Centene Inc. (NYSE:CNC) reported fourth-quarter 2017 adjusted net income per share of 97 cents, which beat the Zacks Consensus Estimate by 3.2%. Earnings, however, declined 18% year over year on higher expenses.

For the fourth quarter, total revenues grew 8% to $12.8 billion from the year-ago quarter, primarily driven by growth in the Health Insurance Marketplace business in 2017 and expansions and new programs in many states in 2016 and 2017. Revenues surpassed the Zacks Consensus Estimate of $12.3 billion by 4%.

Full-Year Update

For 2017, the company reported adjusted earnings of $5.03, up 13.5% year over year. The figure also surpassed the Zacks Consensus Estimate by 0.8%.

Centene reported total revenues of $48.4 billion, up 19% year over year. The rise was primarily driven by Health Net's results throughout the year, impact of growth in the Health Insurance Marketplace business in 2017 and expansions and new programs in many states in 2016 and 2017.

At the end of the year, managed care membership totaled 12.2 million, up 7% from 2016.

Quarterly Operational Update

Health Benefit Ratio (HBR) for the fourth quarter was 87.3% compared with 84.8% in the prior-year quarter. This reflects a year-over-year improvement of 250 basis points (bps).

In the quarter, adjusted selling, general & administrative (SG&A) ratio was 10.5%, up 110 bps year over year. The deteriorationis a result of increased business expansion costs over the prior-year quarter. Notably, revenues recognized in the fourth quarter of 2016, relating to the minimum MLR amendment in California, had reduced the quarter’s adjusted SG&A expense ratio. Hence, the expense ratio for the fourth-quarter 2017 appears higher compared to the year-ago quarter.

Total operating expenses of $12.6 billion at the end of fourth quarter increased nearly 11% from the prior-year quarter.

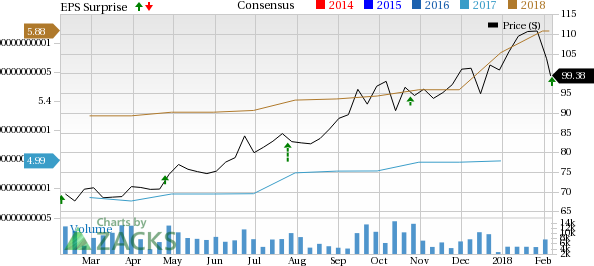

Centene Corporation Price, Consensus and EPS Surprise

Financial Update

As of Dec 31, 2017, Centene had cash and cash equivalents of $4 billion, up 3.6% from 2016 end.

Total assets of $21.8 billion grew 8.2%.

As of Dec 31, 2017, Centene’s long-term debt totaled $4.7 billion, up 0.9%.

For 2017, cash inflow from operations was $1,489 million compared with $1,851 million at the end of 2016.

2018 Guidance

Centene expects adjusted earnings per share to be in the range of $6.95-$7.35, up from the previously guided range of $5.47-$5.87.

Total revenues are expected to be in the range of $60.6-$61.4 billion, up from the earlier guidance of $60.0 billion to $60.8 billion.

HBR is expected in the range of 86.2-86.7% compared with the previous guidance of 86.3% to 86.8%.

Adjusted SG&A expense ratio is expected in the range of 9.2-9.7%, up from the previous guidance of 9.0% to 9.5%.

Shares outstanding is expected be between 199.1 million and 200.1 million, down from the previous guidance of 201.1 million to 202.1 million.

Zacks Rank and Performance of Other Peers

Centene sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Among other players in the Medical sector that have reported their fourth-quarter earnings so far, AbbVie Inc. (NYSE:ABBV) , UnitedHealth Group Incorporated (NYSE:UNH) and Abbott Laboratories (NYSE:ABT) have surpassed their respective Zacks Consensus Estimate.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Abbott Laboratories (ABT): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post