Just like that we say goodbye to the ECB market driver and hello to the Fed. Central banks will get their right of reply to Mario Draghi and last week’s ECB stimulus, with all of the big players in action this coming week.

Tomorrow morning’s economic calendar is packed, with RBNZ Governor Wheeler speaking in Auckland first up, followed immediately by monetary policy meeting minutes out of Australia, and finally the big one of the day: The Bank of Japan policy meeting.

Australian and Kiwi sentiment will already be bearish, already gapping down to begin the week on the back of a weekend deluge of Chinese data misses. The weakening economy printed disappointing numbers in credit growth, industrial production, and the surprisingly weak retail sales which were actually being viewed as one of the final shining lights for the economy.

Following New Zealand’s shock cut last week, it will be interesting to read what the RBA was thinking during their previous meeting and whether external factors have changed expectations since then. Domestically the Australian economy is still performing remarkably well which makes me continue to lean toward the no change camp.

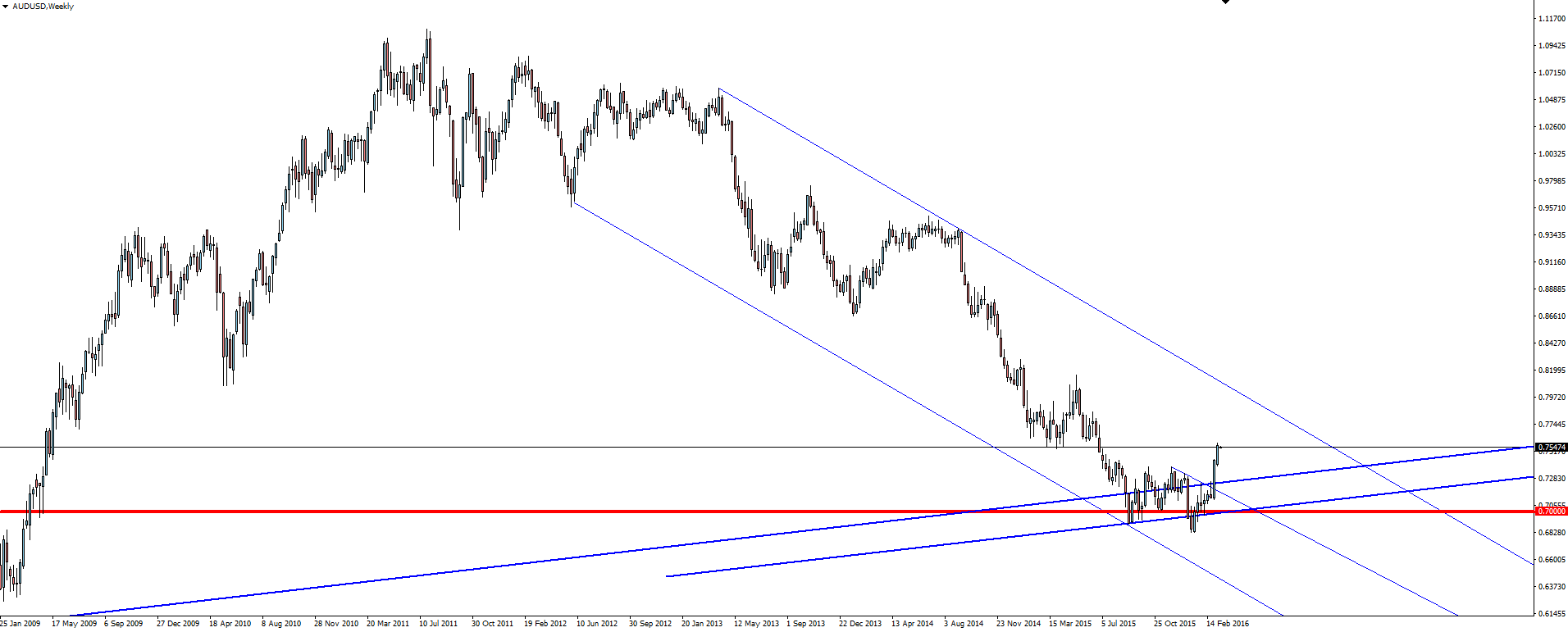

The AUD/USD weekly chart we have published in the technical analysis section of the Vantage FX News Centre is a chart of beauty for traders who rely on major levels to manage their risk. Click the ‘play button’ on the chart for a before and after snapshot of the level.

