Good Year Performance Wise

We closed out our bond short this week and are up 42% so far this year. The reason we closed out our bond short is that we are trying to make money and control risk as much as possible in a market that frankly speaking is off its rockers! Who knows what “Fair Market Value” is for any asset?

Markets are so influenced by Central Bank liquidity that wehave little confidence in what the actual ‘market prices’ are for many assets, we strategically take advantage of extreme mispricing’s

relative to our models, i.e., the low hanging fruit, and get out of the market. I don't want to hold anything these days!

Liquidity, Liquidity, Liquidity

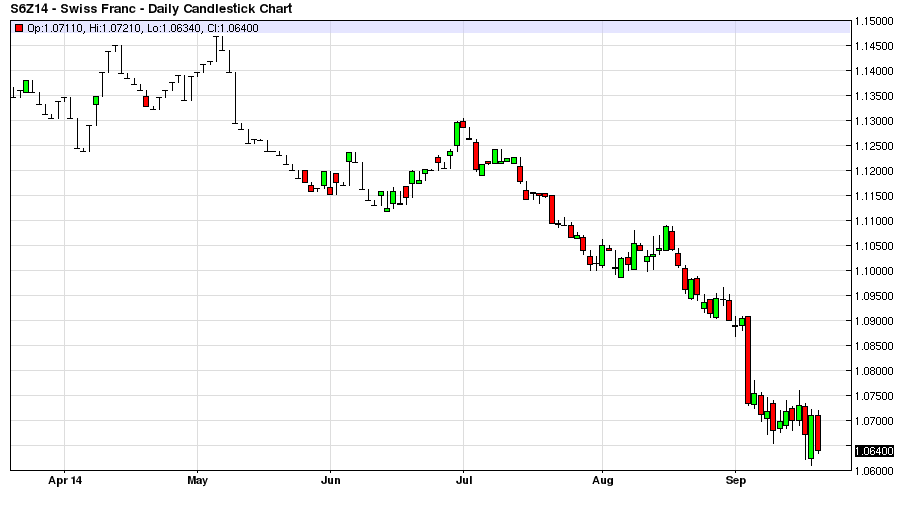

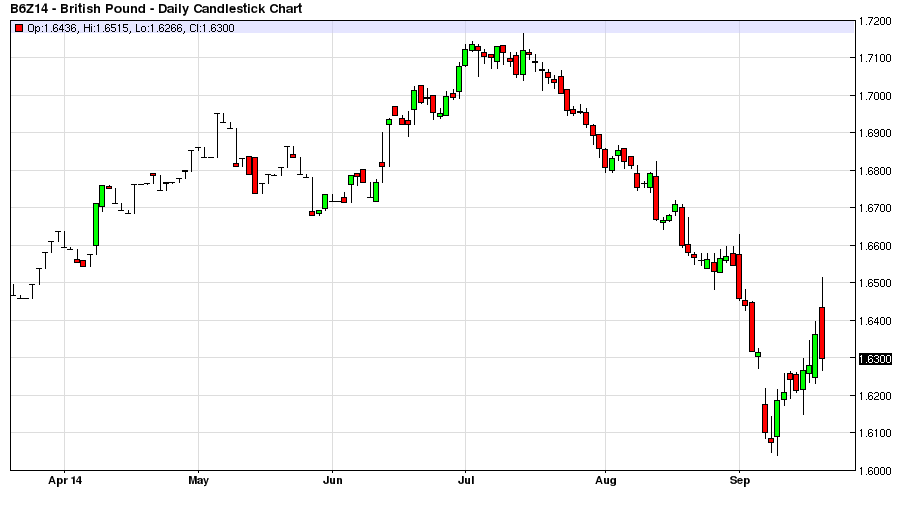

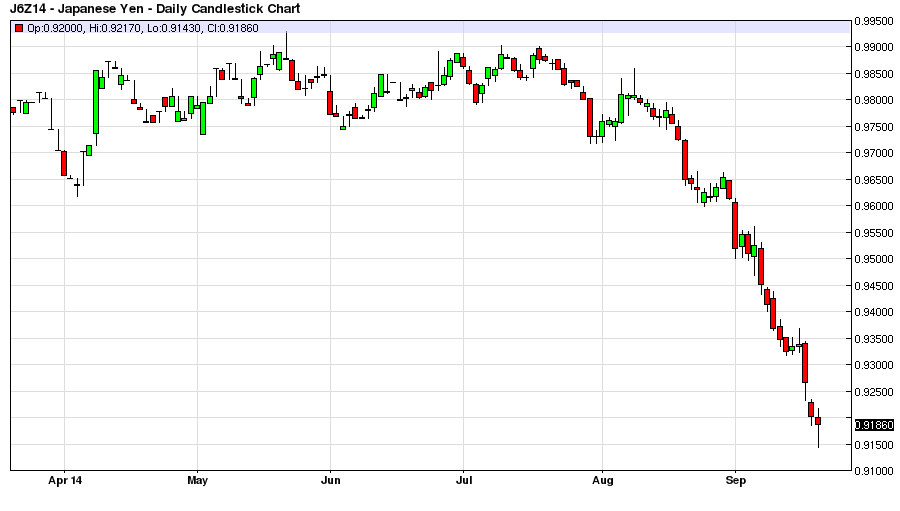

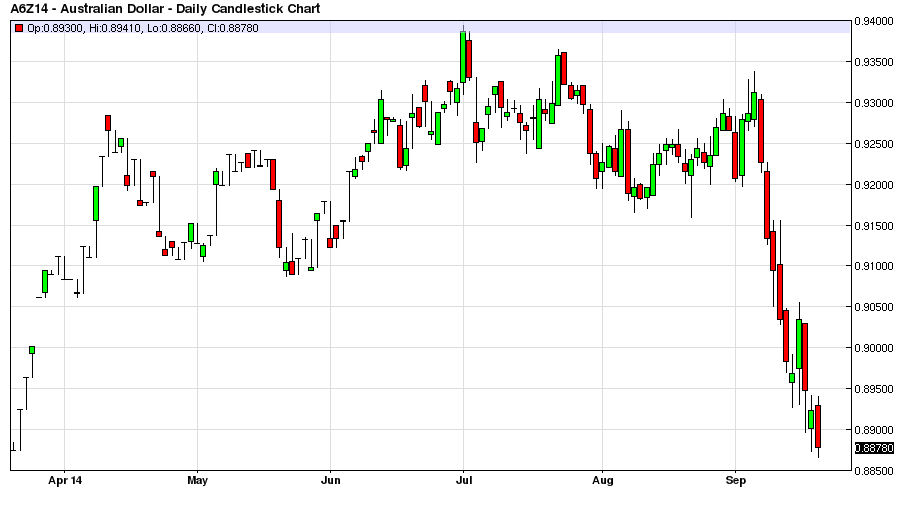

As I was shorting Futures late Thursday night it once again hit home how close financial markets are to some major shocks all due to ridiculous amounts of liquidity by Central Banks all over the world. The movements in the currencies as of late are starting to become worrisome, and with the movements on Thursday night I will not be surprised if we start having some currency inspired major volatility in other asset classes.

