Celgene Corporation (NASDAQ:CELG) is scheduled to report fourth-quarter 2017 results on Jan 25, before the opening bell.

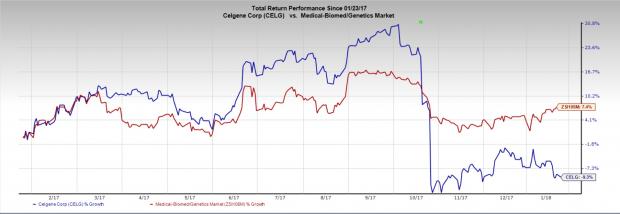

Celgene’s stock has tumbled 9.3% in the last year compared with the industry’s gain of 7.4%.

Celgene has an excellent track record with the company beating earnings estimates in the last four trailing quarters. Last quarter, the company topped estimates by 1.6%. Overall, the company has delivered an average positive surprise of 2.5%.

Why a Likely Positive Surprise?

Our proven model shows that Celgene is likely to beat on earnings estimates this quarter. This is because it has the right combination of two key ingredients, a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold).

Zacks ESP: The Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +0.94%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Celgene currently carries a Zacks Rank #3. The combination of Zacks Rank #3 and a positive ESP makes us confident of an earnings beat.

Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Revlimid to Drive Growth

Earlier in the month, Celgene released preliminary results for 2017. The company expects earnings per share (EPS) of around $7.44 in 2017, up 25% year over year. Operating margin is anticipated around 58.1%. For the fourth quarter, EPS is anticipated to be around $2.00, a 24% increase year over year. Operating margin is expected to be around 55.3%. The Zacks Consensus Estimate for earnings in the fourth quarter is $1.94 and $7.37 for 2017.

Total revenues are expected around $3.5 billion in fourth-quarter 2017 and $13.0 billion in 2017. The Zacks Consensus Estimate for revenues is $3.50 billion for the fourth quarter and $13 billion for 2017. Revlimid revenues are expected around $2.2 billion in the fourth-quarter and $8.2 billion for 2017.

Revlimid, an oral immunomodulatory drug, is currently approved for several indications including MM, myelodysplastic syndromes and mantle cell lymphoma. The drug performed well in the first nine months of 2017 and combated the challenges of uneven buying patterns and coverage gap. Market share gains in key markets and longer treatment duration are contributing to the drug’s growth.

Continued momentum in the core indication, label expansion and global launches should help the product to keep contributing to the top line. The Zacks Consensus estimate for Revlimid currently stands at $2.2 billion for the fourth quarter.

Pomalyst revenues are expected around $442 million and $1.6 billion in 2017. Pomalyst/Imnovid is being evaluated in multiple combination studies in relapsed/refractory MM. The drug’s label was updated in the United States and the Europe to include data from a pooled pharmacokinetics analysis of patients with relapsed and/or refractory MM and impaired renal function which should boost sales.

Otezla revenues are expected around $371 million in the fourth quarter and $1.3 billion in 2017. The deep and persistent slowing growth of the psoriatic arthritis and psoriasis markets, especially during the entire third quarter led to weak performance of Otezla in the quarter which should impact sales in the fourth quarter also. Abraxane revenues are around $251 million in the fourth quarter and $992 million in 2017.

Meanwhile, the approval of Idhifa for the treatment of adult patients with relapsed or refractory AML (R/R AML) will further boost Celgene’s portfolio. The drug was developed in collaboration with Agios Pharmaceuticals (NASDAQ:AGIO) .

Celgene is on the look-out of new deals and acquisitions given the recent setbacks. In January 2018, Celgene announced it will acquire Impact Biomedicines. The company recently announced that it will acquire smaller biotech Juno Therapeutics (NASDAQ:JUNO) whose pipeline includes CD19 and CD22 directed CAR-T cell product candidates for $9 billion.

During fourth-quarter earnings call investors are expected to remain focused on the company’s performance and label expansion efforts, along with updates on recent acquisitions.

Stock to Consider

Here is one stock in the healthcare sector that you may want to consider, as our model shows that it has the right combination of elements to beat on earnings this quarter.

Vertex Pharmaceuticals Inc. (NASDAQ:VRTX) has an Earnings ESP of +6.90% and a Zacks Rank #1. The company is scheduled to release fourth-quarter results on Jan 31. You can see the complete list of today’s Zacks #1 Rank stocks here..

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Agios Pharmaceuticals, Inc. (AGIO): Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Juno Therapeutics, Inc. (JUNO): Free Stock Analysis Report

Original post

Zacks Investment Research