Moving forward and the big Asian session data point on the economic calendar this week is the Bank of Japan’s monetary policy statement on Tuesday.

No change in policy is expected on the back of THE negative rates shock in January. In saying that, we know that the BoJ are always good for a shock or two so who knows!

(We take a look at USD/JPY as today’s chart of the day below.)

The final major piece of central bank action comes from the Fed on Thursday. We will have of course already gotten tier 1 retail sales, building permits and inflation data out of the US heading into the statement which could prove to be a nice little concoction for price action traders who rely on volatility to make their pips.

This month’s meeting isn’t seen as ‘in play’ but if data continues to defy expectations, Yellen will surely deliver a level of forward guidance about the next hike in the near term. In my opinion, the biggest divergence in market expectation and actual pricing lies between the USD and the Fed rate hike timeline. There is some serious scope for rate hikes in the near term.

Chart of the Day:

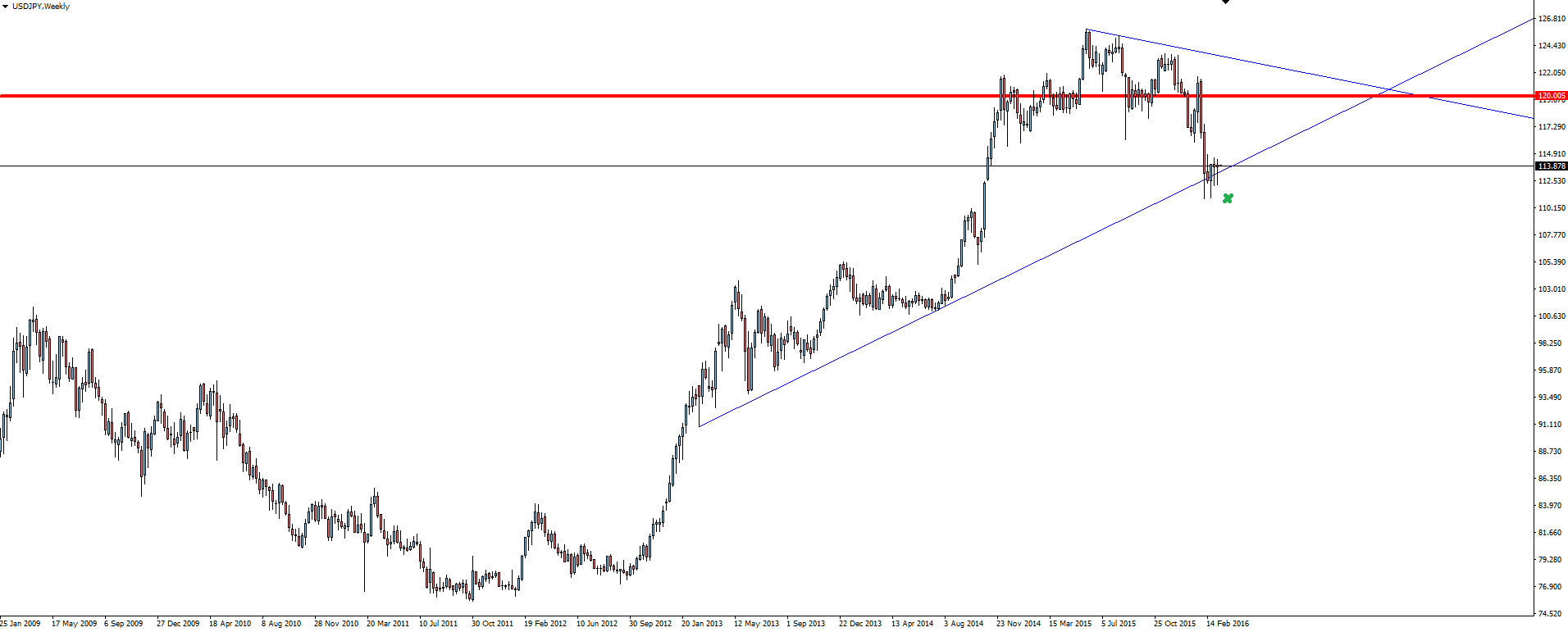

With the monetary policy statement and press conference out of Japan really kicking things off tomorrow during Asia, I wanted to take a deeper look at the USD/JPY bigger picture.