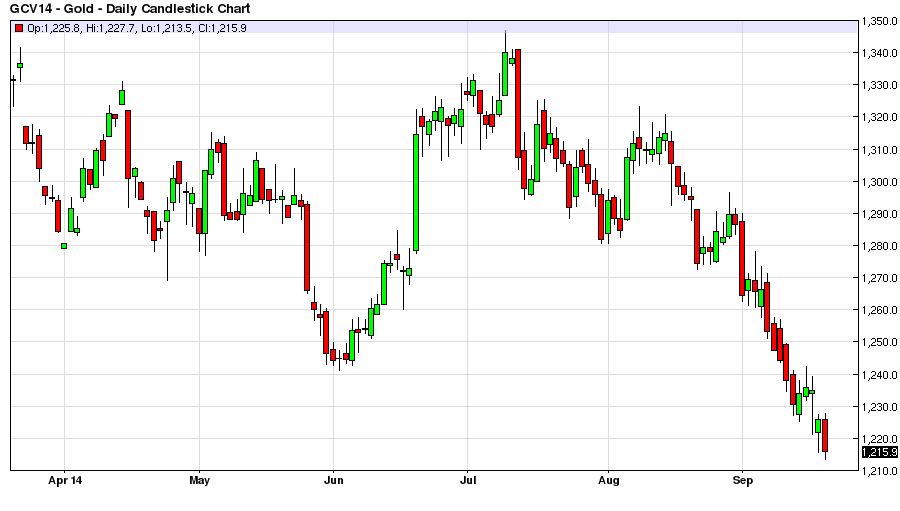

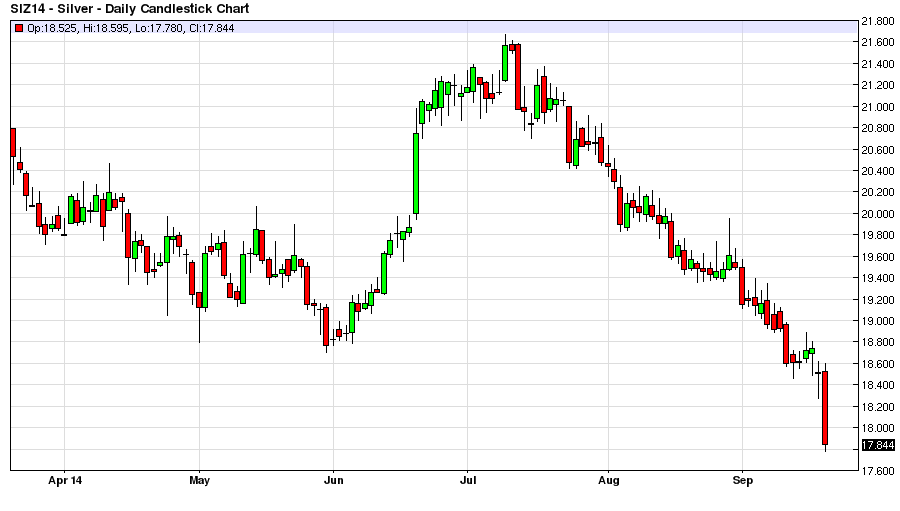

Strong Dollar

Have you seen the effect of the strong dollar on commodities, in particular? I will not be surprised to wake up some morning and find silver trading at $14 an ounce at this point due to some holders getting liquidated in a massive way.

Too Insane That Fed Will Still Be Buying 15 Billion Next Month with S&P at these levels

So late Thursday night Japan hits 2014 highs, then Europe hits 2014 highs, and the US Futures hit all-time highs, and I was struck by the fact that next month the Fed will still be buying 15 Billion of asset purchases for October.

Stock Buybacks & Earnings

This thought further hit home the fact that as earning's season is just around the corner, I am pretty sure that much of the 's outperformance of late is companies buying back stock to hit their respective earning's marks. And as Oracle CEO Larry Ellison steps down what did Oracle announce, another 13 Billion in stock buybacks to soothe investors’ concerns. Low interest rates have fueled a ridiculous and unhealthy amount of stock buybacks at the top of valuations, and this has truly distorted financial markets.

Draining Market Liquidity Primary Concern Right Now! The Fed's biggest concern needs to be draining the liquidity in the financial system before the entire market collapses, and not the unemployment rate, slack in the unemployment rate, or even inflation at this point. The reason is that sure central banks can pump so much liquidity into the system that markets will not go down, volatility will be reduced, but after several years of artificial support, all the liquidity in the world isn't going to support an unsustainable market led by disproportional and untimely stock buybacks, asset prices with overextended multiples, and every company in the world coming to the market to cash in on the IPO madness due to robust excess market liquidity.

Retail Investors Get Out of the Market – Don't be the ‘Suckers/Muppets’ this time!

Retail investors just go to cash because the financial markets are going to crash it is just a matter of when and not if. The Fed will have much bigger employment worries on their hands when the entire financial system collapses because central banks mucked up markets with actual buying of securities in the Bank of Japan, ECB, China and the US Federal Reserve.

Somebody Has to Have Relative Stronger Currency

We are starting to see the strain in the currencies, and everyone cannot debase their currency at the same time, and the market is starting to look away from the US Dollar being the weak currency, and if this continues and silver markets will get destroyed, US corporate profits are going to get hit, and all the stock buybacks in the world are not going to help US Corporations hit the earning's marks.

Alibaba a $20 Stock without Central Bank Liquidity

It is funny watching the analysts discuss Alibaba's (NYSE:) stock price and what constitutes a proper multiple for the stock, is this pre-Central Bank Liquidity or post-Central Bank Liquidity? Is this before or after the financial collapse of the latest fed inspired bubble? Or China for that matter as their property market isn't trending in the right direction at the moment!

Currency Moves & Magnitude of Moves Warning Sign for Markets

I am not calling for a market top, markets will go up until they stop going up, but trading late this week the sentiment that most provoked my psyche was just how vulnerable and shaky the entire financial system is right now, and it is only being masked by massive central bank liquidity, which is ultimately unsustainable, and then what? Look to the currency markets as they are starting to signal that things aren't all ‘Hunky-Dory’ right now by the magnitude of the currency moves, there is just too much liquidity in the financial system right now, and that is a ticking time bomb waiting to explode!