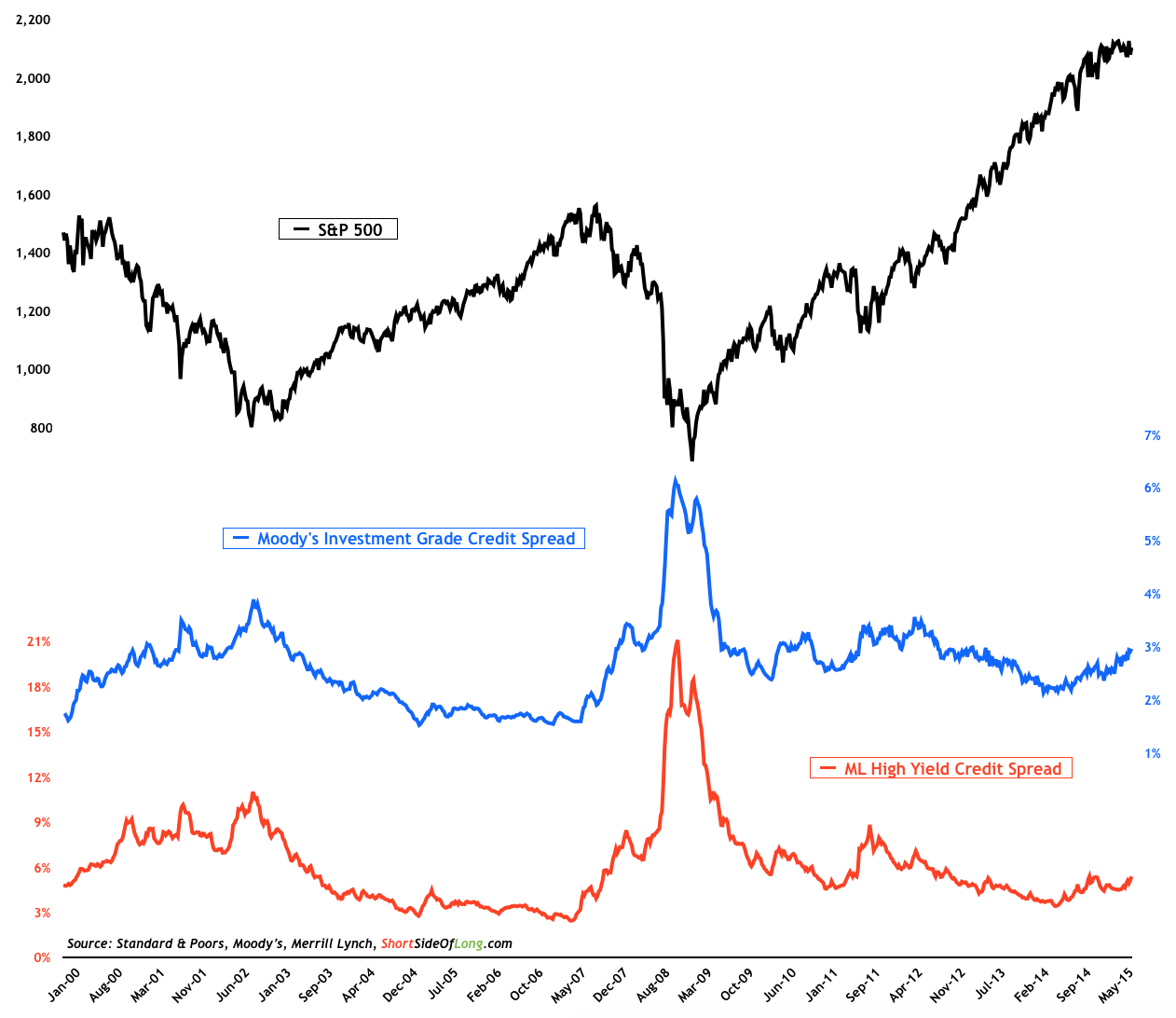

High Yield and Investment Grade credit spreads keep rising

Looking at the S&P 500 (via SPDR S&P 500 (ARCA:SPY)), one would come to the conclusion that the bull market is intact and global growth solid. However, this is far from the truth.

With the rise of the US dollar since the middle of 2014, quite a lot of assets—as well as economies—have been affected. The Eurozone, BRICs, Frontier markets and commodity producers are all feeling the pain. Raw materials (via the Rogers International Commodity Total Return Fund (NYSE:RJI)) are declining, emerging market currencies are under pressure and EU growth is very tepid.

The picture isn’t all that rosy in the US either, as credit markets clearly show. High Yield (via iShares iBoxx $ High Yield Corporate Bond Fund (ARCA:HYG)) and Investment Grade (via iShares iBoxx $ Investment Grade Corporate Bond Fund (ARCA:LQD)) credit spreads have continued to rise since middle of 2014.

Certain readers will state that if we remove energy debt, credit spreads aren’t as high as the chart of the day shows. While this is true, readers should remember that the prudent investor should not cherry pick any data, during any period. Crises usually start in a selected sector and spread from there.

In 2000, it was the Technology sector (Technology Select Sector SPDR (NYSE:XLK)) was the initial source. In 2006/07 it was the Financial sector (Financial Select Sector SPDR (ARCA:XLF)). Could today's problem be linked to the commodity producers? Energy and Materials (Energy Select Sector SPDR (ARCA:XLE) and Materials Select Sector SPDR (ARCA:XLB)) continue to struggle, as already been discussed.