A couple of weeks ago in the headlines and correlations blog, we featured USD/JPY as our chart of the day. The angle of that post was comparing the pair with the S&P 500 but the technicals are the same.

“Yes it may look like the pair has broken support, but the longer these weekly trend lines run, the more I like to treat them as a ‘zone’ rather than a hard level and this is a perfect example here.

That’s not a break out.”

Moving forward the couple of weeks to where price currently sits, we see the support ‘zone’ continues to hold. Price has rejected off the level and printed multiple long wicks.

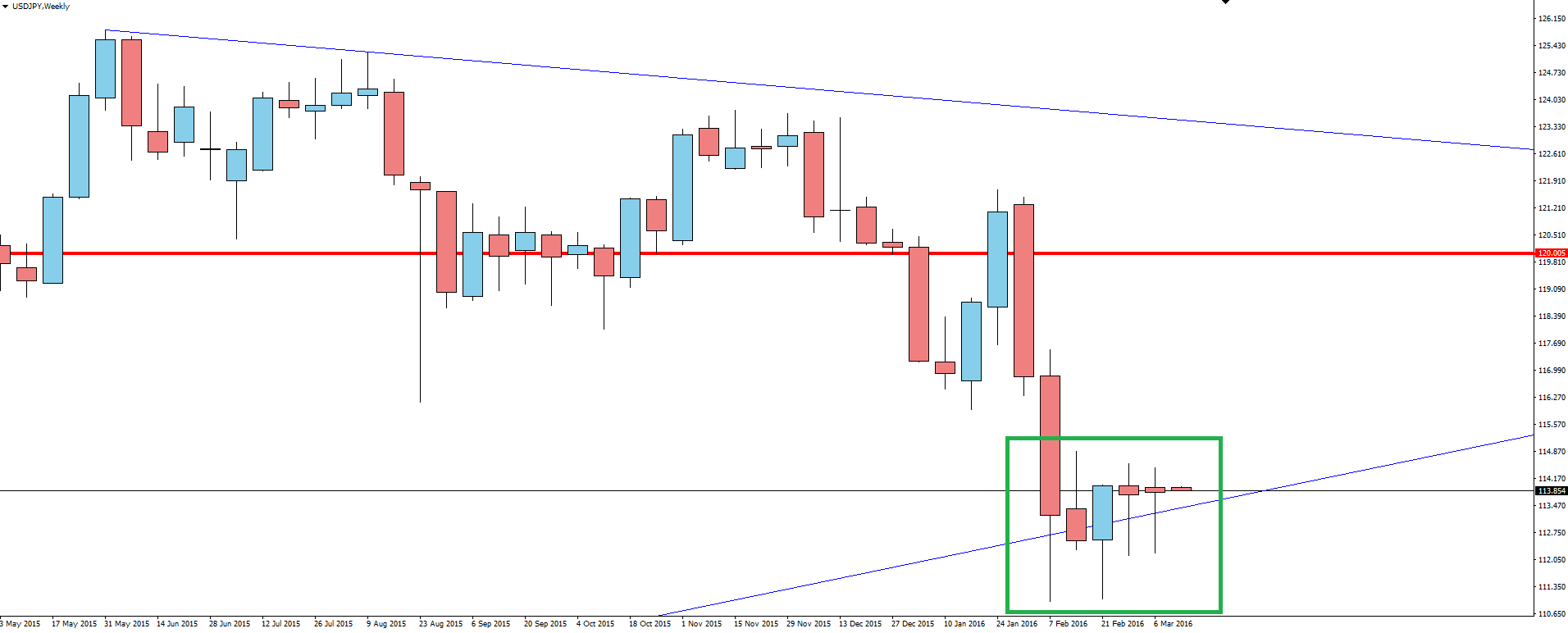

USD/JPY Weekly Zoomed:

This chart shows this indecisive price action with the buyers continuing to soak up the sellers. Are you expecting more indecision or is this the week that we get the move away from support?

Stay safe out there and enjoy your week!

On the Calendar Monday:

CAD Daylight Saving Time Shift

USD Daylight Saving Time Shift

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex broker Vantage FX Pty Ltd does not contain a record of our Forex trading account prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.