C.H. Robinson Worldwide Inc.’s (NASDAQ:CHRW) third-quarter 2017 earnings per share of 85 cents beat the Zacks Consensus Estimate by 3 cents. However, the bottom line decreased 5.6% year over year due to higher costs and lackluster performance of the truckload and intermodal division.

Total revenues rose 12.8% year over year to $3,784.5 million, surpassing the Zacks Consensus Estimate of $3,589.9 million. Notably, volume growth across all transportation services of the company drove the top line.

C.H. Robinson’s outperformance in the third quarter pleased investors. Consequently, shares of the company inched up 1.6% in after-market trading on Oct 31.

Total operating expenses increased 15% year over year to $399.38 million, resulting in an operating ratio (operating expenses as a percentage of net revenue) of 67.3% compared with 62.3% in the year-ago quarter.

From fourth-quarter 2016, the company has been reporting under three segments, namely, North American Surface Transportation (NAST), Global Forwarding and Robinson Fresh. While total revenues at NAST were $2.47 billion in the reported quarter (up 9.6% year over year), revenues at Global Forwarding totaled $552.13 million (up 41.3%)and at Robinson Fresh were $613.65 million (up 3.9%).

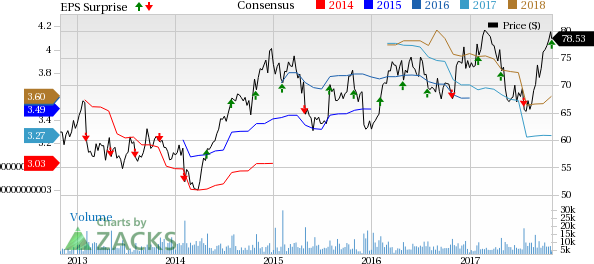

A historical presentation of results on an enterprise basis is given below:

Transportation: The unit (comprising Truckload, Intermodal, Less-than-Truckload, Ocean, Air, Customs and Other logistics services) posted net revenues of $564.08 million in the reported quarter, up 6.7% from the year-ago quarter.

Truckload net revenues declined 2.6% year over year to $301.03 million. Additionally, net revenues at Less-than-Truckload increased 5.6% year over year to $101.87 million.

Net revenues at the Intermodal segment declined 2.6% year over year to$7.48 million.

Net revenues at the Ocean transportation segment soared 43.7% year over year to $81.18 million. The same at the Air transportation division increased 28.3% year over year to $25.53 million. Customs net revenue surged 41.4% to $17.42 million.

Net revenues at Other logistics services increased 10.5% year over year to$29.58 million on the back of growth in managed services.

Sourcing: Net revenues at the segment slipped 0.2% year over year to approximately $29.76 million.

Liquidity

This Zacks Rank #3 (Hold) company exited the reported quarter with cash and cash equivalents of $297.31 million compared with $247.67 million at the end of 2016. Long-term debt was $750 million at the end of the quarter compared with $500 million recorded at the end of 2016. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting third-quarter earnings reports from key players like Expeditors International of Washington, Inc. (NASDAQ:EXPD) , Copa Holdings, S.A. (NYSE:CPA) and GOL Linhas Aéreas Inteligentes S.A. (NYSE:GOL) . While Expeditors will report third-quarter earnings on Nov 7, Copa Holdings and GOL Linhas will release the same on Nov 8.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Gol Linhas Aereas Inteligentes S.A. (GOL): Free Stock Analysis Report

Copa Holdings, S.A. (CPA): Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW): Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD): Free Stock Analysis Report

Original post

Zacks Investment Research