CenturyLink Inc. (NYSE:CTL) has postponed the closing of the Level 3 Communications Inc. (NYSE:LVLT) acquisition till the end of October. This is because the much-hyped merger between CenturyLink and Level 3 Communications is still awaiting approvals from the State of California, the Department of Justice and the Federal Communications Commission.

In fact, the California Administrative Law Judge recognized the merger of CenturyLink and Level 3 Communications is in public interest. So, it proposed to the California Public Utilities Commission to give consent to the transaction at its meeting on Oct 12, 2017.

The proposed merger has already received state approvals from almost 24 states and regulatory clearance from Connecticut, Indiana, Louisiana, Montana, Nevada, Texas and Puerto Rico.

Merger Prospects

On November 2016, the two entities entered into a definitive agreement through which CenturyLink will acquire Level 3 Communications in a cash and stock transaction. The combined entity is likely to generate $975 million of annual cash synergies.

If the proposed merger finally materializes, it will increase CenturyLink's network by 200,000 route miles of fiber including 64,000 route miles in 350 metropolitan areas and 33,000 subsea route miles connecting multiple continents.

Going forward, CenturyLink's on-net buildings are expected to increase by nearly 75% to approximately 75,000. Consequently, the combined entity will become a formidable challenger to their larger counterparts.

Price Performance & Zacks Rank

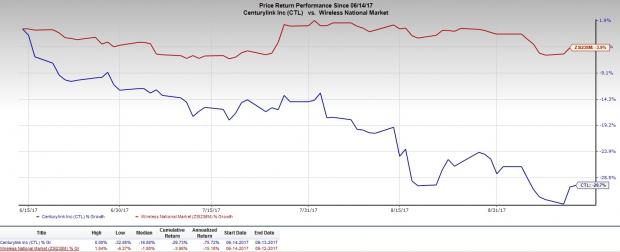

Shares of CenturyLink have declined 29.7% compared with the industry‘s fall of 3.9% in the last three months. The company currently carries a Zacks Rank #5 (Strong Sell).

Currently, CenturyLink and Level 3 Communications are struggling to maintain their business momentum owing to severe competitive threats from large telecom operators like Verizon Communications Inc. (NYSE:VZ) , AT&T Inc (NYSE:T). T and Comcast Corp. (NASDAQ:CMCSA) , each carrying a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Level 3 Communications, Inc. (LVLT): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

CenturyLink, Inc. (CTL): Free Stock Analysis Report

Original post

Zacks Investment Research