Norfolk Southern Corporation (NYSE:NSC) is scheduled to release second-quarter 2019 results on Jul 24, before market open.

In the last reported, the company delivered impressive results, with earnings and revenues beating the Zacks Consensus Estimate. Results were aided by low costs, an increase in revenue per unit and higher fuel surcharge revenues.

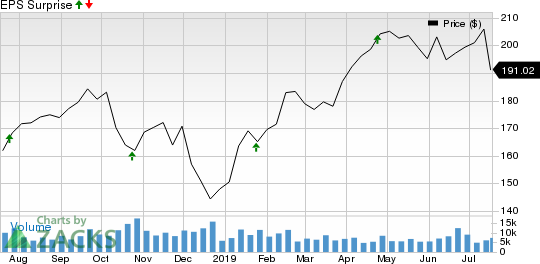

Additionally, Norfolk Southern has an impressive earnings surprise history. The company’s bottom line surpassed the consensus mark in each of the trailing four quarters, the average being 9.7%.

Which Way Are Estimates Moving?

The Zacks Consensus Estimate for second-quarter revenues is pegged at $2.94 billion compared with $2.9 billion recorded in the prior-year quarter. The same for second-quarter earnings stands at $2.78, indicating 11.2% growth from year-earlier quarter figure. However, the Zacks Consensus Estimate for the to-be-reported quarter earnings has been revised downward to the tune of 2.8% or 8 cents over the past 30 days.

Let’s delve deep to unearth the factors likely to influence this Norfolk, VA-based railroad operator’s results in the to-be-reported quarter.

We expect Norfolk Southern’s second-quarter results to be hurt by weak freight revenues due to declining shipments. The downbeat freight scenario is quite evident from the fact that North American freight shipments have declined in each of the last three months (April, May and June) of second-quarter 2019, according to the latest Cass Freight Shipments Index report. In fact, the shipments index has declined since December 2018.

At the Wolfe Research 12th Annual Global Transportation Conference, the company stated that second-quarter volumes are likely to be hurt by below-par performances of the key segments like Automotive (down 4% as of May 18, 2019), Forest and Consumer (down 5%), Chemicals (down 3%) and Intermodal (down 1%).

Evidently, the Zacks Consensus Estimate for carloads at the Automotive sub-group (automotive is a part of the General Merchandise segment) indicates a 1% decline from the figure reported at the year-ago quarter. Sluggish vehicle production in the United States is resulting in the below-par performance of the Automotive sub-group lately.

However, the company’s efforts to reduce costs in a bid to improve efficiencies are expected to drive the bottom line in the second quarter. We also expect Norfolk Southern’s operating ratio (operating expenses as a percentage of revenues) to improve in this reporting cycle owing to its efforts to check costs. The Zacks Consensus Estimate for operating ratio in the to-be-reported quarter stands at 62 compared with 65 reported a year ago. Notably, lower the value of the metric the better.

What the Zacks Model Unveils

Our proven model does not conclusively show that Norfolk Southern is likely to beat estimates in the second quarter. This is because a stock needs to have both — a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially if they have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Norfolk Southern carries a Zacks Rank #3.

Earnings ESP: Norfolk Southern has an Earnings ESP of 0.00% as the Zacks Consensus Estimate of $2.78 is in line with the Most Accurate Estimate. While the company’s favorable Zacks Rank increases the predictive power of ESP, a 0.00% Earnings ESP makes surprise prediction difficult.

Stocks to Consider

Investors interested in the broader Transportation sector may consider JetBlue Airways (NASDAQ:JBLU) , Canadian National Railway Company (NYSE:CNI) and Ryder System (NYSE:R) as these stocks possess the right mix of elements to beat on earnings in the next releases.

JetBlue Airways has an Earnings ESP of +3.01% and a Zacks Rank #2. This company is scheduled to announce second-quarter 2019 numbers on Jul 23. You can see the complete list of today’s Zacks #1 Rank stocks here.

Canadian National is a Zacks #3 Ranked company and has an Earnings ESP of +0.25%. The company will release second-quarter 2019 results on Jul 23.

Ryder has an Earnings ESP of +0.07% and a Zacks Rank #3. This company is scheduled to announce second-quarter 2019 numbers on Jul 30.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

JetBlue Airways Corporation (JBLU): Free Stock Analysis Report

Ryder System, Inc. (R): Free Stock Analysis Report

Norfolk Southern Corporation (NSC): Free Stock Analysis Report

Canadian National Railway Company (CNI): Free Stock Analysis Report

Original post