The idea of understanding ‘what’s priced in’ has been seen front and center this week, and it’s a science all traders should try to understand – Case in point, the ECB hiked by 75bp – the biggest hike in its history and yet EUR/USD fell 90 pips.

I can imagine many new traders buying EURs because they’d heard the ECB would likely pull out the big guns, only to be astonished when the price fell. As a starting point, for those not familiar, a ‘basis point’ (bp) is equivalent to 0.01% - so a one basis point rise would be 1.00% to 1.01% (or 100bp to 101bp).

Trading A Central Bank Meeting Is Rarely Straightforward

Granted, not everyone wants to trade the outcome of a central bank meeting – it’s hard, and there are many variables to consider. However, most traders, especially those using higher leverage, should review the upcoming meeting for the propensity for outsized movement and volatility. The obvious question is whether to hold, reduce or close positions over the event risk.

Some will attempt to trade the outcome of a central bank meeting. For that, having a strong understanding of what is priced into markets is essential. Understanding the best or most sensitive market to trade is also advantageous. For example, I would often see USD/JPY as the cleanest play on the FOMC meeting as it’s the most sensitive/correlated to short-term interest rate changes.

I’d love to say the market movement is driven solely by the change to the current policy rate and whether they hike (or cut) by 25, 50, 75, or even 100bp. Recall that aside from the RBA, central banks tend to lift their policy rate in increments of 25bp.

However, life isn’t that simple. Often, it’s not just about whether the market is priced correctly for the meeting in question but also how the central bank's outlook marries up with where market expectations for interest rates are in the future.

We also need to consider the statement's tone, economic forecasts (if provided), and sometimes explicit projections of future interest rate settings. These all need to reconcile with market pricing, and these can often be far more important than a simple hike at the meeting, especially when the market has already discounted that outcome.

How Do We Know What Is Discounted?

Traders can express a view on a central bank's future interest rate settings using overnight index swaps (OIS) or interest rate futures – such as the fed funds future or Australia's 30-day cash future.

Traders can speculate on interest rate changes or hedge their interest rate risk through these instruments. They are what all other key markets, like currencies or indices, focus on as their guide – they are essentially the first derivative.

When we say a ‘75bp hike is priced in’, we look at the tradeable interest rate markets to assess this call.

As with any futures contract, there are known periodic contracts – most interest rate contracts are monthly, but they can be quarterly, Eurodollar futures, for example. Traders can choose any month where they feel rate expectations are too high or low and trade that pricing accordingly.

Looking at what is priced into each futures contract in the months ahead is called the ‘rates curve’ or ‘term structure.’ We see this above with the fed funds future curve, which has monthly contracts to trade (detonated by the red circle).

An interest rate trader will use the price of the futures contract to calculate what the implied policy rate setting is for that month – they’ll understand how many basis points (bp) are therefore priced in – once they have that quantitative intel, it’s from here they can trade their view.

For FX, commodity, and equity traders, a number of the major central banks have made it easier for us to understand current market pricing, offering rates pricing calculators – granted, the intel is not as dynamic as live interest rates pricing, and in most cases, it is updated daily at the close – but unless you’re trading interest rates I don’t think it matters too much. It still offers a strong understanding of our risk assessment of known event risk.

For current pricing, we can look at:

- Fedpricing - https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

- BoE pricing - https://www.cmegroup.com/trading/interest-rates/bank-of-england-watch-tool.html

- RBA pricing - https://www2.asx.com.au/markets/trade-our-derivatives-market/futures-market/rba-rate-tracker

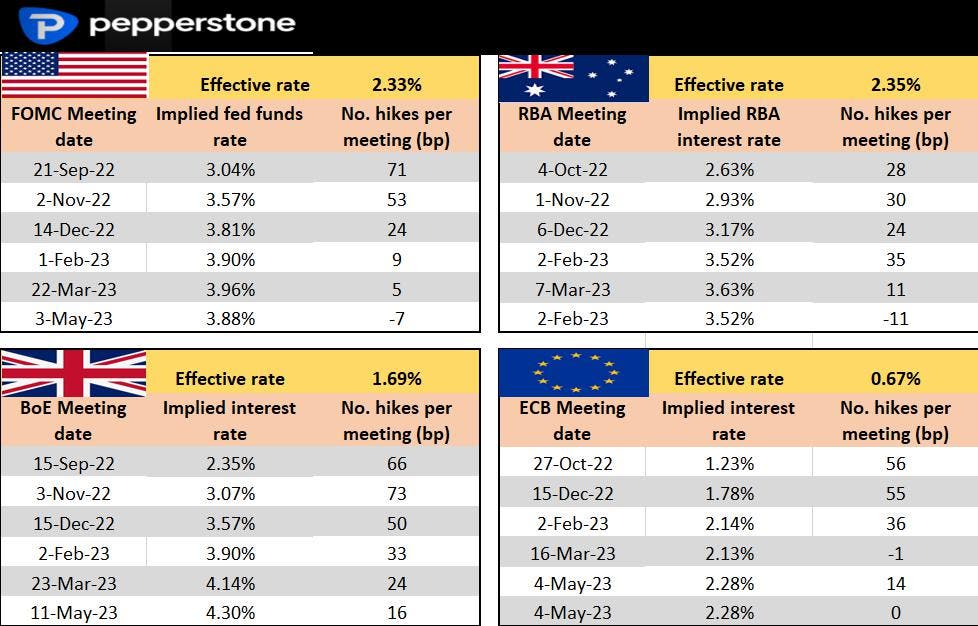

We take the interest rate pricing to calculate the implied policy setting for each near-term monthly futures contract and publish this interest rate expectation table weekly. We then take the ‘effective rate’ – this is the true interest rate and the price that banks borrow overnight and look at the difference between the two.

It tells us ‘what is priced in.’ For example, if we take the 21 Sept FOMC, 71bp of hikes are priced in. Subsequently, if the Fed were to hike by 75bp (recall, they lift in increments of 25bp), then all things being equal, the USD shouldn’t react too much – the hike was priced in.

This is where we look at other variables, such as the tone of the statement, their economic projections, and whether they marry up with future pricing. We then take the next month's contract and the implied policy rate to look at the 'step up' in basis points. For example, the market currently expects around a 50bp hike in the November FOMC meeting.

So, going back to the ECB and even the RBA meeting - why did the EUR (and AUD) fall when the bank hiked so aggressively? It was already expected, and other factors were decisive, such as a sour growth outlook and a continuation of asset purchases until 2024.

While trading FX, commodities, and equity indices, understanding how the market is pricing the event can be essential. It's never as easy as just buying the EUR because rates are going up.